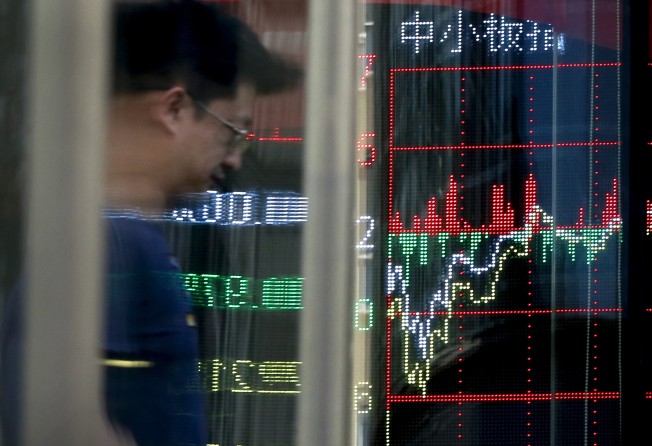

It’s time for China to allow foreign credit rating agencies into its US$13 trillion bond market, say experts

- The world’s third largest bond market is gradually opening up to foreign players as it starts to join global bond benchmarks

International rating agencies must be allowed to operate in China if foreign money is to flow freely into its bond market, said industry experts.

China’s US$13 trillion bond market, the world’s third largest, is gradually opening up to foreign players as it starts to join global bond benchmarks.

The next key step must be for all global rating agencies to be granted access to the Chinese market, so overseas investors can understand and compare the ratings with those at home, said Nick Gendron, head of fixed income indices at Bloomberg. He was speaking in a panel discussion at a fixed income and currencies conference held by Hong Kong Exchanges and Clearing this week.

On Monday Chinese bonds made their debut in the Bloomberg Barclays Global Aggregate Index in what Gendron described as a “truly historic event”. The index will add Chinese government debt and policy bank bonds over the next 20 months, giving them an eventual weighting of 6 per cent and bringing an additional US$150 billion into China’s bond market, by HSBC estimates.

Two competing indices are likely to follow suit: the FTSE Russell’s World Government Bond Index and the JP Morgan Emerging Markets Government Bond Index Global Diversified.

According to Gendron, Bloomberg uses a mid-level rating from the big three credit rating giants, S&P, Moody’s and Fitch. While it is not unprecedented to use non-US agencies, these are the most recognised and trusted agencies by foreign investors, he said, and their inclusion would encourage greater inflows of money from overseas.

“The feedback we receive from market participants is that there is real hunger for greater granularity in domestic Chinese ratings, and for ratings that are determined in a transparent and rigorous way,” Simon Jin, CEO of S&P Global (China) Ratings, told the Post.

In January S&P was the first to be granted a licence by the People’s Bank of China (PBOC) to enter the domestic bond rating market through a Beijing-based wholly owned unit. It would not say when it plans to start operations.

In a statement at the time, the central bank said international rating firms’ ability to rate onshore bonds in China’s interbank market would meet foreign investors’ demand and improve credit rating quality domestically.

Fitch and Moody’s, however, were not mentioned and still await licences.

China has restricted the partnering of foreign rating agencies with domestic firms for the past two decades. In the domestic rating service market, Chinese agencies tend to give high ratings to mainland issuers, under pressure from Beijing.

According to a statement in November from the National Association of Financial Market Institutional Investors, about 97 per cent of 1,741 non-financial corporate bonds in China had ratings of AA or above.

ICBC’s head of global markets, Jimmy Jim, echoed Gendron’s view that international ratings agencies must be allowed into China’s market.

Speaking at the same conference, he said that over time the market will “see much better convergence between international and domestic rating agencies.”

“Hopefully it’ll come sooner rather than later,” he said.

While it awaits a licence, Fitch set up a Beijing-based subsidiary in November, and has hired more than 25 people to start publishing non-rating action research reports. “We are communicating closely with the regulators as part of the application process,” said a spokesperson for Fitch (China).

Moody’s did not respond to a request for comment.