Tycoon Li Ka-shing leads Hong Kong directors’ buying of own-company shares for a second week

The city’s richest man buys another US$30 million of shares in his conglomerate’s property arm, CK Asset Holdings

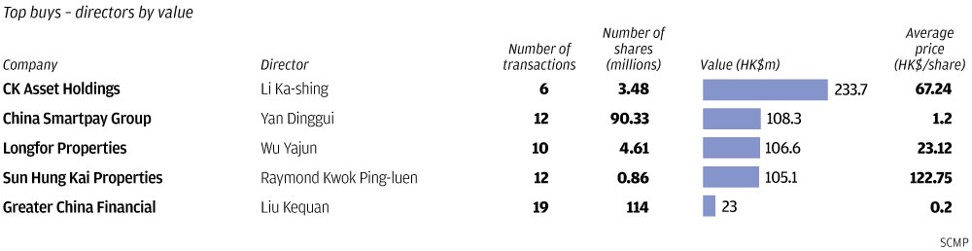

Tycoon Li Ka-shing led Hong Kong company directors’ buying of shares in their own firms in value terms for a second straight week, with purchases of stock in CK Asset Holdings, the property arm of his conglomerate.

Li, chairman of CK Hutchison Holdings and CK Asset Holdings and Hong Kong’s richest man, bought 3.48 million shares in CK Asset Holdings worth HK$234 million (US$29.8 million), bringing his total purchases in the firm this month to 14.64 million shares worth HK$975 million.

The total purchases, which were made from April 10 to 25 at an average of HK$66.57 each, boosted his stake to 1.176 billion shares or 31.82 per cent of the issued capital. The stock closed at HK$67 on Friday.

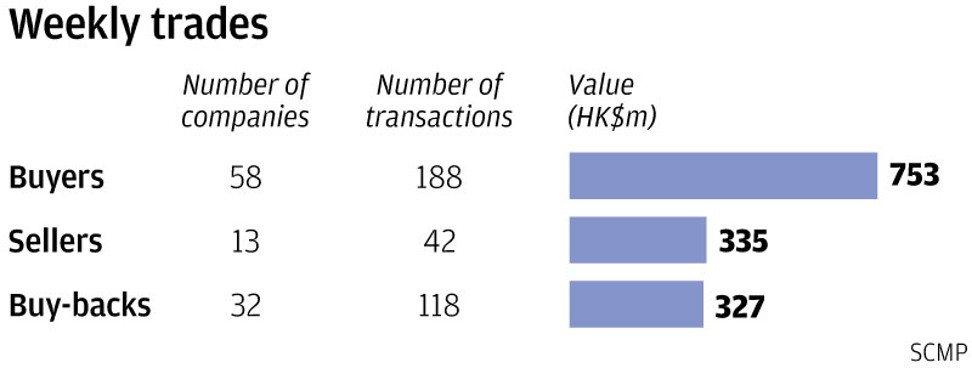

A total of 58 companies recorded 288 purchases by directors worth HK$753 million, versus 13 firms with 42 disposals worth HK$335 million, based on filings to the stock exchange from April 23 to 27.

The number of companies and trades on the buying side was up from the previous week’s 48 firms and 247 purchases but the value was down from the previous week’s HK$1.13 billion.

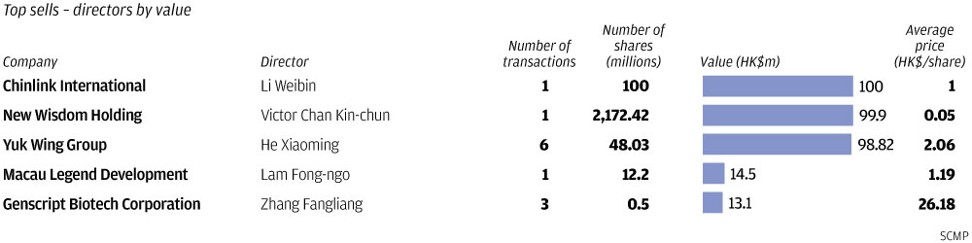

In terms of selling, the number of companies and trades was down from the previous week’s 16 firms and 73 disposals while the sell value was sharply up from the previous week’s HK$79 million.

