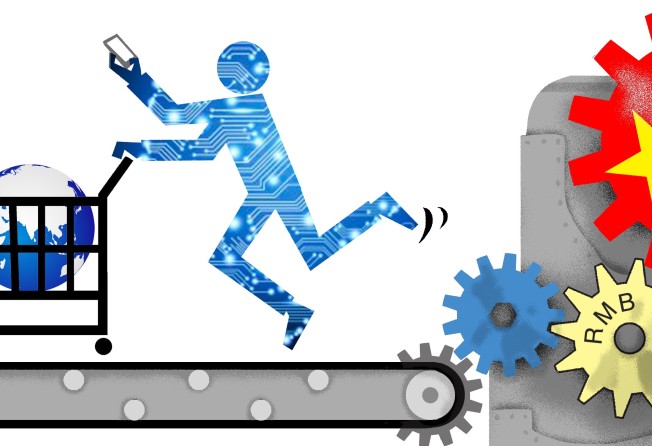

How China’s can-do generation will be the engine of growth, both at home and globally

Helen Wong says armed with the wealth of the baby boomers and the tech savvy of the millennials, China’s young consumers are a formidable force that will transform China and power the world economy

In the 1950s and 1960s, the world economy was transformed by the emergence of the American consumer. Today, China’s rising “i-can” generation is in the driver’s seat.

China’s rapid social and economic transformation over the past three decades has given rise to a new age of consumer – the “I can do anything”, or “i-can” generation. Emboldened by years of economic growth, this generation is now empowered by the rising digital economy in China, represented by a new Taobao-WeChat digital purchasing and communication axis.

Essentially, China’s “i-cans” leapt from the pre-web era straight to the mobile internet, skipping the personal computer altogether. On the way, their e-commerce activity has created one of the world’s largest digital economies and is spawning a new generation of Chinese IT companies that are making their presence felt on the global stage.

The demographic characteristics of the “i-can” generation are very unique: combining the features of the West’s baby boomers and millennials. What this means is that they have all the opportunity, optimism and wealth the baby boomers had, with all the modern technology at their fingertips.

They are more globally minded than their parents. As products of the one-child policy, they have acquired a can-do attitude which is now transforming the country’s society and economy. This new generation is also worldlier, entrepreneurial, individualistic, open-minded and willing to spend.

The “i-can” cohort represents more than 400 million people, or almost a third of China’s population and more than the working populations of the US and Western Europe combined. This new generation is expected to drive 65 per cent of consumption growth in China until 2020, when they will make up around 53 per cent of total consumption spending, up from 45 per cent in 2016.

Their combined economic power is represented by a few statistics. The number of internet users in China is more than 730 million, as big as the total population of the EU, or twice the population of the US. More than 95 per cent of these digital “i-cans” are connected via their smartphones – roughly half a billion use their smartphones to make payments; more than 200 million use them to order food takeaways.

On Singles’ Day last year alone, the “i-cans” spent US$17.8 billion – more than America’s Thanksgiving, Black Friday and Cyber Monday combined in the previous year.

There is no doubt that this generation is poised to become the dominant force in China’s consumer market, which will power the country’s economic growth. This generation’s spending power is resetting China’s growth model, based on domestic consumption over the traditional foreign-investment and export-led growth.

This means that China’s “i-cans” will soon become a force driving global economic growth.

This change in consumption patterns has encouraged innovation and growth in the private sector to meet the rising consumer demand. This is particularly evident within the information technology industry, which has seen Chinese companies such as Alibaba in e-commerce, Tencent in social media, and search giant Baidu, all become leading global businesses.

In 2016, Chinese people spent US$5.5 trillion through mobile payment platforms

Consider this: in 2016, the Chinese spent US$5.5 trillion through mobile payment platforms – about 50 times the amount in the US. Users of Tencent’s WeChat sent around 46 billion digital red envelopes over the Lunar New Year period this year, while PayPal completed 6.1 billion payment transactions in the whole of 2016. Alibaba’s payments affiliate, Ant Financial’s Yu’e Bao became one of the largest online funds, managing US$165 billion for more than 325 million clients, comprising 99.72 per cent individual investors and 0.28 per cent institutional investors by the end of 2016.

And those players are not just providing a single mobile platform, they are integrating everything into a mobile-centric finance solution.

Alibaba, owner of the South China Morning Post, and Tencent are integrating different parts of life, including payments for utilities, transport and hotels, into their mobile platform. You can do almost anything, anywhere – just by swiping your smartphone. Put simply, customers can run a tally of their daily expenses through an accounting function on Alipay or Tenpay, which automatically records every transaction and analyses the flow of money. Consumers also have access to lending, bartering and wealth management solutions, such as trading of funds and stocks.

In the long term, this new, modern Chinese consumer of the “i-can” generation will transform China into a more digital and consumer-driven economy. And their massive spending power will not just be the backbone of China’s sustainable growth, but the primary engine of global economic stability.

Helen Wong is chief executive, Greater China, at HSBC