Economic slowdown’s spread to Asia highlights the need for global policy coordination

- The sluggishness of the global economy shows the need for broad policy coordination to head off the next financial crisis

- The challenge will be creating conditions that are self-sustaining and which work for all economies, not just a few

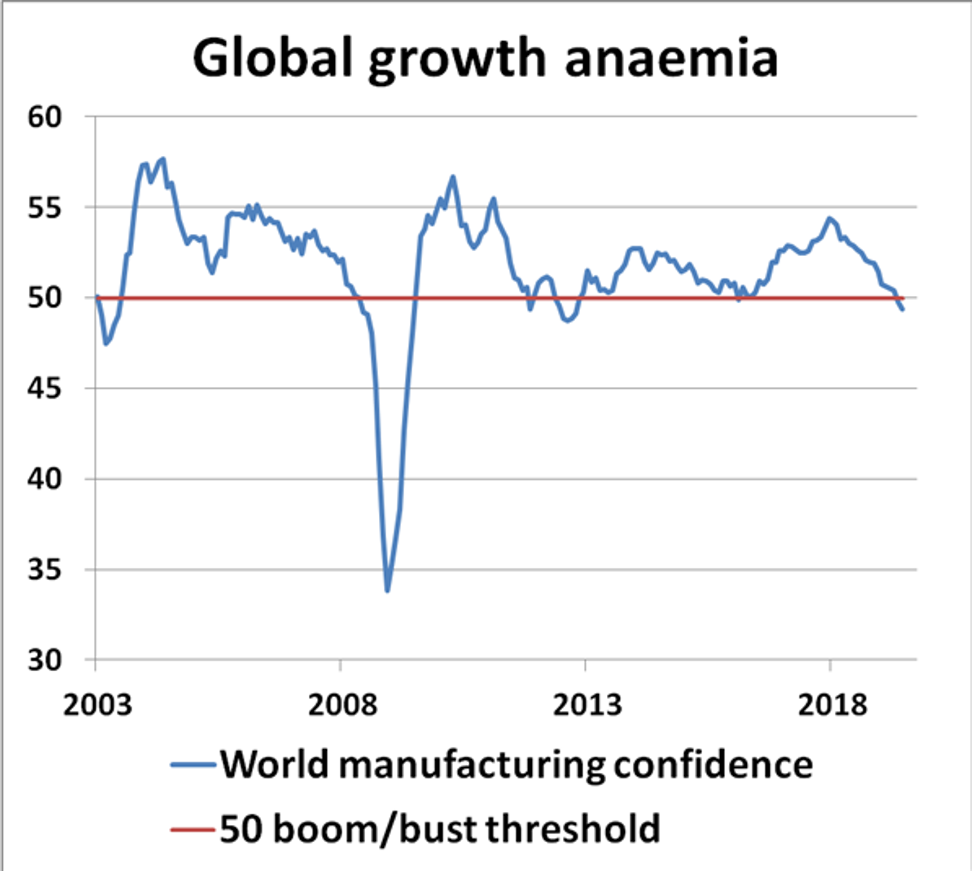

The world is in trouble and policymakers need to act fast to stop the global slowdown turning into a widespread rout as it did during the 2008 crash. In theory, we should be living the dream right now as the world economy has enjoyed a great abundance of engineered central bank money over the last decade, interest rates have hit rock bottom and borrowing rates have been super-friendly to consumers and businesses alike.

But the capital-intensive, productivity-driven corporate sector revival is stalling and forecasters fret about what’s lurking round the next corner.

The world has descended into global growth anaemia. It has become pandemic: you can see it at the national level among the major economies and it is sweeping into regional spheres through trade transmission effects. Global economic confidence is becoming increasingly unresponsive and needs a major reboot as soon as possible.

There should be no excuses for any of the major economies. Just because US core inflation may be showing some signs of short-term pickup does not let the US Federal Reserve off the hook. The Fed must press ahead with rate cuts not only for its own sake, but also to help jump-start the rest of the global economy. Market expectations of 0.75 per cent being lopped off US official rates this year are not outlandish.

The same applies to all major nations right now. Everyone needs to pull their weight in a way which works in concert, not at odds. The cracks are showing everywhere. The euro-zone economy is heading for trouble, Germany, France and Italy are slowing down sharply and the European Central Bank is under intense pressure to act again soon.

Japan’s economy needs another major reboot, but it’s a challenge for policymakers where to start. The policy cupboard is pretty bare, but the Bank of Japan and the Japan’s Ministry of Finance must start working together to stop Japan’s slowdown from spiralling out of control.

There is mounting pressure on Beijing to do more than its fair share to help revive global growth too, especially with signs of business economic activity slowing down sharply in the Asian region. The impact of the US-China trade war is impacting badly on export-dependent nations like South Korea and Singapore, both important yardsticks for global demand.

Both economies could be on collision course with recession fairly soon. South Korea’s economy shrank at a 1.5 per cent annualised rate in the first quarter, while Singapore contracted at a 3.4 per cent rate in the second quarter. The situation is deteriorating fast and ominous for the bigger picture.

China’s external sector is certainly feeling the strain, so Beijing must redouble its efforts to shore up domestic demand as insurance. The latest trade data for June showed China’s exports were down 1.3 per cent from a year earlier, while imports fell by 7.3 per cent year on year. The trade war between the US and China is taking its toll, intensifying the need for speedier government intervention.

Beijing must pull out all the stops to protect this year’s 6 to 6.5 per cent growth target before it is too late. Sitting on the fence is not an option when growth, job creation and financial stability are at risk.

A stronger dose of short-term monetary and fiscal stimulus is definitely needed now. Deeper interest rate cuts, easier credit conditions and faster deficit spending are long overdue. Structural reforms will help the push in the longer term, but it is short-term policy expedients which are in short supply right now.

There is definite potential for another 1 per cent cut off official short-term interest rates and the authorities must ease the relative squeeze on real money supply and government spending growth.

The world economy is still stuck in the tail of the 2008 global financial crash. The challenge for policymakers is achieving global recovery which is self-sustaining and mutually inclusive for all economies, not just the privileged few. Nations must start thinking beyond their borders and working in the world’s interest and not just for narrow domestic gain.

David Brown is the chief executive of New View Economics