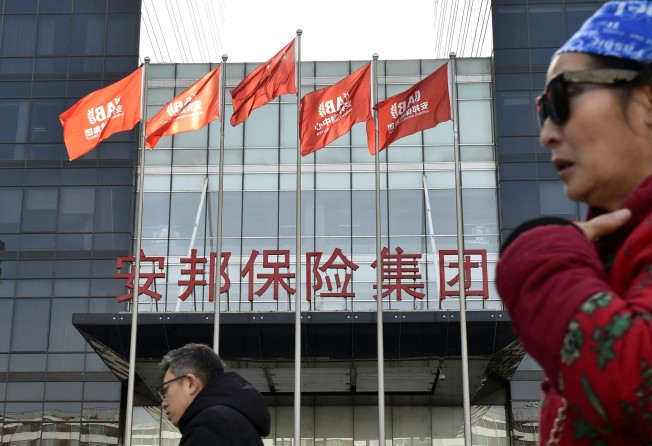

Trial of Anbang boss a landmark case in financial crackdown

The nation can expect to see a number of major entrepreneurs brought to trial in a crackdown on freewheeling deal makers, with Wu Xiaohui just the first

Decades of high-speed growth have left China exposed to financial risks from excessive debt burdens. Officials have made it clear the focus of economic management this year is on bringing them under control. As a result, the nation can expect to see a number of major entrepreneurs brought to trial on charges of financial crimes in a crackdown on freewheeling deal makers. The first case, involving former chairman of the giant Anbang Insurance group Wu Xiaohui, is therefore a landmark.

The government has chosen perhaps the most egregious example to showcase its determination. Wu appeared in court in Shanghai charged with fraud valued at 65.25 billion yuan (HK$81.6 billion), illegal fundraising and embezzlement of 10 billion yuan from Anbang’s insurance premium income.

Under Wu’s orders, the court said, Anbang raised capital through selling wealth management insurance policies to more than 10 million policyholders, exceeding the insurance regulator’s approved quota by more than 700 billion yuan. The prosecutor left no doubt about the gravity of the perceived threat of such activities by accusing Wu of having “crushed national financial security” and damaging “the safety of investors’ capital”.

The authorities telecast the court case live via the Weibo social media network, and Wu contested all the charges before finally admitting guilt. Then the government announced it was injecting nearly 61 billion yuan into the group to ensure its solvency.

Under official classification of such cases into three types, Wu is seen as representative of the worst. The former car insurance salesman-turned-tycoon is accused of using his company as a shell to raise capital from insurance clients or retail investors and diverting the cash into high-leverage speculation. He also borrowed heavily from banks, to whom his credit appeared good because on paper at least he had a very successful business empire.

However, the money found its way into overseas assets, which amounted to leaving the risk in China on leveraged acquisition of those foreign assets, reason enough for Beijing to want to make an example of him. Other groups facing prosecution may not have targeted retail investors but they engaged in similar operations and are now cashing out of accumulated stakes in companies.

The telecasting of the trial on Weibo, unusual in a contested case, is evidence that the government wants to send a clear message to entrepreneurs. Since the case does not involve state secrets and is not political, an open court is the right place to prosecute violation of insurance law.

Moreover, if the aim is to deter such speculative behaviour and safeguard market stability, legal process is part and parcel of the whole operation. Proper legal procedure is just as important as the crackdown.