Brexit is knocking out British industry, and it may not bounce back

David Brown says UK companies are already feeling the pain of losing their stake in European ventures and access to the single market, yet the government appears clueless about the impact of Britain’s departure from the union

Britain is bearing the scars of a car-crash economy as the political crisis deepens over Europe. More firms are voting with their feet in a desperate attempt to avoid the likely chaos when the country finally quits the European Union. If the corporate exodus from the UK turns into a stampede, Britain’s industrial prosperity could be ruined forever.

Britain is heading into the unknown. By now, the government should have had a much clearer idea about what impact Brexit would have on the economy, but politicians seem increasingly baffled about what the consequences will be for UK manufacturing, services and its financial markets.

Those tasked with the job of finding out what happens to the economy after Brexit have come up empty-handed. Promised detailed government analyses of the 39 key business sectors likely to be affected by Brexit have been a sham. British industry is heading into an uncertain future without a strategy.

It is a far cry from what was expected when Britain joined the European Economic Community back in 1973 when hopes were high that Britain could thrive and prosper under membership of the single market. The new door into Europe would present untold business and trading opportunities for British companies, economic growth would pick up and UK living standards would improve. Now that door is about to close, there is real fear that the benefits will quickly unravel.

It is also a very different vision to the one fancied by former prime minister Margaret Thatcher, who saw Europe as a prime opportunity for Britain when her Conservative government came to office in 1979. Thatcher launched attractive tax breaks and advantageous regional aid deals as golden lures for overseas businesses to set up shop in the UK, offering an easy way to break into the lucrative European market. Many firms like Nissan, Honda and Toyota flooded in over the years.

As a result, the UK automotive industry, once the joke of British manufacturing, is now one of the jewels in Britain’s industrial crown, employing nearly one million workers.

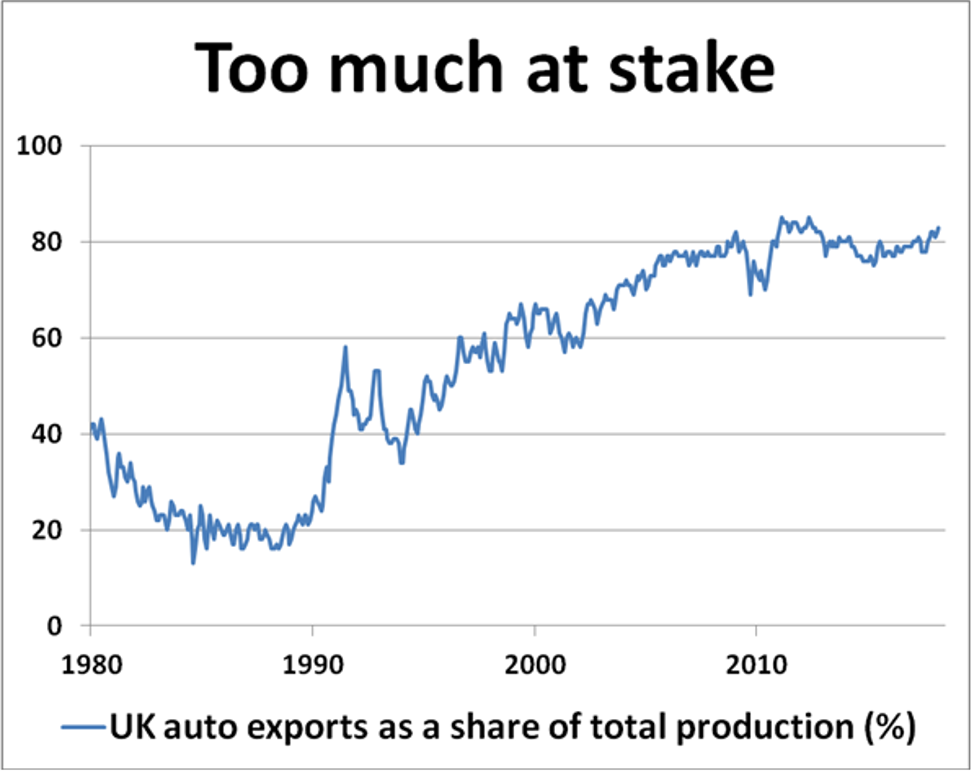

The arrival of foreign firms over the past four decades brought much-needed productivity and new working practices, which revolutionised the car industry and turned Britain into a major auto exporter again. Brexit could change this overnight.

Thanks to Brexit, Japanese carmakers, who account for more than 40 per cent of British car output, could lose free access to the single market and end up subject to significant tariffs exporting into Europe. Unless the UK can strike special deals, Japanese car manufacturers could easily jump ship into Europe to circumvent future trade barriers. Britain’s car production hub in Sunderland, which voted 61 per cent in favour of quitting Europe, would be pole-axed by any such moves.

Leaving Europe is already taking its toll on the economy, especially for those British firms hoping to stay involved in costly EU joint ventures. Hi-tech UK companies, especially in the aerospace and defence industries, are already feeling the pinch from being frozen out of the bidding process for new euro contracts. It can only get worse.

But there could be positive spin-offs too, as threats to exclude British firms from future involvement in Europe’s Galileo satellite navigation programme could spur Britain into going it alone with its own rival system, sparking a vital new rush of jobs and investment into the British space industry. Funding would be key.

Whether Britain has the wherewithal to go it alone is critical. Financing alternative ventures to rival expensive projects like the Typhoon Eurofighter could be beyond British means, especially after years of domestic austerity cutbacks. Unless the government stumps up the necessary funds to beef up Britain’s crumbling industrial infrastructure, the outlook is bleak. Output, jobs, exports and growth are all at risk outside Europe.

The UK government has two options. It can either decide it is “better in than out”, choosing to stay in Europe. Or, it can decide to break free and make a new start – but this option is looking less viable given the financial restraints battening down Britain’s economy at the moment.

The real risk is that Britain could easily slip from envy of the world to the laughing stock among major industrial nations. British firms are struggling right now and the economy is only a whisker away from recession. The descent into industrial decline could soon become an unstoppable force.

David Brown is chief executive of New View Economics