Emerging markets still have upside amid the downturn

Nicholas Spiro says developing economies may not be as disengaged from advanced economies as the decoupling thesis makes out, but as US equity markets slide, there is reason to be optimistic about emerging-market stocks

To what extent are emerging markets disconnected from developments and trends in advanced economies?

In the aftermath of the global financial crisis, the “decoupling” thesis was popular among some investment strategists as the economies and financial markets of many large developing nations, notably China, performed better than those of advanced economies, having proved more resilient to external shocks than previously assumed.

The decoupling theme was, in truth, overhyped and misleading. The steep declines in asset prices in developing economies during the so-called taper tantrum in 2013 revealed the degree to which emerging markets are influenced by financial and economic trends in advanced economies.

The surge in volatility in the stocks of developing economies since a bout of turbulence swept through global markets at the end of January is the latest sign that the fortunes of emerging markets remain closely tied to those of developed countries. While the benchmark S&P 500 index has dropped more than 8 per cent from its peak on January 26, the MSCI Emerging Markets Index, a leading gauge of stocks in developing nations, has fallen by roughly the same amount. What is more, emerging-market shares have been almost as volatile as the S&P 500, plunging in early February, only to rebound sharply throughout the remainder of the month.

A decade or so ago, the woes of a large tech stock would have barely ruffled Wall Street … Now, however, tech shares account for seven of the world’s top 10 companies

Last month, developing countries’ stocks came under renewed pressure because of the turmoil in the popular technology sector which has suffered due to mounting concerns about data privacy and the threat of greater regulation.

A decade or so ago, the woes of a large tech stock would have barely ruffled Wall Street. Back then, Microsoft was the only tech group in the world’s top 10 companies by market capitalisation. Now, however, tech shares account for seven of the world’s top 10 companies. The S&P 500 has become tech-heavy, with the industry now accounting for roughly a quarter of the index.

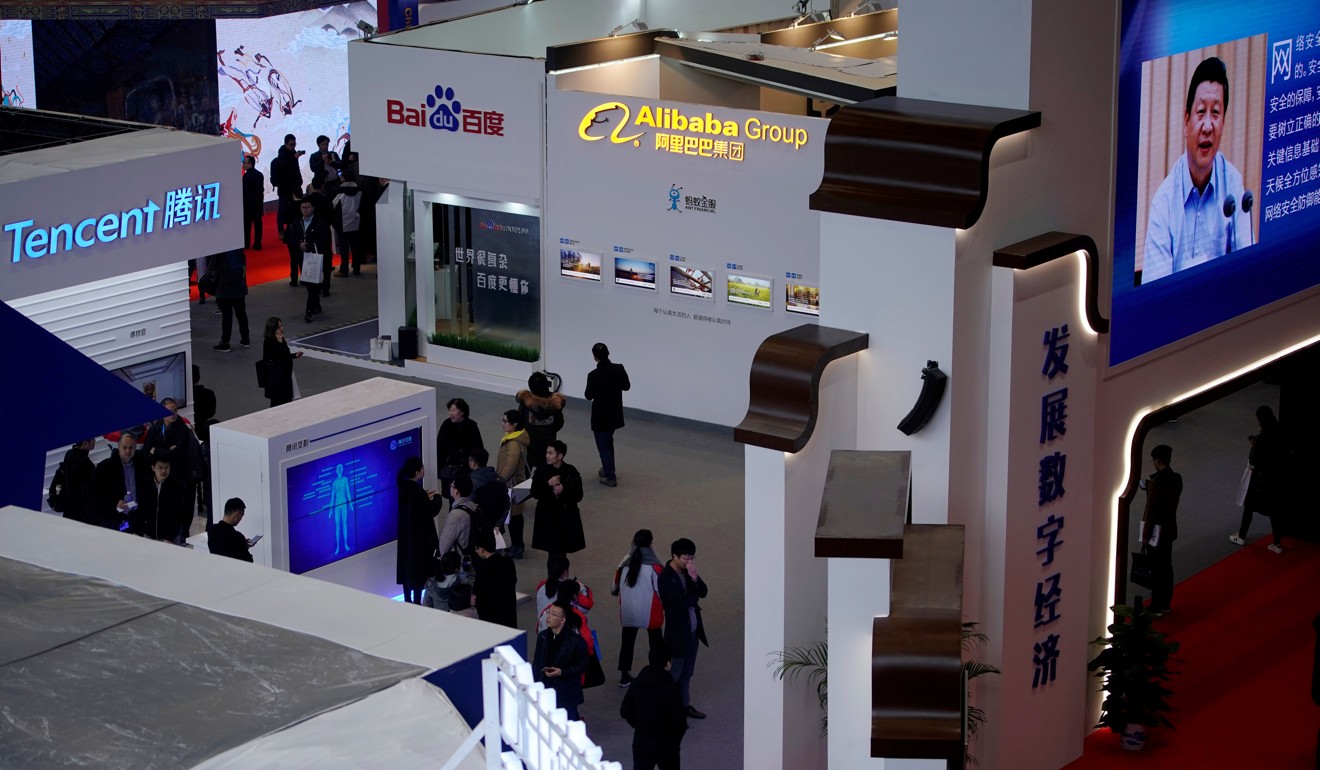

While emerging-market equities used to be a play on commodities, they too are being driven by the tech sector, with the shares of China’s Tencent Holdings and Alibaba Group, South Korea’s Samsung Electronics and Taiwan Semiconductor now accounting for nearly a fifth of the market capitalisation of the 846-member MSCI EM index.

Last year, the Asia-led tech component of the index skyrocketed more than 60 per cent, turbocharging the 37 per cent rise in emerging-market stocks. Yet since the end of January, it has been tech shares which have experienced the steepest declines (and the sharpest rallies) as the sector has become a focal point of market anxiety.

Add in this week’s severe escalation in trade tensions between Washington and Beijing, and the bull case for an emerging-market equity market, in which tech accounts for nearly 30 per cent of the benchmark index and in which China, South Korea and Taiwan – three of the developing economies most at risk from trade protectionism – make up more than 55 per cent of the gauge, is getting harder to make.

Still, there are reasons for optimism.

Firstly, sentiment remains bullish towards emerging markets. The equity funds of developing economies have attracted more than US$43 billion of inflows so far this year, roughly the same amount in outflows from US stock funds, according to JPMorgan. This is partly because emerging markets have recently been growing at an even faster pace relative to advanced economies, but also because the dollar has fallen sharply – and is expected to remain weak given the weighty speculative bets against it.

According to a market sentiment survey published by DataTrek Research, a US consultancy, on Tuesday, investors believe emerging-market equities are the asset class most likely to outperform this year despite concerns about tech stocks.

Secondly, and more importantly, mounting strains on emerging-market equities are a blessing in disguise.

Not only do the recent declines in the stock markets of developing countries stem entirely from external factors, the sell-off began, and is still most apparent, in US equity markets. This is not a home-grown downturn – quite the opposite. Investors know this and are therefore likely to continue to perceive emerging markets favourably, at least for the time being.

More importantly, renewed volatility in equity markets is forcing investors to pay more attention to valuations.

While US stocks, which have been dangerously overvalued for some time, have become less expensive, emerging-market shares are still significantly cheaper. The so-called forward price-earnings ratio, a popular valuation tool, for the S&P 500 still stands at just below 17, compared with 12 for the MSCI EM index.

The decoupling thesis may have been flawed, but there is still value in emerging-market shares.

Nicholas Spiro is a partner at Lauressa Advisory