Smart money shuns China stocks as foreign and leveraged traders wary of state bailout

- Foreign investors record net selling of Chinese equities via exchange links last week

- Stock holdings of leveraged traders languish close to lowest level in four years

Smart money is steering clear of Chinese stocks, putting into question whether the efforts by top policymakers to shore up the world’s worst-performing equity market this year will find traction.

Foreign investors this week were net sellers of Chinese shares through the connect programmes, while stock holdings by leveraged traders lingered around a four-year low. The tepid responses highlight the challenges facing Chinese regulators to lure investors back to the stock market after they unveiled a deluge of measures to arrest declines earlier this month.

Chinese stocks have stabilised after sharp decline early last week, but the relative calm is at risk of faltering any time with the benchmark Shanghai Composite Index falling again on Friday.

The gauge had fallen by 21 per cent as of Friday’s close, having touched a four-year low in early October, and is now in what’s known as a bear market. Confidence has been roiled by an escalating trade war with the US, intensified surveillance of shadow banking and a worsening liquidity crunch among smaller companies.

“These government support measures may have an unintended consequence and it will probably reinforce the view among these smart investors that fundamentals are pretty bad,” said Wu Kan, an investment manager at Soochow Securities in Shanghai. “They are still very cautious and taking a risk-averse approach. With the low risk appetite, the market may not have found its bottom yet.”

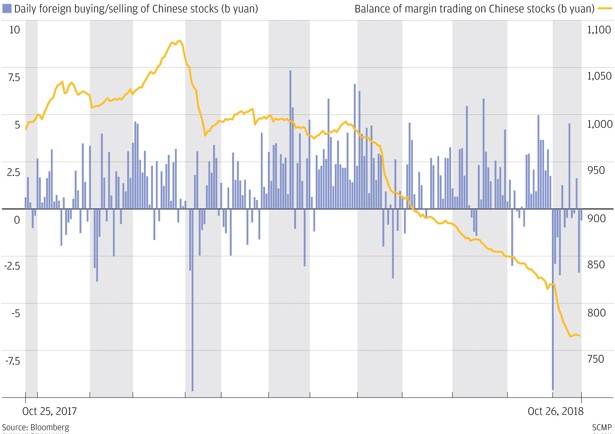

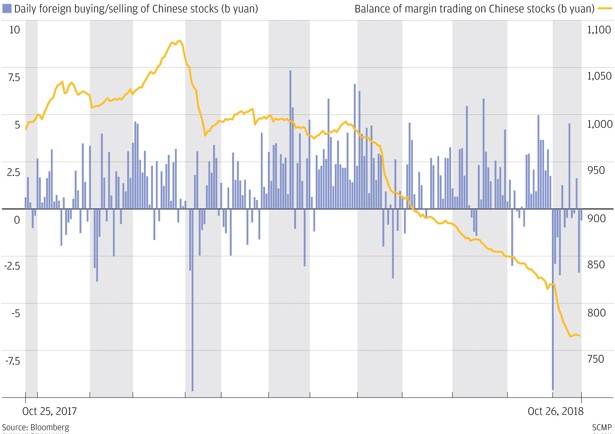

Overseas investors sold more Chinese stocks than they bought in four out of the five days last week via the exchange links with the Hong Kong bourse. Net selling reached 1.56 billion yuan (US$224.2 million) on Friday, taking the total sales to 4.02 billion yuan for the week, according to Bloomberg data.

Investors dumped once favoured consumer stocks including liquor distiller Kweichow Moutai on concerns that a slowdown in China’s growth will eventually hurt consumer spending. Shares of Kweichow Moutai tumbled 8.9 per cent last week, the worst performance for the five-day period in three years.

Leveraged traders were also on the sidelines. The outstanding balance of shares bought with borrowed money on the Shanghai and Shenzhen exchanges barely increased and remained nearly unchanged close to a four-year low at 765.8 billion yuan, data from China Securities Finance showed.

Only the “national team,” the nickname of Chinese retail investors for state-linked rescue funds, remained as active buyers. The Shanghai Composite unexpectedly escaped from a regional rout on Thursday, clawing back an intraday loss of as much as 2.8 per cent, as the state funds were suspected to have bought large caps companies to prop up the market. The index resumed declines with a 0.2 per cent loss on Friday, extending its drop in the month to 7.9 per cent.

Even as Vice-Premier Liu He said Chinese stocks are a good buy now and the central bank as well as the top financial regulators pledged more funding support for smaller listed companies facing a liquidity crunch, top money managers and investment banks from the fund unit of HSBC Holdings to USB Group said the worst might not be over because of slowing earnings growth and the spillover risk from more volatile global markets.