Hong Kong stocks pare gains after a strong start as weak Chinese data, protests weigh on sentiment

- Smartphone components maker Sunny Optical Technology (Group) was the day’s biggest gainer, jumping 8.7 per cent

- Cathay Pacific reverses four days of losses to rise 2.83 per cent

Hong Kong and Chinese markets reversed Tuesday’s losses on optimism over US President Donald Trump’s tariff concession, but gains were capped because of weak economic data from the mainland and ongoing protests in the city.

The Hang Seng Index closed up 0.1 per cent at 25,302.28 on Wednesday. Twenty of the gauge’s 50 constituent stocks ended higher compared with only one in the previous session.

The gains were led by smartphone components maker Sunny Optical Technology (Group), which jumped 8.7 per cent to HK$93.95 on the back of strong earnings. The tech subindex was the biggest gainer among the nine industry gauges, rising 2 per cent.

The inability of the index to hold on to morning gains showed just how bearish investors were in Hong Kong, according to Castor Pang Wai-sun, head of research at brokerage Core Pacific Yamaichi.

“There is not very strong confidence in the Hong Kong stock market, particularly right now, even though Trump is trying to elevate the situation by delaying tariffs on some goods,” he said.

The US said it would delay some of the 10 per cent tariffs on Chinese consumer goods until mid-December, including some laptops, mobile phones, toys and clothing, sparking a 1.7 per cent jump in the Hang Seng Index at the open.

The ongoing protests, however, continued to weigh on market sentiment.

Demonstrators had brought Hong Kong airport to a standstill for a second day on Tuesday, with China’s Hong Kong and Macau Affairs Office warning the escalating violence was showing “signs of terrorism”.

After dropping to a 10-year low, Cathay Pacific Airways ended up 2.83 per cent, reversing four days of losses. Its top shareholder, Swire Pacific, condemned the protests in Hong Kong and vowed to follow China’s aviation regulations. Swire was the second biggest gainer on the city’s benchmark, up 3.9 per cent.

Cathay has also banned staff from taking part in the protests and sacked two pilots amid mounting pressure from Beijing.

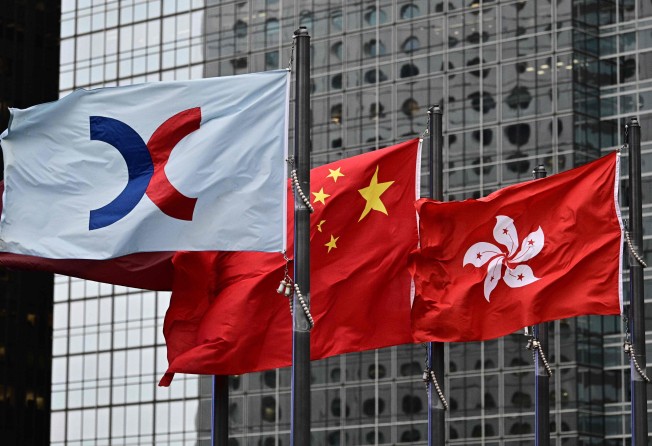

Shares of Hong Kong Exchanges & Clearing (HKEX) rose 0.51 per cent after the bourse operator reported its best interim profit on record, as more global funds used the city’s cross-border investment channel to invest in Chinese stocks, after MSCI quadrupled the representation of China’s A shares in its benchmarks.

Property developers were among some of the worst performers. Hang Lung Properties lost 3.2 per cent and CK Asset Holdings dropped 2.4 per cent, over concerns the city’s downbeat mood was forcing more developers to postpone sales launches, which would erode earnings.

On the mainland, the Shanghai Composite rose 0.4 per cent to 2,808.91, with all sectors except telecommunications rising. The CSI 300 Index of large caps in Shanghai and Shenzhen rose 0.5 per cent to 3,682.40.

The world’s largest distiller, Kweichow Moutai, rose 2.5 per cent to a new high of 1,043.33 yuan, giving it a market cap of 1.3 trillion yuan (US$184.9 billion).

It has risen 76.8 per cent this year, led by upbeat first-half earnings and expectations Beijing will further boost domestic consumption to help economic growth, following weaker-than-expected retail sales.

Capping gains was official data from the National Bureau of Statistics, which showed China’s economy stumbled more than expected in July.

Industrial production – including manufacturing, mining and utilities – grew at its lowest since February 2002. It grew by 4.8 per cent in July from a year earlier, but below the 6.3 per cent rise in June and economists’ estimates of 6 per cent polled by Bloomberg.

Retail sales, meanwhile, grew by 7.6 per cent in July, down from a 9.8 per cent growth in June and again short of economists’ forecast of 8.6 per cent growth. The figure is a key metric of consumption in the world’s most populous country.