Why start-ups like to set up in Singapore but list in Hong Kong

Singapore could be where start-ups prefer to set up shop, but Hong Kong is the market that they want to list in, according to analysts and industry players.

“Singapore government has introduced many measures to support start-ups, which is why it has attracted many new companies to set up there. However, these start-ups would get bigger and want to go public, Hong Kong is a better choice as the overall market size and new listing activities are more active in Hong Kong than in Singapore,” said Joseph Tong Tang, chairman of Morton Securities.

Hong Kong has lagged behind Singapore in terms of drawing start-ups to establish on its turf. The latest case is Lujiazui International Financial Asset Exchange, or Lufax, the peer-to-peer lender that was established by Hong Kong and Shanghai-listed Ping An Insurance in 2011.

The firm was last month given the green light to launch a global wealth management platform by the Monetary Authority of Singapore.

Still, the overall Hong Kong IPO market is more robust. It has raised four times more funds than Singapore so far this year, totalling US$8 billion in 92 IPOs. The island republic has raised only US$2 billion from 13 IPOs, according to Thomson Reuters data.

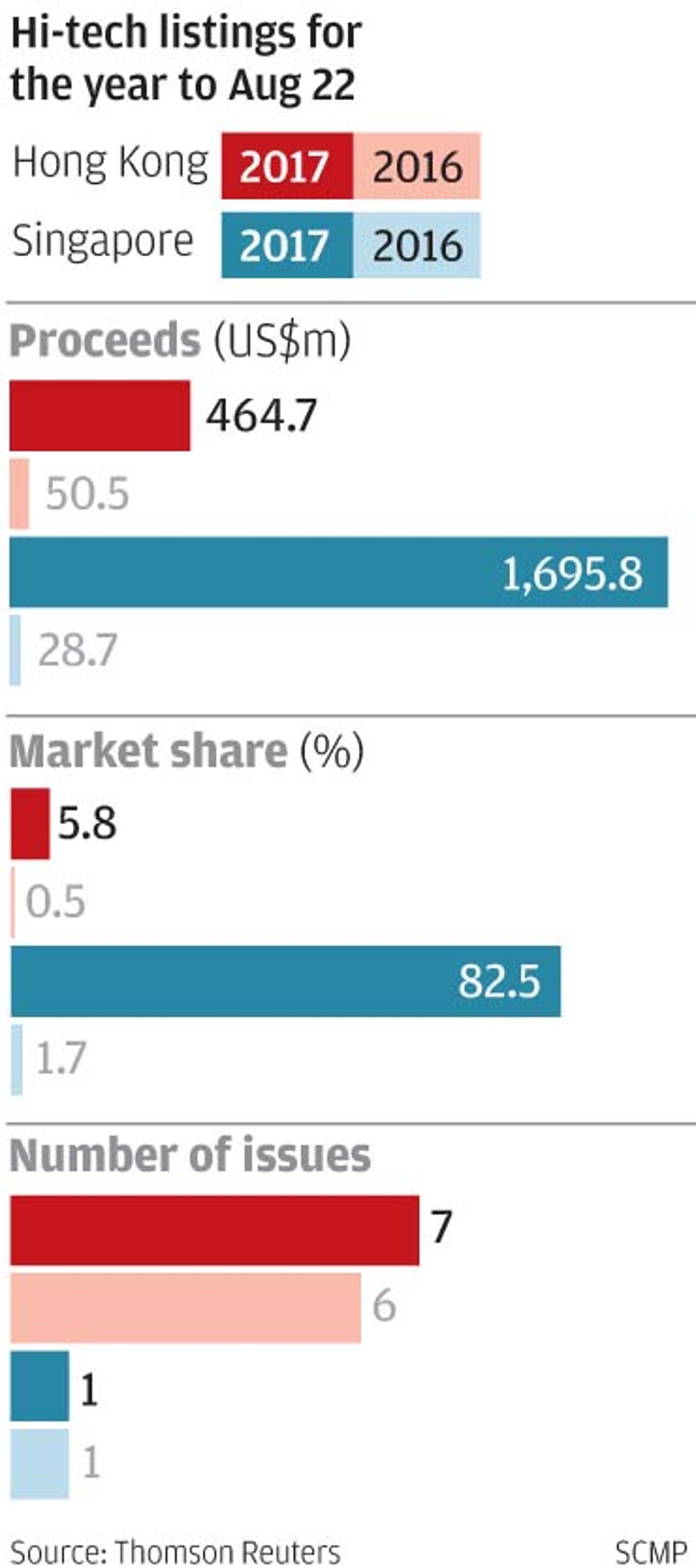

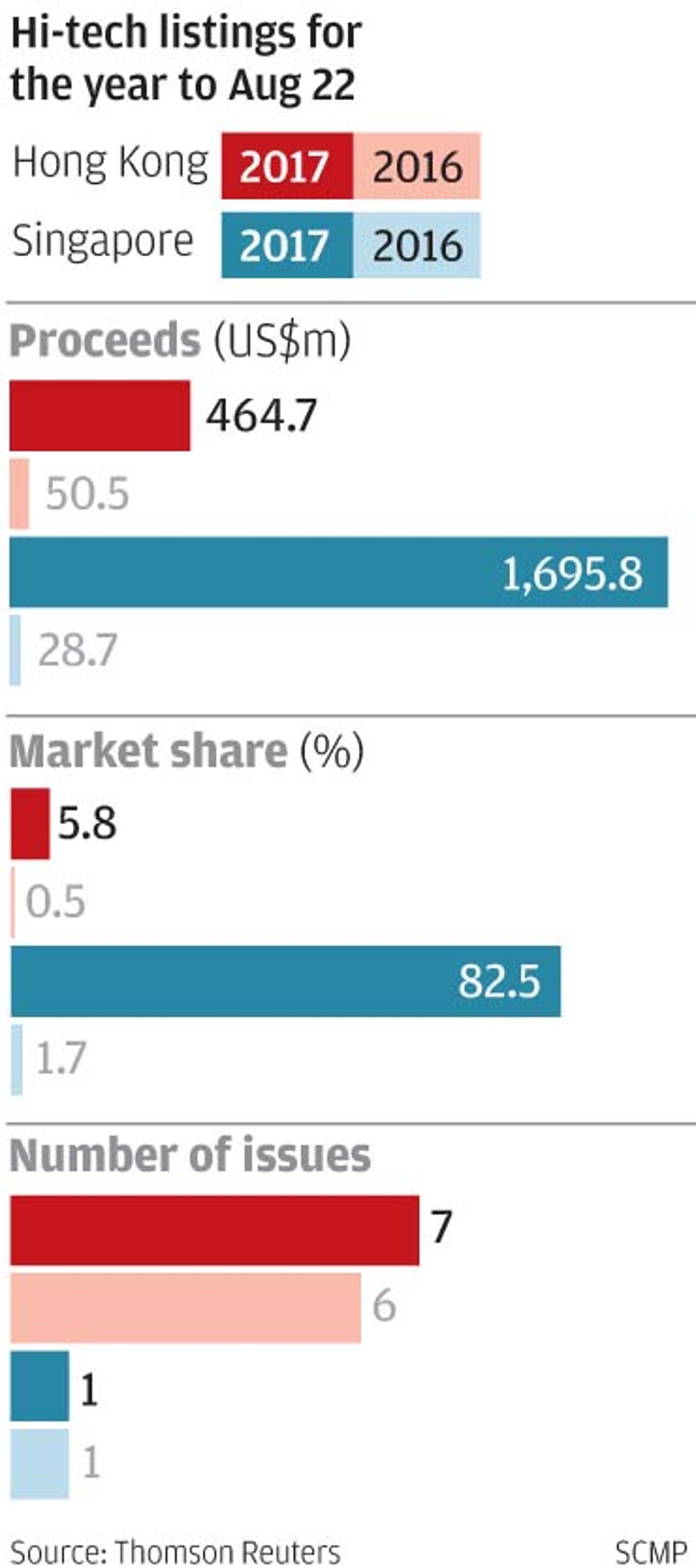

Hong Kong is the world’s fourth-largest IPO market worldwide while Singapore is not even in the top 10 list. But the flip side is Hong Kong is losing out in the amount of funds raised from technology IPOs as Singapore is ranked fifth, while the city is in the 12th position.

This is because the majority of funds raised in Hong Kong IPOs were from traditional firms with financial firms representing 56 per cent of all IPO funds raised this year, while technology firms only represented 5.8 per cent, according to Thomson Reuters data.

