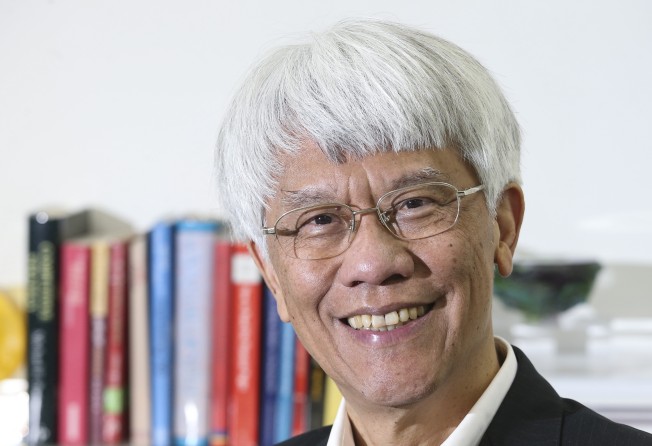

Joseph Yam warns of challenges for Hong Kong dollar stability

The challenges of keeping the Hong Kong dollar stable are likely to increase because of greater capital flows in a new era of the city’s capital market, said former Hong Kong Monetary Authority chief executive Joseph Yam Chi-kwong.

Demand from foreign players in the city’s capital market will increase as China continues to reform and open up, a process that will also be driven by the huge investment needs under the Belt and Road Initiative, said Yam, who stepped down from Hong Kong’s de facto central bank in 2009.

Financing needs for the Greater Bay Area project will also be big, said Yam.

“The volume of flows into and out of Hong Kong’s foreign exchange system will become greater and

greater, increasing risks and challenges to the HKMA’s goal to keep the Hong Kong dollar stable and monetary environment stable, ” Yam said on Friday.

“Given that foreign players have no choice but to only use the Hong Kong dollar as a medium for trading in the city’s capital markets, especially for stocks, they will also be facing for bigger foreign exchange risks.”

Authorities will strive to keep Hong Kong’s free capital mobility and its Hong Kong dollar

linked exchange rate system, he said.

So far Hong Kong has been successful in keeping the local currency stable, which has helped build the

city into a world financial centre, with the proportion of foreign participants in its stock markets one of

the highest in the world, Yam said.

But geopolitical tensions and US interest rate changes will impact the local dollar. Any resulting

adjustments to Hong Kong’s financial and property markets may not always be orderly.

The Hong Kong dollar was pegged at HK$7.80 to the US dollar in October 1983, with a trading band of 7.75 to 7.85 introduced in 2005. The HKMA is obliged to intervene to prevent the currency from trading outside this range. The currency traded at 7.8499 on Wednesday morning.

Since April the HKMA has intervened nine times, spending HK$70.35 billion (US$8.97 billion) out of its US$440 billion in foreign reserves as the local currency reached the weak end of its trading range.

It is important to consider whether foreign and Chinese players will become worried in the security of the city’s capital markets, while the question also remains whether Hong Kong’s capital markets are sufficiently attractive, Yam said.

Yam repeated his call to provide market participants with the option to trade in yuan in addition to Hong Kong dollar in the city’s stock market.

In January Yam said pricing, trading and the settlement in yuan for stocks listed in Hong Kong would

enable banks to manage their yuan assets and liabilities more effectively.

This would reduce the challenges of keeping the local currency and monetary environment stable and also reduce risks to foreign and Chinese market participants, he added.

“I am not saying to replace the Hong Kong dollar, but to provide an alternative option in Hong Kong’s new era for it’s capital markets as we need to ensure Hong Kong’s role as a financial centre as China’s market becomes liberalised further,” Yam said.