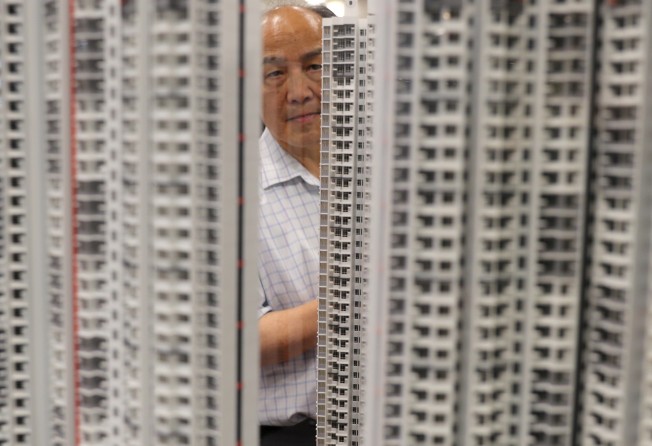

Homebuyers beware as interest rates start to rise

The property market has defied gravity so far but given the era of cheap money is starting to end, runaway home prices will surely be hit

Local banks kept in step with rising official interest rates yesterday, paving the way for higher home mortgage repayments. They lifted their best lending rates after the Hong Kong Monetary Authority raised its base lending rate following the United States Federal Reserve’s overnight increase in its benchmark rate. With the latter indicating yet another rise in December, the end of the cheap credit cycle looms closer. The question for Hong Kong is what it means to the 10-year run-up in the city’s soaring property market. It cannot go on forever, but it has so far defied the negative predictions of analysts.

Commercial banks had until now left their prime mortgage rates unchanged at the 2008 level even when the HKMA raised its base lending rate to maintain the local currency’s peg to the US dollar. But they were expected to raise rates if the cost of capital rose further.

Two factors have been principally credited with driving the city’s housing prices higher – the influx of fully cashed-up buyers from the mainland, and ample liquidity in the city’s financial system that enabled the banks to keep rates low for local borrowers.

Any increase in the prime lending rate could put pressure on property prices. What sets this upwards cycle apart is that comes amid the threat to Hong Kong’s externally oriented economy posed by the trade war unleashed by the US.

The resulting uncertainty magnifies the risk to stable markets. Fortunately, homebuyers are deterred from over-committing themselves by borrowing high ratios to property value, with HKMA figures having shown that most take out a mortgage for just half their property’s purchase price.

Nonetheless, rate rises and the prospect of more have prompted warnings to those thinking of buying property from the city’s top financial officials. HKMA chief executive Norman Chan Tak-lam says the end of an era of extremely cheap lending is set to bring volatility to the investment and property markets and “it would be unrealistic to expect property prices to only go up”. Financial Secretary Paul Chan Mo-po says the super low-rate environment is over and the public should exercise careful risk management because higher rates affect asset prices.