Singapore government has introduced many measures to support start-ups, which is why it has attracted many new companies to set up there

The Hong Kong Exchanges and Clearing is trying to play catch up in technology IPOs. It last week ended a consultation for a proposed third board in 2018 that will house two markets – one for the start-ups and the other for mega dual class shares.

Francis Leung Pak-to, chairman of the Chamber of Hong Kong Listed Companies, has opposed to the start-up market as he said these newly set up companies are too risky.

Leung however urged the HKEX to launch the dual class shares market to attract the so-called unicorn technology companies with a market cap over US$1 billion.

“There are many Chinese unicorn technology companies that like to list in Hong Kong. What we need to do is to prepare our markets to meet the needs of these companies,” Leung said.

Epi Ludvik Nekaj, founder and chief executive of Crowdsourcing Week said he chose to set up his company in Singapore in 2012 because the process was easy.

“It was a very seamless process with functional government agencies giving me guidance at the early stage, proactive Singapore Tourism Board attracting cutting edge conference like ours and ever-growing ecosystem,” he said.

“When it comes to fintech start-ups, allowing them to test their financial products in a controlled environment, [that has] put Singapore ahead of Hong Kong. In addition, the entire government of Singapore is mobilised to reinvent its economy, which puts start-ups as one of the main priorities in the government agenda.”

He said if the HKEX would launch the third board for start-ups, he would consider listing in Hong Kong.

“I may consider if this would be a combination of what a second market of crowdfunding may look.”