If it is done right, business #immigration can help support Canada’s economic growth priorities: https://t.co/BuRjeRRUBd #Immigration150 pic.twitter.com/yAtuz0LIZi

— Conference Board Cda (@ConfBoardofCda) May 2, 2017

Can Canada’s immigration industry bring federal millionaire migration scheme back from the dead?

The Conference Board of Canada has issued a report that recommends a new immigrant investor program - and says concerns about real estate prices in Vancouver must be ‘placated’

Few mourned when Canada’s federal immigrant investor program met its demise (1986-2014), crushed to death under the weight of endemic tax cheating, a vast backlog of applicants and the dubious ethics and temptations involved in selling residency.

Few, that is, outside the immigration industry.

For years the federal IIP had been a spectacular money-spinner - although not necessarily for the Canadian economy.

“Lucrative” doesn’t cover it: commissions of C$100,000 or more were being paid to “facilitators” for every successful referral of an immigrant to the IIP. Up to C$40,000 of that came from provincial investment funds receiving the applicants’ C$800,000 IIP investments; the rest was generally topped up by banks that provided financing for applicants.

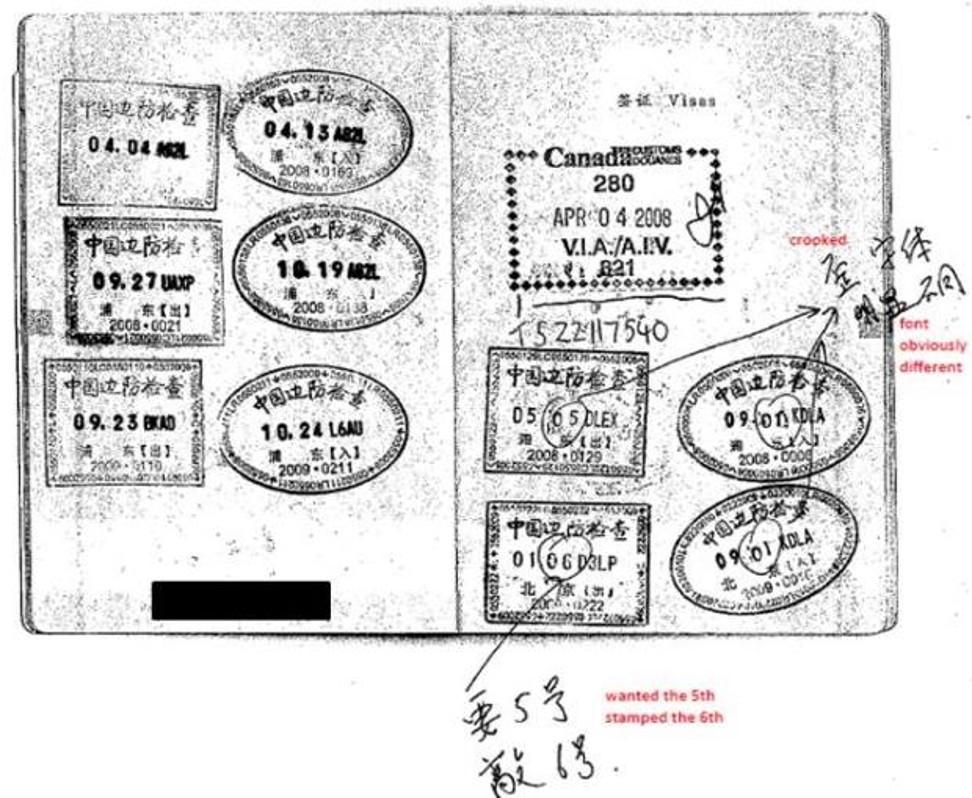

Why so much, when the popular scheme was heavily over-subscribed? Consultants in the Chinese market, which provided the bulk of all applicants, were colluding to “fix” the commissions, raising concern that the practice would “incentivise fraud”, according to an internal Citizenship and Immigration Canada memo describing the payments. “Non-competitive pricing practices, particularly in the Chinese market, have the potential to result in the payment of substantially higher fees to third parties offshore,” the memo noted.

“The fact that access to the Chinese market is restricted through government regulations exacerbates this situation,” said the 2011 document, obtained under an access to information request by Vancouver immigration lawyer Richard Kurland.

Another immigration lawyer, Ryan Rosenberg, warned Canadian senators at the time of the potential for fraud in the federal IIP by immigration consultants, hungrily eyeing C$100,000 commissions and commensurately desperate for applicants to get approved.

