Why China must be prepared for Brexit and the possibility of another European crisis

- Germany’s economy is flashing warning signs and with a no-deal Brexit imminent, contagion might spread across Europe and the world. The Chinese economy, already under stress from the US trade war, is vulnerable

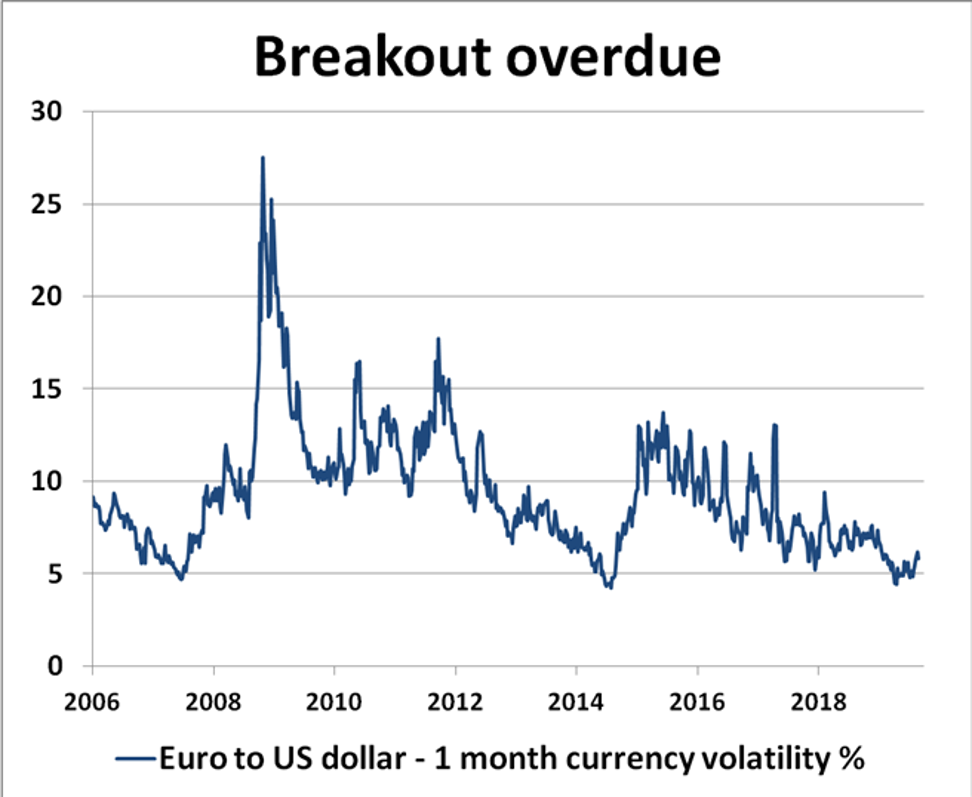

If the euro is a handy bellwether for global risk perceptions, then recent price action suggests financial markets are in for a storm. And if Germany’s economy is a weather vane for global growth, the world seems to be heading for more trouble.

Germany’s trade surplus is shrinking fast, its foreign orders are slumping and its business confidence is imploding – all signs of a possible recession. Worse, German business has yet to reckon with a greater nemesis – namely, a Brexit shock, for Britain looks increasingly likely to crash out of the European Union without a deal.

A major European crisis is brewing and the Chinese economy, already battered by the trade war with the United States, will not be spared. World trade will suffer badly as global economic confidence experiences another punishing body blow.

Europe might have slipped off investors’ radar screens in recent years but its internal tensions have never gone away. The EU might appear united in its battle with Britain over Brexit, but the blight of European populism and dissent from Brussels will quickly resurface if recession returns to the euro zone, unemployment starts rising again and question marks hang over the euro’s future.

The euro has been through the wringer many times before and seems to be in danger again. With Brexit and the threat of recession, the euro might reach parity with the US dollar. Currency markets don’t seem to have fully woken up to this risk yet.

If Brexit poses a threat to European unity, investors hardly need to look too far to see other cracks in the system. With the formation of another new Italian government last week, its domestic politics remains in tumult and could come back to haunt markets with a vengeance, especially if Italian credit default risks resurface again.

Greece might have been beaten into submission over the EU’s bailout terms during the debt crisis, but things look far from resolved. Greek resentment against Brussels over the grinding austerity measures imposed on the country is deep and unforgiving. New recession risks could easily bring this to the forefront again.

Judging by the recent downward drift in the German economy, a euro-zone recession is a real possibility. By the simple logic of their close economic interdependence, where Germany leads, the rest of Europe generally follows.

Recent German economic data is not encouraging. German business expectations are on a knife edge, according to the latest surveys by the Ifo and ZEW institutes. Industrial output and orders are down sharply from last year and German exports are struggling due to the US-China trade war.

Germany’s annual trade surplus is down more than 10 per cent from a year ago. Unemployment has just started to tick up and consumers are feeling the pinch.

It is hard to exaggerate the shock both sides could suffer should Britain crash out of the EU without a deal on October 31. Much is at stake. Britain had an overall trade deficit of £64 billion (US$77.8 billion) with the EU in 2018. Britain’s trade surplus of £29 billion in services was outweighed by a trade deficit of £93 billion in goods.

Germany’s trade surplus with Britain alone stood at £32 billion last year. Germany’s 0.1 per cent dip in gross domestic product in the second quarter could easily turn into a rout, and the European Central Bank would be helpless to stop it spreading to the euro zone. Negative multiplier effects would be catastrophic for Europe.

The world is not in a good place right now and the resurgence of trouble in Europe is the last thing anyone needs. The trouble is that European policymakers lack adequate resources to deal with any future emergency with the same degree of effectiveness as they did during the euro-zone debt crises.

Europe seems badly exposed, vulnerable and an accident waiting to happen. Global financial stability is under threat, which would leave China’s economy exposed.

Risks of global contagion remain acute and Beijing must stay focused on its domestic recovery to fend off the coming storm. Faster monetary and fiscal expansion is even more paramount now.

David Brown is the chief executive of New View Economics