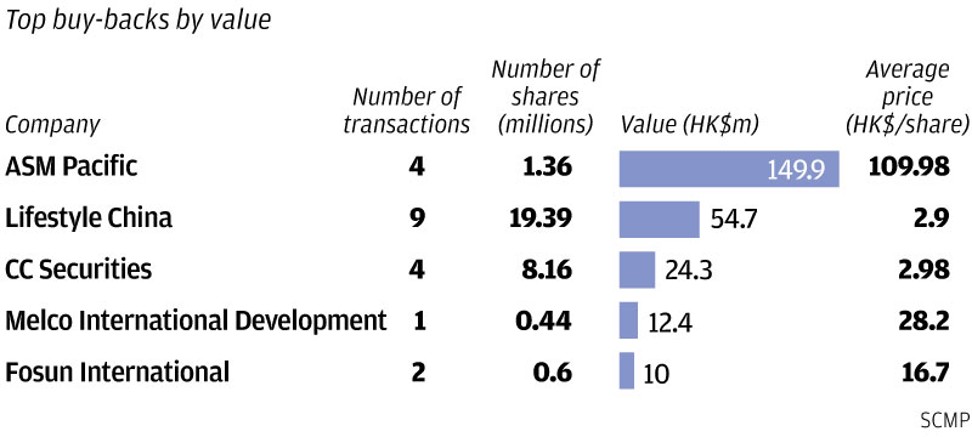

Meanwhile, 32 companies posted 118 buy-backs of their own shares worth HK$327 million, based on filings from April 20 to 26. The number of firms and trades was little changed from the previous five-day totals of 29 companies and 120 repurchases, but the value was sharply down from the previous week’s HK$682 million.

Another tycoon to join the buying of his own company’s stock was Raymond Kwok Ping-luen, chairman and managing director of Sun Hung Kai Properties, who recorded his first on-market trades in the developer since December 2016 with 856,000 shares purchased from April 17 to 25 at HK$123.70 to HK$121.08 each, or an average of HK$122.75 each.

The purchase was at a higher price than the 12.1 million shares he had acquired from January to December 2016 at HK$80.60 to HK$104.20 each or an average of HK$91.54 each.

The latest trades, which accounted for 4 per cent of the company’s trading volume, increased Kwok’s holdings to 515.138 million shares, or 17.78 per cent of the issued capital. The purchases were made after the stock fell by as much as 12 per cent from HK$138.30 in the last week of January.

Before 2016, Kwok had acquired 52.8 million shares from January 2003 to December 2015 at HK$35 to HK$140.80 each and 4.57 million shares from February 1993 to November 1996 at HK$27.20 to HK$93.75 each, or an average of HK$46.07 each. The stock closed at HK$122.80 on Friday.

Elsewhere, there were rare buys in mobile communications components maker MOBI Development, with chairman and CEO Hu Xiang and executive director Chen Zhaojun buying a combined 1.48 million shares between April 19 and 25 at HK$0.85 to HK$0.78 each or an average of HK$0.83 each.

The trades, which accounted for 15 per cent of the stock’s trading volume, were made after the stock fell by as much as 52 per cent from HK$1.63 in October 2017.

Hu recorded his first on-market trade since September 2016, with 170,000 shares purchased on April 19 at HK$0.85 each, increasing his holdings to 27.211 million shares or 3.32 per cent of the issued capital. He previously sold 115,000 shares in September 2016 at HK$1.31 each and purchased 762,000 shares from December 2015 to June 2016 at an average of HK$1.01 each.

Chen recorded his first on-market trades since his appointment in July 2016, with 1.3 million shares purchased from April 20 to 25 at an average of HK$0.82 each. The trades boosted his stake by 42 per cent to 4.432 million shares or 0.54 per cent.

The company announced its year-end results on March 23, reporting a loss of 48.51 million yuan (US$7.7 million) versus a profit of 65.85 million yuan the previous year. The stock closed at HK$0.79 on Friday.

Separately, the executive director of children’s goods maker Goodbaby International, Michael Qu Nan, recorded his first on-market trades in since his appointment in March 2014, with 800,000 shares sold from April 17 to 18 at HK$5 each.

The trades, which accounted for 12 per cent of the stock’s trading volume, reduced Qu’s holdings by 33 per cent to 1.6 million shares or 0.09 per cent of the issued capital. The disposals were made after the stock surged by 21 per cent from HK$4.12 on March 26. The stock is also up since June 2017’s HK$3.19.

The company announced its year-end results on March 26, with profit down by 13.1 per cent to HK$184.4 million. The stock closed at HK$5 on Friday.