On China’s ‘currency manipulation’, the US should be careful what it wishes for

Neal Kimberley says by squarely blaming Beijing for the weakness of the yuan and insisting it follows a ‘market-determined currency regime’, the US may have misread the likely consequences of China loosening its grip and shedding its capital controls

The more the United States sets out its differences with China over trade, the harder it is to see an easy resolution. The renminbi is a case in point. Washington clearly wishes to limit the potential for yuan depreciation, given that it bolsters China’s competitive position, even though in the past the United States hasn’t been averse to talking down the US dollar on occasion.

Washington seems to feel it will be fruitful, when discussing issues around yuan weakness with Beijing, to reference the currency provision in the recent US-Mexico-Canada (USMCA) trade deal as a template. In fact, applying such a currency provision to the yuan could end up leading to more, not less, yuan weakness.

Speaking to CNBC on Friday, US Treasury Secretary Steven Mnuchin said that he’d had a “productive discussion” with People’s Bank of China Governor Yi Gang last week. In that conversation, Mnuchin had expressed his “concerns about the weakness in [China’s] currency”. Indeed, he made it quite clear that China’s currency will be part of the broader discussion between Washington and Beijing on trade.

“We’re going to make sure that whatever we make up on trade, we don’t lose on currencies,” Mnuchin said, “and if you look at the US-Mexico-Canada deal, for the first time, we put a currency provision into the agreement and that’s something that’s going to be important going forward for trade negotiations.”

On Saturday, Mnuchin reiterated that, “the currency issue is an important issue for us in trade and will be part of our trade discussions. We want to make sure that depreciation is not being used for competitive purposes in trade.”

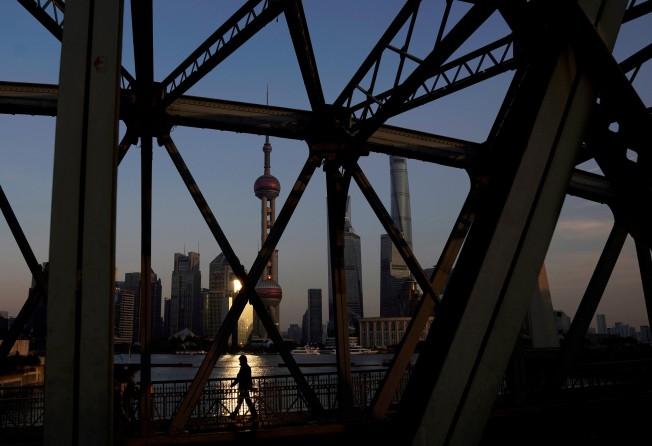

Watch: The impact of the US-China trade war

Of course, it should be noted that, as recently as January, Mnuchin himself seemed to welcome a weaker US dollar, noting that, “obviously a weaker dollar is good for us as it relates to trade and opportunities”.

Investors might also recall that previous US Treasury secretaries, such as W. Michael Blumenthal in 1977 and Lloyd Bentsen in 1993, had no qualms about talking the greenback down to gain US economic advantage when it suited.

Even setting that aside, the US position on the yuan also seems to presuppose that Beijing has been engineering a weaker renminbi rather than the move having been market-led. Investors might rationally contest that assertion. The present combination of tighter US monetary policy and looser Chinese policy settings surely lends itself to a degree of yuan weakness versus the US dollar.

Indeed, August’s reintroduction by the PBOC of the counter-cyclical factor, which in a circumstance of a falling yuan helps attenuate pressure for renminbi depreciation, would suggest to the casual observer that far from encouraging yuan weakness, Beijing is seeking to limit its pace and extent.

But what of the USMCA currency provision that Mnuchin referred to last week? Clause 2 of Article 33.4 states that the signatories should “achieve and maintain a market-determined exchange rate regime”.

“A market-determined exchange rate regime” is surely inconsistent with the use of an adjustment mechanism such as the PBOC’s counter-cyclical factor. In such a scenario, the very factor that can mitigate yuan weakness in a market-led drop in the renminbi’s value would not be available to China’s central bank, opening up the possibility of even more yuan weakness, the very thing that concerns Washington.

Moreover, the notion of a market-determined exchange rate regime would almost certainly require the removal of capital controls, yet China’s existing capital controls arguably promote a stronger yuan than otherwise might be the case.

China has recently been unveiling new measures to make investment into the Chinese government bond market more attractive to overseas investors, with the intention of fostering increased yuan-denominated capital inflows into the country. But Chinese investors looking to move money into foreign assets are still constrained by the existence of capital controls.

In the same way that many birds would fly away if the cage doors were to be opened at the bird market in Yuen Po Street, if China’s controls on capital outflows were eased, such outflows would increase, triggering yuan selling.

Clearly, Mnuchin has a problem with the prospect of yuan weakness. But it’s not an issue that’s easily resolved. Nor might Beijing be inclined to be too accommodating on the issue. After all, Washington historically hasn’t had any problem when it was the US dollar weakening versus the yuan.

In truth, if Mnuchin means what he says, resolving the China-US trade dispute just got even harder.

Neal Kimberley is a commentator on macroeconomics and financial markets