China needs to spend big, like it’s 2008 again, before the economic slowdown sets in

- David Brown says the Chinese economy needs a stronger dosage of government intervention, or growth may slow to under 5 per cent next year

- Beijing must expand the money supply, and ease credit conditions for households and companies

It came like a bolt out of the blue when China’s Premier Li Keqiang recently ruled out a strong monetary stimulus to boost the economy. China can ill afford to burn its bridges, as it needs every chance to pump-prime faster growth. More fiscal spending, easier monetary policy, yuan stabilisation, faster structural reforms and better bridges with the United States are needed. Nothing should be ruled out, or China’s economic slowdown will become more entrenched, with Beijing fighting a losing battle. Without stronger intervention, sub-5-per-cent growth is definitely on the cards next year.

China needs as much stimulus as possible, from wherever it can find it, as the economy struggles to maintain momentum close to Beijing’s target of about 6.5 per cent GDP growth. Global headwinds are getting stronger, especially with pressure from the deepening trade war with the US. Current trends are not encouraging. World trade seems more hamstrung and global economic confidence is wavering. If Beijing is not careful, the slowdown could turn into a rout, posing deeper problems ahead for China’s domestic economy.

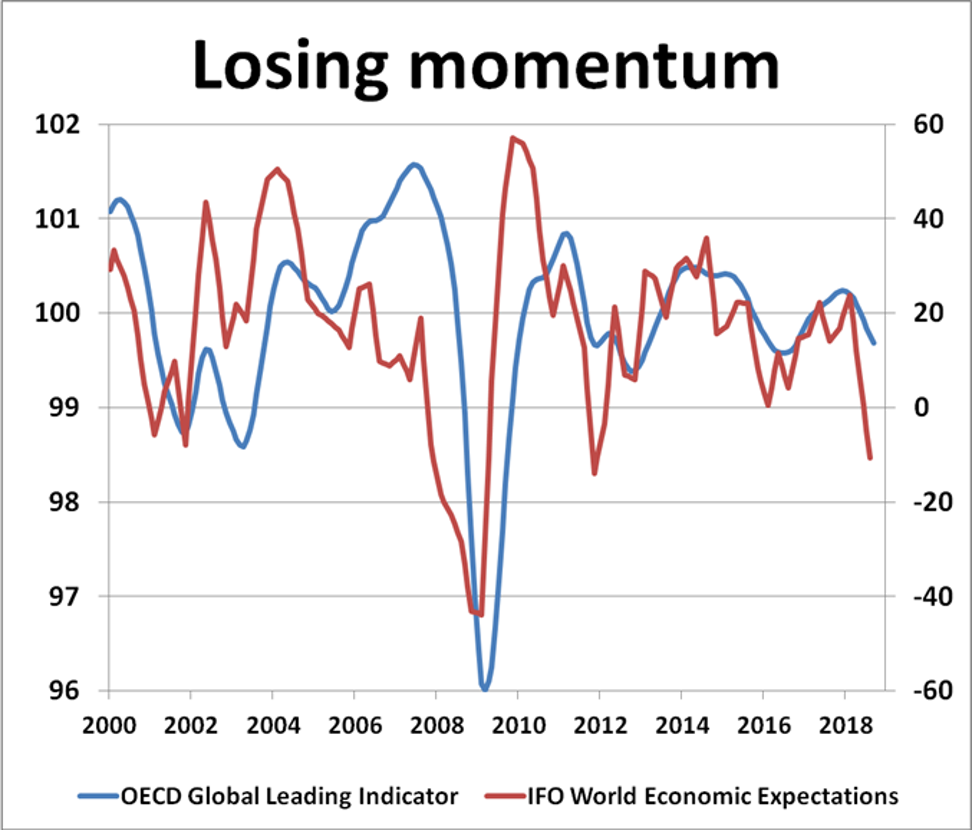

Business optimism is flagging in China, as corporate investment slows, dampening jobs growth and consumer demand. It is hard to see how Beijing can conjure up stronger growth over the next couple of years without a more balanced business plan. Most leading indicators underline that conditions are getting worse, not better.

The Organisation for Economic Cooperation and Development’s global leading index shows a worrying deterioration, an ominous warning signal of trade prospects ahead. Business optimism is being affected not just by the trade war, but also a wide range of fear factors. Political uncertainty and rate-tightening worries in the US, debt default risks in Italy, a euro crisis and a bad Brexit are just a few potential tripwires for global markets.

Chinese consumer confidence has peaked and business optimism is dipping back into negative territory, as corporate investment slows, dampening jobs growth and consumer demand. An economic reboot is long overdue. Beijing succeeded in protecting its economy from the worst effects of the 2008 crash but it needs to do more now – more monetary and fiscal stimulus – to stop the rot. Nothing should be ruled out.

Beijing needs to strike a better balance between its currency, monetary and fiscal policies to achieve better growth. Over-reliance on competitive devaluation would be a grave mistake, heightening trade war tensions even more, while sending misleading allocation signals to the rest of the economy. The renminbi is already competitive enough and it is in Beijing’s best interest now to stabilise the currency to avoid any further ructions with Washington.

Why trade war with US has sparked a thaw in China’s relations with long-time rival Japan

The general thrust of monetary and fiscal policy is so far behind the curve that it is no wonder China’s economy is flagging. Annual money supply growth is running at 5.8 per cent and the underlying trend of government spending is rising in real terms by 3.5 per cent year on year, falling short of what is needed to sustain the 6.5 per cent growth of the economy. Considering that domestic credit expansion and government spending growth were running close to 30 per cent year-on-year in the wake of the 2008 global crash, it is clear more needs to be done. At the moment, Beijing’s measures look more like a policy squeeze than a recipe for solid economic expansion.

Beijing must put words into action with bigger tax cuts, increased infrastructure spending and more focused measures to lift consumer spending and domestic demand. On the monetary side, the government should give the People’s Bank of China freer rein to ease policy again. Much work must be done to ease credit conditions for households and companies, meaning additional cuts in interest rates and bank reserve requirements. Ideally, money supply should be expanding by at least 10 per cent per annum to have any chance of success.

With the economy losing so much momentum, Beijing must pull out all the stops and regain the initiative before it is too late.

David Brown is chief executive of New View Economics