Experience counts in the city’s fight against dirty money

For the sake of the city’s reputation, the government should do what it can to maintain competitive career prospects and remuneration for people who have the experience and ability to match wits with wrongdoers

No reputable financial centre wants to see its image tarnished internationally by failure to comply with or to enforce laws against money-laundering of the proceeds or funding of crime, including drug trafficking and terrorism.

There are two reasons for Hong Kong authorities to reflect on the city’s performance in this regard against international benchmarks. One is a risk assessment issued by the Financial Services and Treasury Bureau, confirming a Post report that the city’s financial system is groaning under the weight of a deluge of suspicious transaction reports.

The other is that the city faces a major audit of anti-money-laundering capabilities by a team from the Paris-based international dirty money watchdog, the Financial Action Task Force, expected here in late October.

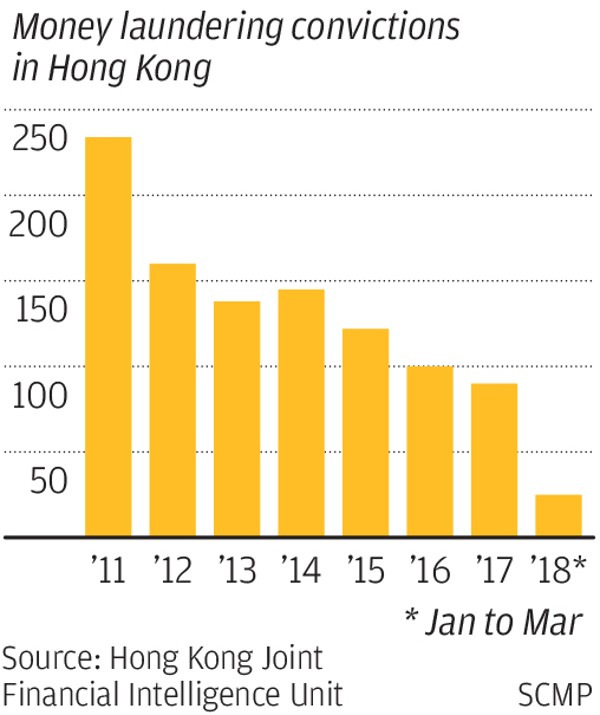

At first sight the Post report rings loud alarm bells, not least because in 2017 the city’s Joint Financial Intelligence Unit (JFIU) received 92,115 reports from banks and other financial institutions of local, national or international transactions with suspected links to money laundering or terrorist financing.

In 2011, the figure was just 20,287. But staffing of the JFIU stands at just 48, two less than several years ago.

The bureau’s risk assessment describes the rise in money-laundering reports as “significant” as the city tries to plug gaps in the fight against dirty cash.

That said, the number of reports can be deceiving.

There is higher awareness, and financial institutions and others are filing “protective” or precautionary reports, not necessarily based on facts that give rise to a reasonable suspicion of money-laundering.

We will know more about this before too long, once the financial action task force team assesses how the city is faring in the battle against increasingly sophisticated methods used by global criminal and terrorist networks to hide and clean dirty money.

Evidence that the joint intelligence unit is facing a formidable international adversary is that British lawmakers have just launched an inquiry after Transparency International claimed £4.4 billion (HK$48.8 billion) worth of property in Britain was bought with suspect wealth.

Outlining “threats and vulnerabilities” facing Hong Kong, the financial services and treasury bureau report acknowledges that the local regime is under stress but says solutions are being pursued.

Ironically, the joint intelligence unit competes for experienced staff with the same banks responsible for filing an increased volume of suspicious transaction reports. Experience counts, since money launderers are resourceful in their efforts to safeguard their ill-gotten gains.

For the sake of the city’s reputation, the government should do what it can to maintain competitive career prospects and remuneration for people who have the experience and ability to match wits with wrongdoers.