China’s stock market bulls and bears are locking heads, leaving room for cautious investor optimism

Nicholas Spiro says despite the recent market turbulence, the divergence of views on Chinese stocks and the economy means the country’s equities could still be attractive

That was quick. No sooner did China’s battered equity markets receive a fillip from Beijing’s recent slew of measures aimed at countering the economic slowdown than a three-week-long rally gave way to renewed selling pressure.

On Thursday, the CSI 300, a gauge of large mainland-listed stocks, suffered its sharpest fall in a month, helping it erase almost all the gains it made in July and leaving the index down by nearly 25 per cent from its recent peak in late January. Composite gauges for the Shanghai and Shenzhen exchanges, which performed strongly for most of July, have also resumed their declines and have lost more than 23 per cent since their January peaks.

The catalyst for the latest sell-off was US president Donald Trump’s decision last Wednesday to instruct his trade negotiators to consider more than doubling proposed tariffs on US$200 billion in annual imports from China, marking the latest escalation of the trade conflict between the two countries that has contributed to this year’s sharp falls in China’s foreign exchange, equity and corporate debt markets.

While the severe strain on Chinese assets, coupled with this year’s marked slowdown in domestic demand, have revived memories of the 2015-16 crisis, the turmoil has also created opportunities for traders and investors, partly because of the recent shift towards looser monetary and fiscal policies, but mainly as a result of more attractive valuations.

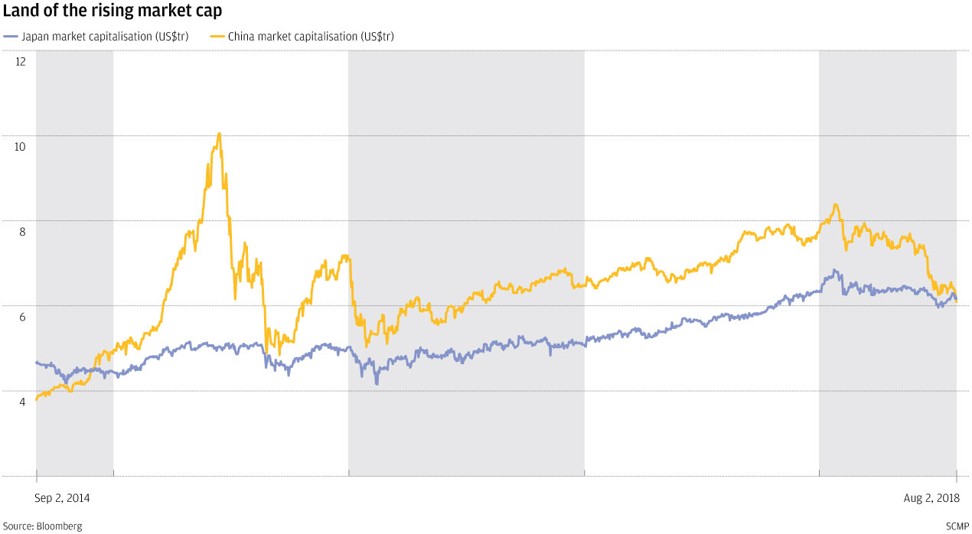

The rout in Chinese stocks – nearly US$2.3 trillion has been wiped off the value of the country’s shares since January (nearly half of this in the past two months), according to data from Bloomberg, allowing Japan to reclaim the title of the world’s second-largest equity market – has provided ammunition to bulls and bears alike. The divergence of views comes at a time when pockets of value are emerging in developing economies following a steep sell-off, but also when China itself has again become a focal point of market nervousness after more than two years of relative calm.

The bullish case for Chinese stocks – both offshore and onshore – is based mainly on cheaper valuations due to the combination of this year’s steep fall in share prices and, for the time being, a robust earnings outlook.

According to a report from JPMorgan published on July 21, the forward price-to-earnings ratio of the China component of the benchmark MSCI Emerging Markets Index (which now includes a small percentage of some 230 mainland stocks’ free-float market capitalisation) has dropped to 11.4, down from 14.6 at the end of last year and a nearly 30 per cent discount to stocks in developed economies.

While the high-flying technology sector’s forward P/E ratio stands at 25 (compared with 36 at the end of 2017), more than half the sectors of the MSCI China index – including banks and property which have been hit hard by tightening liquidity – are currently trading at below 10, according to the report.

Mainland-listed shares are even cheaper. According to Bloomberg, the Shanghai Composite Index, nearly 40 per cent of whose constituents are banks, is currently trading at earnings multiples below the levels of the troughs during the 2015-16 crisis. By some measures, the index is the cheapest on record compared with the benchmark S&P 500 index.

China bulls also take comfort in the recent shift towards growth-supportive policies, particularly given the severity of the escalation in the trade war. JPMorgan sees the plunge in the yuan as a “positive signal” which, together with measures to ease liquidity, show that Beijing is “taking out some insurance with respect to rising trade fears.”

The renewed strains on China’s economy come at a time when the emerging market asset class as a whole is under pressure

China bears, on the other hand, counter by warning that the current sell-off is worryingly reminiscent of the 2015 crisis, with the additional threat of a trade war that continues to escalate. Just as importantly, the renewed strains on China’s economy and markets come at a time when the emerging market asset class as a whole is under pressure, creating dangerous feedback loops, given China’s growing influence on global markets, particularly Asian assets.

While Chinese equities have clearly cheapened, the current risk premium does not adequately compensate investors for the plethora of domestic and external risks confronting China’s economy, bears insist.

Although a boon to most investors, the recent stimulus measures also raise concerns that Chinese policymakers are backsliding on deleveraging. Indeed, given that this year’s attempts to stimulate demand are much tamer than those in previous years, Beijing could end up facing the worst of both worlds: a continued slowdown and very little market bang for its stimulus buck.

Watch: Caviar feels the heat of US-China trade war

Still, the fact that there is a strong divergence of views on Chinese stocks – and the country’s markets more broadly – is reason enough to be cautiously optimistic. While sentiment towards the world’s second-largest economy has deteriorated sharply, the sell-off is not perceived as another 2015.

The bears are giving the bulls a run for their money, but Chinese equities are starting to present an enticing opportunity.

Nicholas Spiro is a partner at Lauressa Advisory