“My point is that the carrot has never been more golden. There has never been a better reason to join the industry in an unregulated manner and to stop at nothing to see that applications are successful,” he told a committee.

By 2014, the point regarding commissions was moot – the federal IIP was axed, although Quebec’s sister QIIP still operates.

But now the immigration industry is hoping to bring the federal IIP back from the dead.

Courting millionaires and placating Vancouver

A new report by the Conference Board of Canada, designed to influence government policy makers and drawing heavily from immigration industry input, has recommended the launch of a new federal immigrant investor scheme.

Based on a December summit in Toronto, the report last month called for the evaluation of a range of at-risk and passive investment types, in the pursuit of a new IIP.

A public awareness campaign would also be required to placate concerns regarding the impact of immigrant investors on real estate prices in major cities such as Vancouver

“Entrepreneur and investor immigration allows Canada to attract people that can launch innovative businesses, increase the flow of foreign direct investment to Canada, and support economic development goals such as building infrastructure,” the board announced on May 2.

The report framed Canada as being in “competition” with other countries for investor migrants. “However, as other countries are becoming less welcoming to newcomers, Canada can position itself to reap greater economic benefits from entrepreneur and investor immigration in the future by opening its doors to more foreign talent,” said Craig Alexander, the board’s chief economist, according to a news release.

The report meanwhile took time out from immigration policy to suggest an “increase [in] the real estate supply to help address affordability concerns”, having concluded this “the best way to address rising real estate prices”. It even suggested investor funds might be used to build affordable housing.

The report acknowledged the various problems with the old IIP, including fraud. But with “careful consideration” and “strict program integrity”, such concerns could be put to rest, it said. “A public awareness campaign would also be required to placate concerns regarding the impact of immigrant investors on real estate prices in major cities such as Vancouver,” the news release said.

Kareem El-Assal, the author of the board’s report, told the SCMP before it was issued that it would “voice what was said at the summit, but [would] not be representative of the Conference Board’s views”. The board was “an evidence-based organisation”, Assal said.

The mindset justifying investor migration

Tweaking the various rules that govern investor migration is one thing.

But this does nothing to change the fundamental mindset required to justify it – that Canadian residency, and thus eventually citizenship, should be put on sale in a competition-based marketplace.

And no matter how the benchmarks are set - for investment levels, how investors are scrutinised and how their money is spent – those ethical challenges exist in ways that they do not for other laudable immigration programs that satisfy admirable economic and humanitarian goals.

The practice of paying huge commissions to recruiters, and the subsequent risk of fraud? It could probably be eliminated - but such a problem is merely symptomatic of the required mindset.

This is not to suggest that all IIP migrants employ similar tactics – but for the majority of rich applicants, whose economic success is based upon connections and relationships forged in their home country, the same motivation certainly exists.

That it does so is born out in Canadian tax data. Another related problem with the old IIP was the chronically low levels of income tax paid by applicants – a pitiful C$1,400 per year on average, on par with refugees. As long ago as the 1990s, Canadian tax auditors were ringing alarm bells about this particular problem of millionaire migration – that applicants, like Wang’s clients, continued to earn their primary income elsewhere while declaring little or none of it in Canada.

Again, the problem is mindset – instead of residency being seen as a set of ongoing obligations and privileges, it is reduced to the status of a commodity, bought and paid-for.

The 90-page Conference Board report dwelt heavily on how Canada could compete in the global marketplace for millionaire investor migrants. But if the premise of the race is ethically flawed, it remains so whether Canada wins it or not.

The report also suggested coming up with a Canadian version of the US EB-5 scheme, costing US$500,000 per family, which grew in popularity after the IIP was axed.

Ironically, the publication of the report virtually coincided with a firestorm erupting around the EB-5 scheme, when it was revealed that the family of White House adviser Jared Kushner had been touting his administration links in their efforts to woo Chinese EB-5 investors to their real estate projects.

There were calls for the scheme to be halted from US senators and others. In an editorial, the New York Times dubbed the EB-5 a “scandal magnet” that sells green cards.

The Times’ editorial board was right. Selling visas is scandalous. And that’s regardless of whether it’s US or Canadian residency up for grabs.

*

The Hongcouver blog is devoted to the hybrid culture of its namesake cities: Hong Kong and Vancouver. All story ideas and comments are welcome. Connect with me by email [email protected] or on Twitter, @ianjamesyoung70.