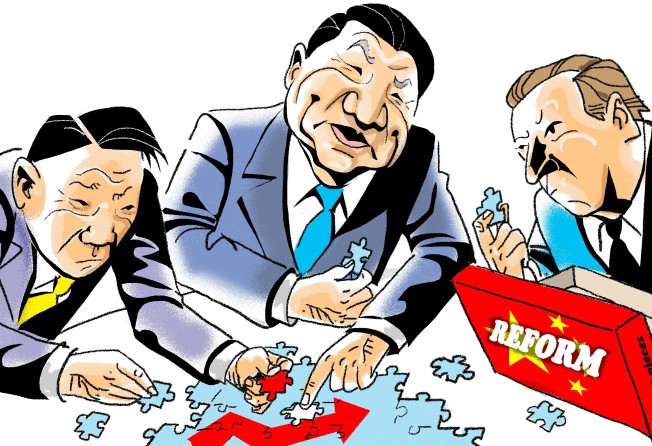

Did the US play a role in China’s long-term market reform plans? Wait for the policy details

Victoria Ruan says a clearer picture of China’s long-term economic reform blueprint, which may have been formulated in anticipation of tough US trade action, will emerge only when leaders lay out annual policy in December

The US$250 billion worth of deals announced during US President Donald Trump’s state visit to China made headlines. And, while the value of the newly signed and legally binding contracts in the package may be much smaller, the deals will help the two countries to narrow the trade gap somewhat.

However, what represents more substantial changes is the set of longer-term reform plans on easing market access recently announced by Beijing. This could be partly in anticipation of tough US action on trade and investment in the months ahead. Coming shortly after the 19th party congress, the announcements also fuel hope that China’s domestic reform may eventually pick up pace after getting largely stalled in the past five years. Of course, uncertainty remains over the details of the plans and how they will be implemented.

Deputy Finance Minister Zhu Guangyao said Beijing has decided to treat foreign and domestic investors equally when they take stakes in banks. It also plans to let foreign investors take a majority stake of up to 51 per cent in domestic life insurers after three years, and pledged to remove the limit permanently within five years.

Starting next year, China will also adopt a unified negative-list system for the whole country, meaning foreign investors – in theory – would enjoy equal treatment with domestic players, except in fields restricted by the list.

And, the government has pledged to reform the pricing mechanism for items ranging from natural gas to agricultural products and utility fees by 2020. Echoing these plans, Vice-Premier Wang Yang wrote a lengthy commentary in the People’s Daily, calling for “forming a new pattern of comprehensive opening up of the market”. Wang emphasised that this opening up “isn’t a tactic of expediency” but a long-term strategy.

But despite all the pledges, some details are lacking, such as which areas will face restrictions in the unified negative list.

Meanwhile, Beijing has said it will improve the review system on national security interests, suggesting sensitive foreign deals will be subject to even stricter scrutiny, such as those believed likely to threaten national cybersecurity.

China’s economic reforms: the last five years

However, the overall impact of the latest reforms look positive for investors, as they appear more concrete and have clearer timetables. Judging from the timing, Beijing’s generous purchase of US products and the reform plans will help it negotiate with the US on its planned action on investment and trade.

After the two sides failed to narrow key differences at the US-China Comprehensive Economic Dialogue in July, US Trade Representative Robert Lighthizer initiated a Section 301 investigation focused on China’s intellectual property and technology transfer issues.

A bill was introduced in Congress this month on tightening the review of foreign investment for potential threats to national security, with China deals expected to take the hardest hits.

However, it would be wrong to think the Chinese reforms were merely motivated by external relations. China’s macroeconomic policies, especially those with a long-term vision, usually reflect a consensus among the top leadership about its domestic priorities.

Xi faces more arduous challenges than his predecessors, [amid] rising labour costs and pollution

Should President Xi Jinping wish to leave a legacy as one of China’s greatest leaders, ensuring economic prosperity is a must. But he faces more arduous challenges than his predecessors, as rising labour costs and pollution threaten the country’s economic boom that has gone on since the 1980s. That places great pressure on the leadership to introduce advanced technology from abroad to move up the value chain.

Now that Xi has gained greater authority, he will find it easier to push his own agenda without having to worry much about opposition.

‘Xi Jinping Thought’ made part of Communist Party charter

The party congress unanimously endorsed writing Xi’s name into the Communist Party’s constitution, granting him the same status as Mao Zedong, the founding father of the People’s Republic.

Xi also got his closest allies elected to key positions. In his team are Harvard-trained economic policy crafter Liu He, a top candidate for the vice-premiership, who helped Xi forge the idea of supply-side structural reform; Wang Yang, a reputable veteran reformist from the Deng Xiaoping era; and Han Zheng, a new face in the Politburo Standing Committee who has a proven record in managing booming Shanghai. Xi’s close allies now also lead important economic centres, including Guangdong, Chongqing and Beijing.

Nevertheless, it is always risky to predict the outlook for China. The most recent lesson can be learned from the past five years. To the disappointment of those who cheered the third plenum statement in 2013 on deepening market reform, progress has lagged significantly behind the drastic pace of the anti-corruption campaign.

Who are China’s new top leaders?

If Beijing hopes to convince the world of its sincerity to push forward reform, it needs to address some persisting puzzles.

How will China’s market reform be designed differently from that in the West?

For example, how will a more assertive and centralised leadership, refusing to copy any Western models, embrace market liberalisation, and how will China’s market reform be designed differently from that in the West? Also, how can a government allocate the best resources to its state sector in order to make it stronger and bigger, while simultaneously encouraging competition from the private sector?

To get a better idea about Beijing’s policy road map, it may be necessary to wait until the central economic work conference next month. Hopefully, we will hear more details from central and provincial economic leaders when they lay out the monetary and fiscal policy tone for the coming year.

Victoria Ruan formerly covered China’s economic policy at the Post and now works for a strategic consulting firm in Washington, DC. The views expressed here are purely her own