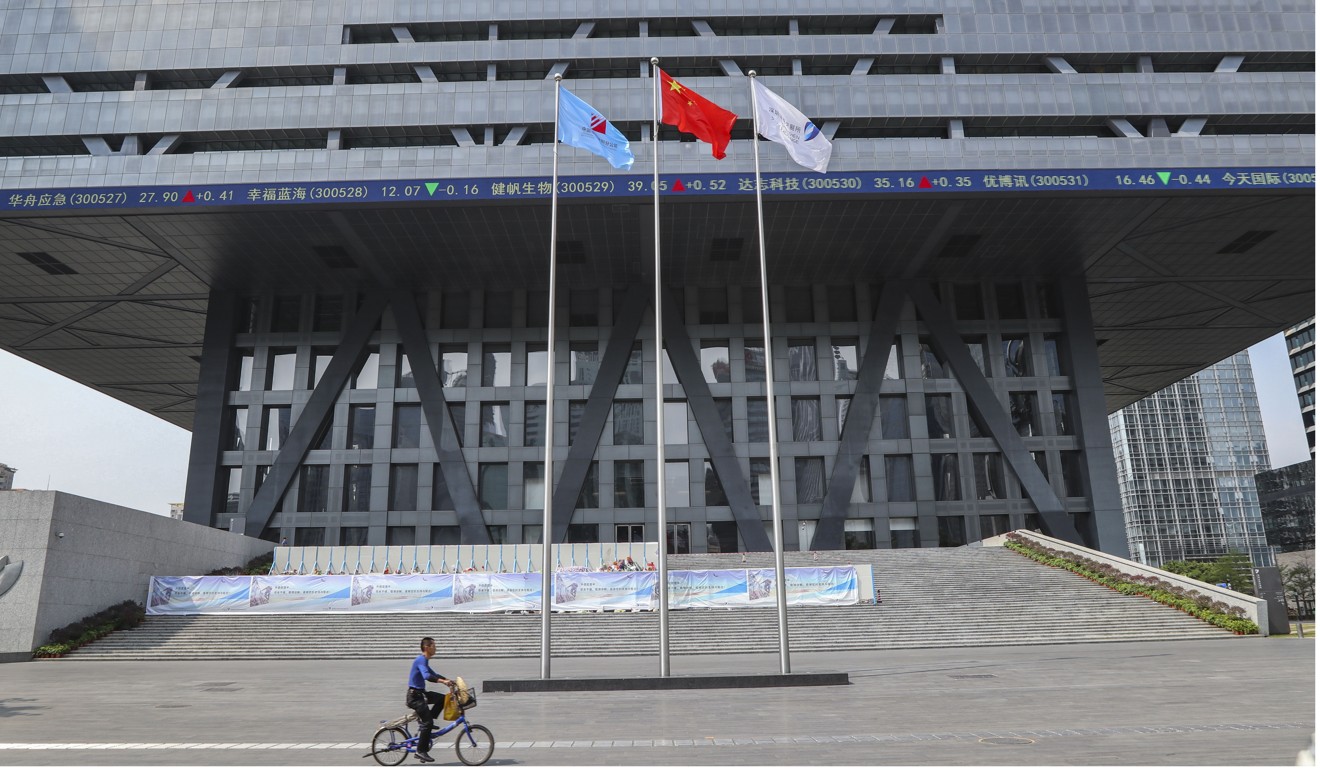

Global investors take their positions ahead of China’s inclusion in MSCI index

The phased addition of A shares in MSCI’s Emerging Markets Index will prove to be a major catalyst for foreign inflows into China’s stock markets, says top JPMorgan banker

Global investors are gearing up to invest in China’s stock markets as their confidence grows following the accelerated deregulation of the country’s financial sector and inclusion of A shares in the MSCI’s emerging markets benchmark next month, according to investment bank JPMorgan.

Filippo Gori, head of sales and marketing for markets and investors services for Asia-Pacific at JPMorgan, said global investors’ understanding of China has deepened after one of China’s top economic advisers Liu He’s visit to the US in March.

“Investors are impressed by how knowledgeable he is and by his understanding of what foreign investors are looking for,” he said.

“All the policies the [Chinese] government recently announced have improved foreign investors’ perception of China despite concerns over the escalating US-China trade conflicts,” said Gori. “They think China is moving in the right direction by opening up the market.”

China is in the process of opening up its securities sector to foreign players and will allow them to own a maximum 51 per cent stake in securities joint ventures.

From May 1, China quadrupled the daily quotas of the stock connect schemes linking mainland and Hong Kong markets, in a move seen easing the inclusion of A shares in the MSCI index.

“We expect an increase in stock transaction volumes in the short-term as a result of the expansion of the quotas,” said Gori.

Under the phased inclusion plan, MSCI, the global equity indices compiler, will include 222 mainland listed firms in its widely tracked Emerging Markets Index from June 1.

JPMorgan research estimates the inclusion would draw around US$6.6 billion of passive inflows into Chinese stocks.

“We estimate the active flows can be several times larger than the passive flows,” said Gori.

Foreign investors have been piling into A-share stocks, with money buying from Hong Kong into Shanghai and Shenzhen stocks via the cross-border connect scheme totalling 187.04 billion yuan (US$29.5 billion) in April, up six per cent from March.

“MSCI inclusion is a major catalyst for meaningful foreign inflows into the A-share market,” said Gori. “In the long-term, volumes will inevitably increase as the development and scale of China’s capital markets accelerate, and as the importance and size of China’s economy grows.”

Gori said the deregulation and the MSCI’s A shares inclusion would underpin the growth of foreign institutions’ participation in China, helping the Chinese market to move from being retail driven to institutional driven.

China’s stock market is currently dominated by retail investors in terms of turnover. About 85 per cent of the turnover comes from retail investors, against Hong Kong’s 30 per cent, 20-30 per cent in the US and 10 per cent in UK.

In preparation for greater foreign flows into China, Gori said the bank has increased its Greater China equity research headcount by 20 per cent.

“We do have a fairly aggressive investment plan in place for 2018 and 2019.”

The US bank has added four new analysts to its team in an anticipation that technology, media telecoms and health care sectors will be the most sought after by global investors.