War in Syria and US-China trade tensions strain global economic confidence

David Brown says financial instability may be about to return as trade tensions between China and the United States, and the threat of US-Russia military confrontation escalating in Syria, affect economic confidence indicators around the world

No one said it was ever going to be easy. Putting the world economy back on the road to recovery was always going to be fraught with risk. But global growth now faces the daunting task of being trapped between a rock and a hard place. The outbreak of global trade tensions and the nightmare scenario of possible conflict between the US and Russia over Syria pose deadly risks for world economic recovery. It begs the question where our future growth is going to come from.

Economic confidence can be a fickle thing at the best of times but it is the lifeblood that drives the global economy forwards. Consumers need to feel upbeat about future prospects for income growth, employment and well-being. Businesses need to feel secure about committing new capital to investment, inventories and production. Exporters must feel sure about the global marketplace for trade. And governments need assurance that their economic plans are not going to be derailed.

Watch: Christine Lagarde shares her views on Sino-US trade tensions

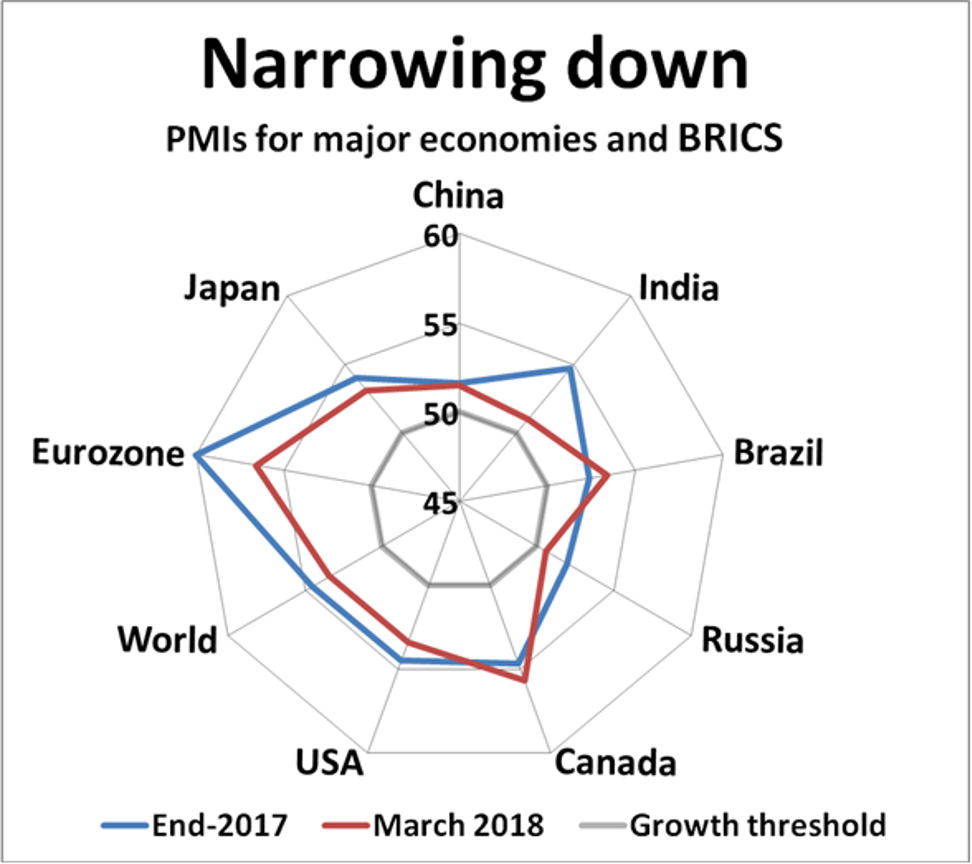

Recent events could conspire to turn what has been near-stellar global economic activity in the last half of 2017 into an anticlimax this year. The worry is that global confidence has already passed tipping point, financial market stability is poised on a knife-edge and consumers, business and investors could soon end up on the defensive. Early signs of strain are already showing in key confidence data, raising questions about whether the game is already up for stronger growth ahead.

Weaker trade worries, Brexit uncertainties and the gloomy global backdrop are beginning to take their toll. If Germany sneezes, Europe always catches a cold

In the major economies, benchmark business confidence indicators are looking past their best. The US Purchasing Managers Index for manufacturing has enjoyed rampant recovery in the past few years, surging to a 14-year high of 60.8, well above the threshold 50 boom-or-bust line. US companies have had a huge windfall from President Donald Trump’s tax cuts, but it is hard to see how optimism can extend much more, especially given the negative geopolitical backdrop right now.

Europe’s business sentiment indices have been firing on all cylinders, charged up by the European Central Bank’s colossal monetary stimulus in the past few years. Germany remains in the vanguard, but there are strong hints that momentum is starting to stall. German orders, output and exports all dipped last month, hinting at potential fault lines in the business outlook.

Critically, Germany’s bellwether IFO Business Climate and ZEW Economic Conditions indicators have tumbled in the past few months, early warning signs that Germany’s manufacturing powerhouse is starting to stutter. Weaker trade worries, Brexit uncertainties and the gloomy global backdrop are beginning to take their toll. If Germany sneezes, Europe always catches a cold.

Japan’s Tankan Business Confidence Index has shown some solid results in the past few years, but the mood worsened slightly in March as manufacturers kept a watchful eye on unsettling events abroad. Any downturn in the global economic picture could have profound repercussions for Japan’s reflation battle.

There is little to suggest the BRICS countries, developing nations or emerging markets will be able to make up any slack. Tighter borrowing conditions around the world, the threat of a global trade war and increased tensions between the superpowers could pose serious drains on confidence and economic activity in the coming months.

China’s economic confidence indicators have seemed reasonably robust but their durability would be sorely tested in the event of any interruption to global trade. Likewise, India, Brazil and Russia would all be highly vulnerable to any slowdown in the major economies and a weaker global picture.

It adds up to a highly precarious cradle of contingent risk. If economic confidence capitulates and business activity folds, then global investors will begin to panic. Once equity and housing markets are affected and financial wealth expectations take a dive, consumers will go to ground, leaving recovery hopes badly marooned. The general mood could easily slip back into a downward spiral.

For the moment, the jury is still out on which way events may turn. The global economic rebound has had a good run for its money since the 2008 crash and there is still the outside chance that improved diplomatic efforts could lead to a breakthrough on the trade front and the crisis in the Middle East. Hope is a good thing, but the danger is that it ends up overstretched.

Once the world loses hope, it is game over for global recovery and financial instability will return.

David Brown is chief executive of New View Economics