HKEX, SFC propose overhaul of stock market listing regime

Move comes after Charles Li Xiaojia’s role in process seen as conflict of interest

Hong Kong Exchanges and Clearing would face a cut in its power on listing matters, while chief executive Charles Li Xiaojia would be removed from the committee that approves new listings, under a major reform proposal.

The blueprint would allow the Securities and Futures Commission to have a bigger say in the listing approval process and in setting new listing rules, under an overall plan aimed at improving listing quality following a series of high-profile cases of badly handled new listings.

Under the proposal — jointly issued by the HKEX and the SFC on Friday evening for a three-month consultation — it is suggested Li will no longer be a member of the listed committee which approves new listings.

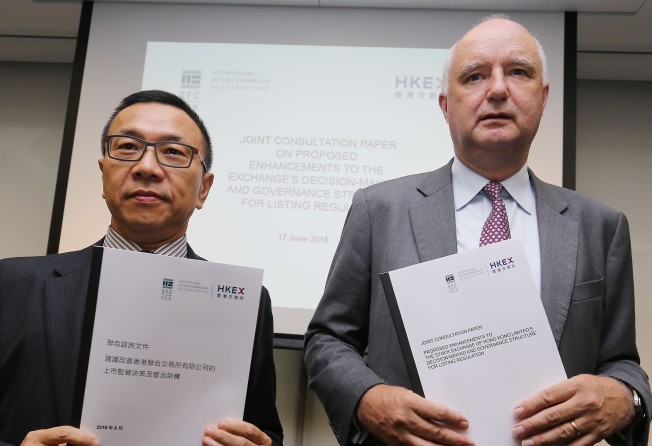

David Graham, chief regulatory officer at HKEX, said the move was aimed at addressing what had been seen as a conflict of interest for the exchange to have an official sitting on the listing committee to approve new listings.

HKEX collects listing fees, and there have been concerns it could be profiting by approving more new listings than necessary.

“The HKEX chief executive is only one of 28 members of the listing committee,” said Graham.

“But the market still had the perception of a conflict of interest of the exchange’s role in the listing approval process.

“This proposal would address this, and show the independence of the listing committee.”

The proposal, however, still keeps the role of the exchange as frontline regulator, and HKEX’s listing department will continue to be the first to approve listing applications and reject unsuitable candidates.

The stock exchange’s listing committee, which is made up of representatives of listed companies, investors, accountants and lawyers, would continue to approve simple listing applications which had initially been approved by the listing department.

The listing committee, however, will lose its power to set listing policies or approve complicated new listing applications, with that power shifting to two new committees, equally represented by HKEX and SFC representatives.

Any serious concerns raised by listing applicants will have their applications handled by a newly set up listing regulatory committee.

All listing policies now determined by the listing committee, will also be shifted to a newly set up listing policy committee.

The two new committees will be formed by equal number of representatives of the SFC and the HKEX, the plan suggests.

While Li will be a member of the newly set up listing policy committee which Graham said allows him to speak on behalf of commercial interests of HKEX.

The proposed reforms come after the quality of some new listings in recent years were called into serious question, especially some on the Growth Enterprise Market (GEM), whose shares were the target of speculative trading shortly after listing.

SFC executive director Brian Ho refused to respond to suggestions that the proposed reforms were actually aimed at adding power to the SFC, due to growing dissatisfaction of the HKEX’s listing approval process. He insisted they were aimed at creating a platform both the exchange and the SFC could use to better handle complicated new listings.

“The proposed reform is aimed at enhancing co-ordination and efficiency of the listing approval process,” he said.

Some overseas markets including Britain have removed the stock exchange from listing approval process altogether, in favour of an independent body, but Graham said Hong Kong did not need to follow the trend.

“The current system for the HKEX to act as frontline regulator has worked well,” he said.

“Hong Kong has a lot of differences from overseas markets, so we do not need to follow other models.”

In some markets it has also been proposed stock exchanges take more involvement in listings, he added.

Graham said there would be a separate consultation paper issued later on how to improve the GEM market.