Canada's millionaire migrants earn less than refugees, so why bother with wealth migration?

Canada’s new millionaire migration scheme, the Immigrant Investor Venture Capital (IIVC) programme, appears to be dead on arrival. Authorities were last week forced to extend the application window after failing to fill a very modest quota of 500 applications worldwide.

But was the patient worth saving in the first place?

Wealth migration has drawn tens of thousands of rich Chinese to Canada recently and it has plenty of supporters here in Vancouver - real estate agents, some segments of the immigration industry, and those in the business of selling luxury goods and services spring to mind.

The arguments in favour of such programmes (excluding the dubious short-term benefit of selling passports) generally run thus: Millionaire migrants, by definition, are economically successful individuals who bring talent and money-making expertise with them to Canada. Their children are likely to be well-educated and similarly successful, long-term boons to the Canadian economy.

But the numbers do not stack up.

Logic would dictate that big-earning millionaires continue to earn big after settling in Canada. They might take a pause from their business activities while they settle in to their new country, but it’s only a matter of time before the money, and the trickle-down benefits, start flowing, right?

Not so.

According to the study, five years after immigrating, only about 39 per cent of IIP principal applicants reported ANY employment earnings whatsoever to Canada’s taxman, compared to 67 per cent of all Canadians.

And the annual employment income among those who did report was pitifully low. After their first year in Canada it averaged about C$18,000. After five years, it was about C$21,000; after 15 years in Canada, it had only risen to C$25,000. Compare that to the Canadian average of C$41,000 for the 2008 tax year, from which the data is extracted.

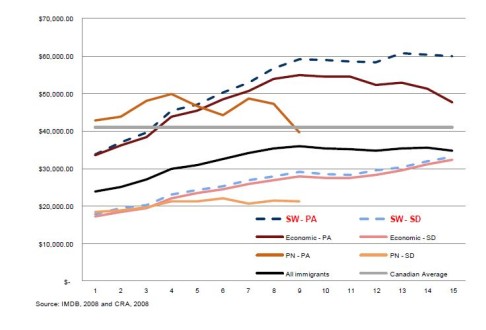

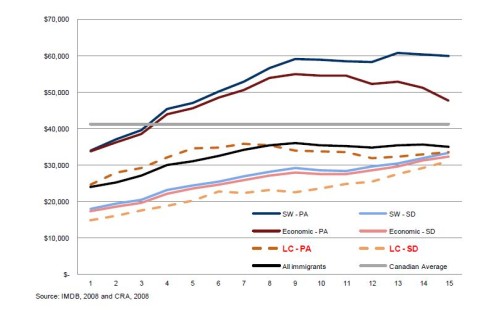

Lest it be thought that millionaire migrants are somehow disadvantaged in the Canadian economy by virtue of their newcomer status alone, let’s compare those earnings to three other immigrant classes.

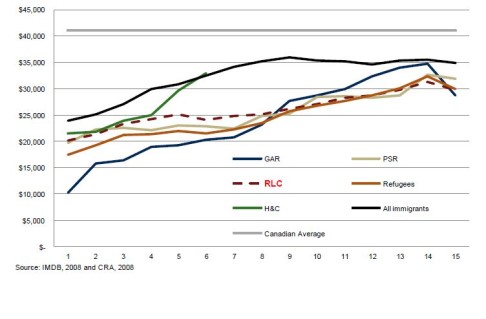

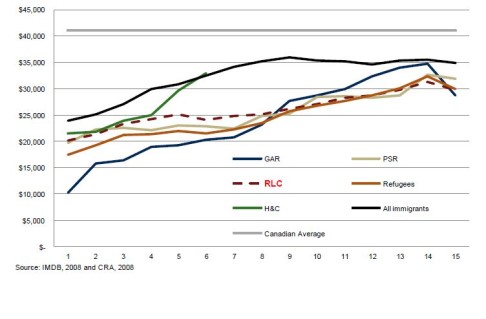

Skilled worker immigrants averaged C$34,000 after one year in Canada, and after 15 years were averaging more than C$60,000. Live-in caregivers averaged C$25,000 after one year, and C$34,000 after 15 years. Even refugees, who averaged about C$17,500 in earnings after year one, were earning an average of C$30,000 after 15 years.

Yes, that’s right. Refugees end up reporting higher wages to the Canadian taxman than millionaire migrants ever do. And two-thirds of all refugees declare income, bang on the Canadian average.

The same tax data provides evidence of another inconvenient truth about millionaire migrants: They don’t seem terribly devoted to living in Canada once they have obtained citizenship.

Three years after immigrating (the period of residency required to secure citizenship) around 47 per cent of IIP principal applicants reported earnings to Canada. But after another two years, their income-reporting rate had fallen steeply, to the aforementioned 39 per cent.

None of the other immigrant classes I have mentioned displays the same tendency, with income-reporting rates either increasing or remaining stable between three and five years of residency. The fact that some rich immigrants head for the airport after securing a Canadian passport is widely understood, but the tax data comes close to proving it.

What about the children of investor immigrants? Surely they make a go of it in Canada?

The data does not differentiate between spouses and children so we can’t be exact here, but it doesn’t look good.

For a start, the same phenomenon of a decline in tax-reporting rates (three-year residents versus five-year residents) could be seen in IIP spouses and children, suggesting some of them, too, head for the exits.

And although reported pay among IIP dependents rose from less than C$10,000 after year one in Canada to about C$29,000 after year 15, that is still well below the national average. It’s particularly worrisome considering that the biggest cohort of dependents upon arrival is made up of children aged 10 to 19, representing about 40 per cent of all IIP dependents. These would be aged 25-34 after 15 years, and should be earning good money. But they aren’t.

Exactly why millionaire migrants, as a class, have failed to integrate economically in Canada is a matter of some guesswork. But why would someone who has enjoyed great economic success in one place (say, China), reject that in favour of trying their luck in a new country, unless compelled to do so? And once a passport is secured, there is nothing that prevents any Canadian, native-born or immigrant, from going wherever they wish to seek out further success.

The big question about Canada’s new millionaire migration scheme isn’t whether it will succeed or fail. Instead, we should be asking why Canada bothers with millionaire migration at all.

NOTE: This blog was updated on March 10, 2015, to clarify that earnings discussed here are from employment only. But previously released information suggests that self-employment and investment earnings reported by investor migrants to Canada's CRA are also virtually non-existent, on average: According to the federal government, the average amount of income tax (covering all classes of earnings) paid by an investor immigrant over 20 years was C$100,000 less than the tax paid by a live-in caregiver, and C$200,000 less than that paid by a skilled worker. This level of disparity makes it likely that investor migrants also pay less Canadian income tax (and report lower overall income) than refugees too.

*The Hongcouver blog is devoted to the hybrid culture of its namesake cities: Hong Kong and Vancouver. All story ideas and comments are welcome. Connect with me by email [email protected] or on Twitter, @ianjamesyoung70