Why the US dollar still reigns supreme and how the renminbi can knock it off its throne

David Brown says there are signs that the US dollar’s dominance as a reserve asset is on the wane but, for the renminbi to fill the gap, China must run a truly independent foreign exchange and monetary policy

When you are on top of the world, there is only one place to go and that is down. Just how long the US dollar survives as the world’s No 1 currency is a matter of debate. Russia would love to see the dollar knocked off its throne, while Europe and China both believe their currencies can challenge the dollar’s hegemony in the long run.

It will take more than bravado though. A strong economy, a plausible monetary policy and a rock-solid reputation as an ultra-safe money store are vital. The dollar’s currency crown may be slipping but it is not about to fall by the wayside just yet.

Groaning under the weight of tough US sanctions, Russia would love to cut its dependence on the dollar but remains stuck with it. Europe’s hope for vaulting the euro to greater prominence has stalled, while China’s plan to launch the renminbi to greater heights is still in its infancy. By far, the dollar remains the world’s most widely held reserve asset, the most actively traded currency on global foreign exchanges and the main driver for funding world trade. Dollar supremacy seems inviolable for now.

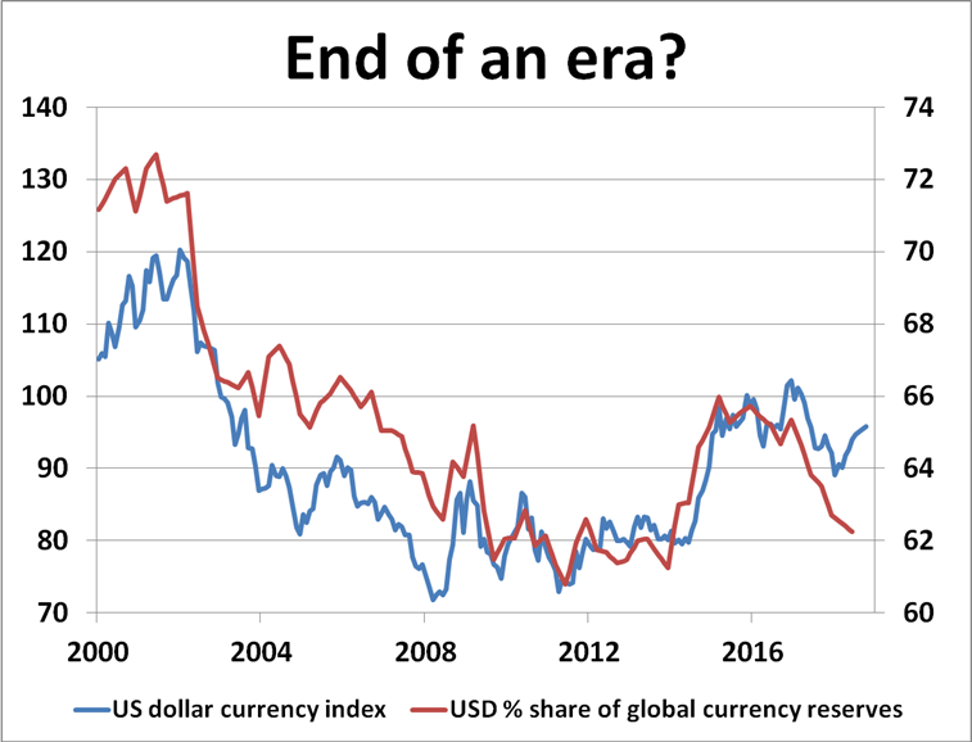

But there are signs of cracks, with the dollar’s share of global central bank reserves slipping from around 73 per cent in 2000 to just over 62 per cent this year, according to the International Monetary Fund’s “currency composition of official foreign exchange reserves” report in June.

The impact of the US Federal Reserve’s extremely loose monetary policy stance after the 2008 crash definitely dampened dollar demand, while President Donald Trump’s economic and political agenda may be causing more headaches for international investors. America’s international standing has taken a heavy knock in recent years.

A gap is waiting to be filled. Unfortunately, the euro’s progress hit a brick wall after the 2010 European debt crisis posed serious doubts in investors’ minds about the currency’s long-term survival. The euro’s share of global forex reserves dropped from a 28 per cent peak at the end of 2009 to 20 per cent this year and looks set to fall even more as Italy and the European Union trade blows over fiscal policy with new murmurs of euro turmoil doing the rounds again.

From a standing start, [the renminbi’s] share of global forex reserves has risen to almost 2 per cent

China has a golden opportunity to take up the slack. The renminbi may be the new kid on the block, only adopted by the IMF as an official reserve currency in 2015, but it is already making a mark. From a standing start, its share of global forex reserves has risen to almost 2 per cent. And, according to the Bank for International Settlements, the renminbi is already the world’s eighth most actively traded currency, accounting for 4 per cent of global daily forex flows.

To have any hope of breaking into the major league, Beijing must speed up the process of monetary reform and fast track market liberalisation to win the hearts and minds campaign with international investors. They want assurances that Beijing has a “hands-off” policy towards the currency, allowing the renminbi free rein to float according to the ebbs and flows of market forces. Any hint of official market manipulation is anathema for investors.

China must decouple from US economic policy. Shadowing the dollar is a sham and must be avoided at all costs, especially while America sets the bar higher on US interest rates. The US needs higher rates to tame potential domestic overheating, while China should be doing the opposite, easing monetary policy for its own purpose to boost growth, cutting the exchange rate loose in the process. The renminbi should be allowed to find its own level, undeterred by official intervention.

The renminbi will stay stuck as a non-starter until Beijing makes the necessary structural changes and improves its prestige. Running a truly independent forex and monetary policy will help make the breakthrough for international investors and win over reserve managers. In efficient market terms, the less covariance the renminbi has with the dollar and other major reserve currencies, the better scope for investors to optimise diversification.

It is nowhere near the end of the dollar’s rule. But if China is intent on breaking America’s stranglehold over the world’s currency system, it is time to liberalise and internationalise.

David Brown is chief executive of New View Economics