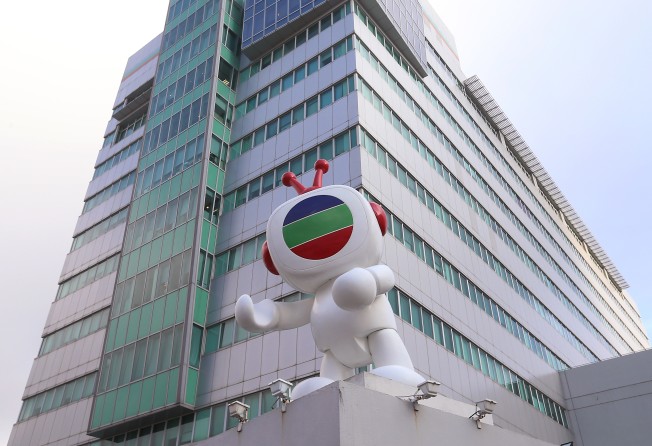

TVB bonds blunder beats any soap opera

- Latest profit warning by the television giant is sheer embarrassment and comes in the wake of disastrous deal with mainland theatre operator SMI Holdings Group

TVB’s once popular soap operas and variety shows have become self-parodies. Sadly, those in charge of its finances aren’t the sharpest tool in the shed, either. It has been said that its rise to TV dominance mirrored the golden age of Hong Kong. Let’s hope its decline doesn’t represent the same parallel for the city.

TVB’s latest profit warning is sheer embarrassment. It is expecting a HK$200 million net loss for the financial year ending December 31, 2018. The losses mostly stemmed from a write-off of HK$500 million on its holdings of convertible bonds issued by mainland theatre operator SMI Holdings Group. TVB’s share price promptly fell by more than 8.5 per cent on Monday.

Rarely did a corporate investment by a major company turn sour so quickly, in a matter of months. When the TV station announced its purchase of SMI bonds worth HK$651.55 million in May last year, it was positively bullish.

Not only did the purchase pay 7.5 per cent interest per year over two years, extendable for a third, it was also convertible into equity. Besides providing a steady income stream at a time of declining profit in Hong Kong, it also offered the prospect of a slice of the country’s fast-growing cinema market.

China is the world’s second-largest market in terms of box office takes. At that time, SMI ran 320 theatres across the mainland and was the country’s fourth-largest cinema operator with 1,945 screens.

This is what TVB said at the time of its filings to the stock exchange: “The board considers that the convertible bond subscription can broaden the group’s source of income and provide the group with a stable investment return.

“[T]he directors, including the independent non-executive directors, consider that the terms of each of the transaction documents are fair and reasonable and the convertible bond subscription is in the interests of the company and shareholders[.]”

By September, SMI suspended trading in Hong Kong over debt repayment and management problems, the value of its shares having fallen by almost 40 per cent over the previous 12 months. By that time, SMI’s chairman and three executive directors had quit.

Without the bond purchase, TVB could have reported a profit – albeit a meagre one. It was a classic case of wishful thinking over due diligence. Its investment blunder is far more dramatic than any soap opera it has turned out in years.