Why China is unlikely to weaponise the yuan, even as the trade war rages

Richard Harris says the level-headedness of Chinese policymakers has been evident in the past months as the yuan has not excessively devalued despite the US-China trade war

Currency forecasting is a black art even though the impact that currency has on portfolio investment returns is dominant. It is the canvas on which all investments are painted. It is just as important to get the currency of the investment right as the investment itself. There is never a free lunch in investment.

While Hong Kong investors are somewhat sheltered from currency movements by the US dollar peg, we depend for just about everything else on the value of the yuan. Our food, our water, our very prosperity depends on the Chinese economy. It is a comfort to note that Chinese lever-pullers are possibly the most responsible policymakers of any at the moment.

In the past 18 months, they have been uniquely focused on the control of debt that inflated liquidity and led to the bubble of 2015. Uncontrolled and unregulated lending was reported to be as large as the official banking sector itself. There is now less money flying around, which is slowing the domestic economy – but it is necessary short-term pain for long-term gain.

The authorities have tried to lessen the pain recently by increasing government spending, relaxing monetary policy and reducing taxes and bureaucracy, but they cannot ease it entirely. This is the price of getting the economy back in line. Western democratic governments cannot currently stomach paying the price of an economic slowdown as it typically means getting thrown out in the next election.

The reduction of liquidity coupled with the separate imposition by the US of tariffs on Chinese imports has intensified the slowdown and driven a severe fall in China’s stock market. Yet this domestic slowdown has not been accompanied by excessive currency weakness. That indicates the yuan is not being used as a weapon against the trade tariffs – and nor is it likely to be.

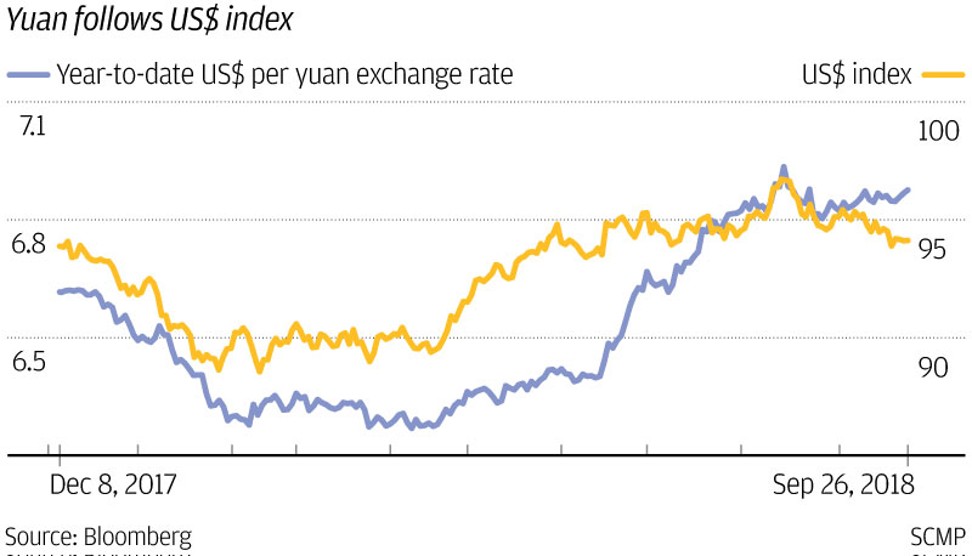

“A one-way depreciation will do more harm than good for China,” said Premier Li Keqiang last week. It is easy to be cynical about political pronouncements but the data tells us that, for a year or so, the yuan has closely followed the US dollar index and the highs and lows of the euro.

A currency managed in line with a stable basket of currencies does not make China a currency manipulator

It looks as if it is trading about where it would be if it were freely floating, rather than being managed. A currency managed in line with a stable basket of currencies does not make China a currency manipulator.

If the yuan was allowed to weaken substantially as a weapon of trade not only would this be against World Trade Organisation rules, not only would it be seen as a major threat to the US, not only would it increase inflation domestically, but it would also allow fat and lazy domestic state industry to avoid reform for just a little longer.

A further reason that the Chinese currency will not be used as a trade weapon is that a strong yuan is much better as a tool of geopolitical influence. It means yuan loans go further, it allows the purchase of foreign assets with a stronger currency and, above all, it is a sign to smaller countries of China’s strength. A weak currency may be a sign to China’s friends and rivals of weakness elsewhere and that would inhibit China’s foreign investment plans.

The imposition of trade tariffs and the associated negative sentiment aired in the US and Europe about previous trade and economic relations with China seems to have shocked Beijing, forcing a rethink of government subsidies and forced technology transfer. Former Chinese central bank governor Zhou Xiaochuan recently admitted: “There could have been some inappropriate behaviour sometimes, but we are improving.”

Policymakers now seem to understand that the Chinese economy has already passed from the developing to developed phase. An economy with lower but achievable growth targets, increased efficiency in state-owned enterprises and a stable currency will make the West more comfortable.

Paradoxically, a China seeing itself as an equal and moving its economy towards a better sense of balance and harmony with other global economic powers is more likely to succeed than the one that was looking for a free lunch.

Richard Harris is chief executive of Port Shelter Investment and a veteran investment manager, banker, writer and broadcaster, and financial expert witness