US consumer confidence shines amid the gathering economic gloom. But for how long?

- With the latest manufacturing data apparently supporting growing market pessimism as the US-China trade war rages on, American consumer sentiment has become the single most important factor shaping the global economic outlook

The gloom merchants are having a field day. The fallout from the intensifying trade war is exacerbating the slowdown in the global economy, which began at the beginning of last year.

Manufacturing activity worldwide has contracted for four straight months, sapped by the steepest decline in international trade volumes since late 2012, survey data published jointly by JPMorgan and IHS Markit revealed on Tuesday.

Germany, Europe’s largest economy, is on the verge of a recession, while growth in China, which appeared to be stabilising, continues to weaken as the government eschews heavy-handed stimulus.

According to the latest fund manager survey published by Bank of America Merrill Lynch last month, more than a third of respondents believed a global recession was likely to materialise in the next 12 months, the highest percentage since 2011.

The pessimism is most acute in government debt markets. Last month, a closely watched portion of the US yield curve – the difference between 2-year and 10-year Treasury yields – turned negative for the first time since 2007.

The inversion of the curve, a move often considered an accurate harbinger of an economic downturn, has stirred fears that the countdown to the next US recession has already begun.

In a sign of the extent to which bond markets have turned gloomy on the prospects for the world’s largest economy, some investors believe there is a significant chance that America’s benchmark 10-year yield will drop to zero, having already plunged to 1.4 per cent, down from 3.2 per cent as recently as last November.

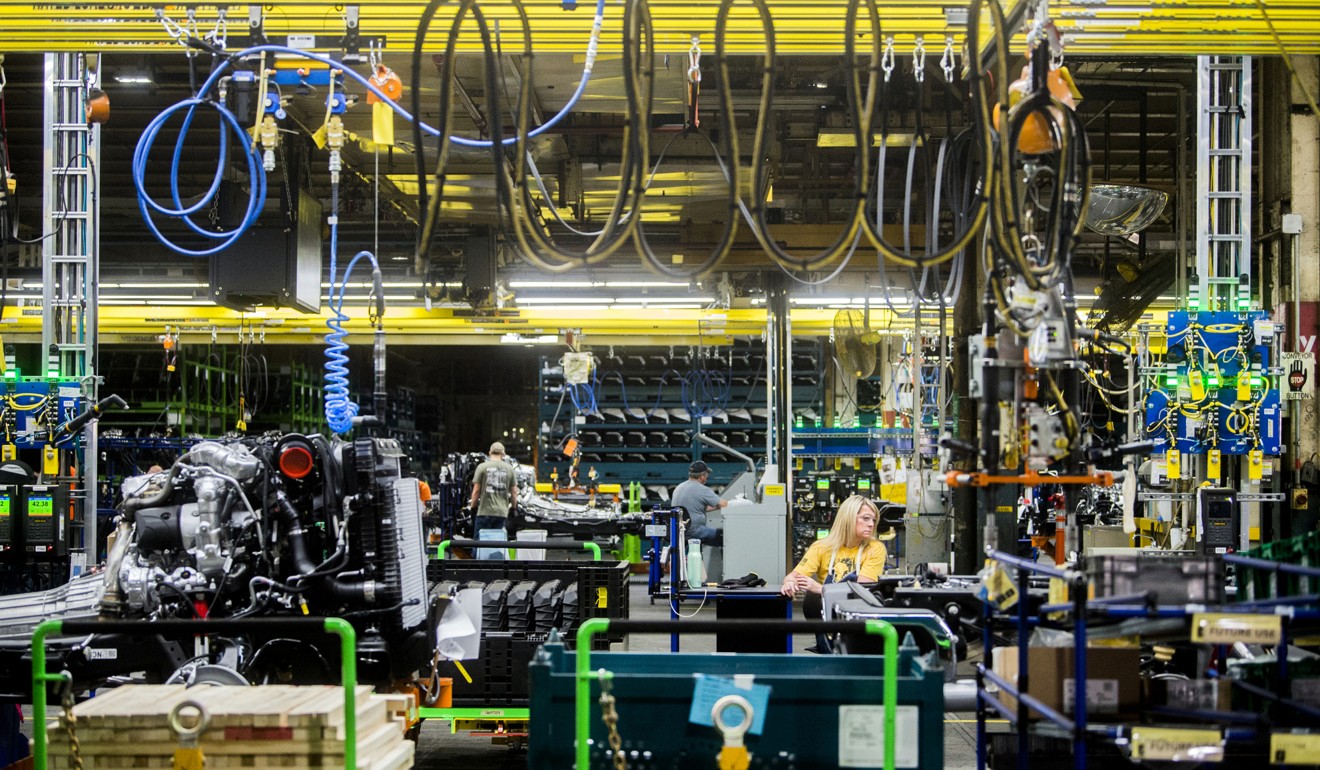

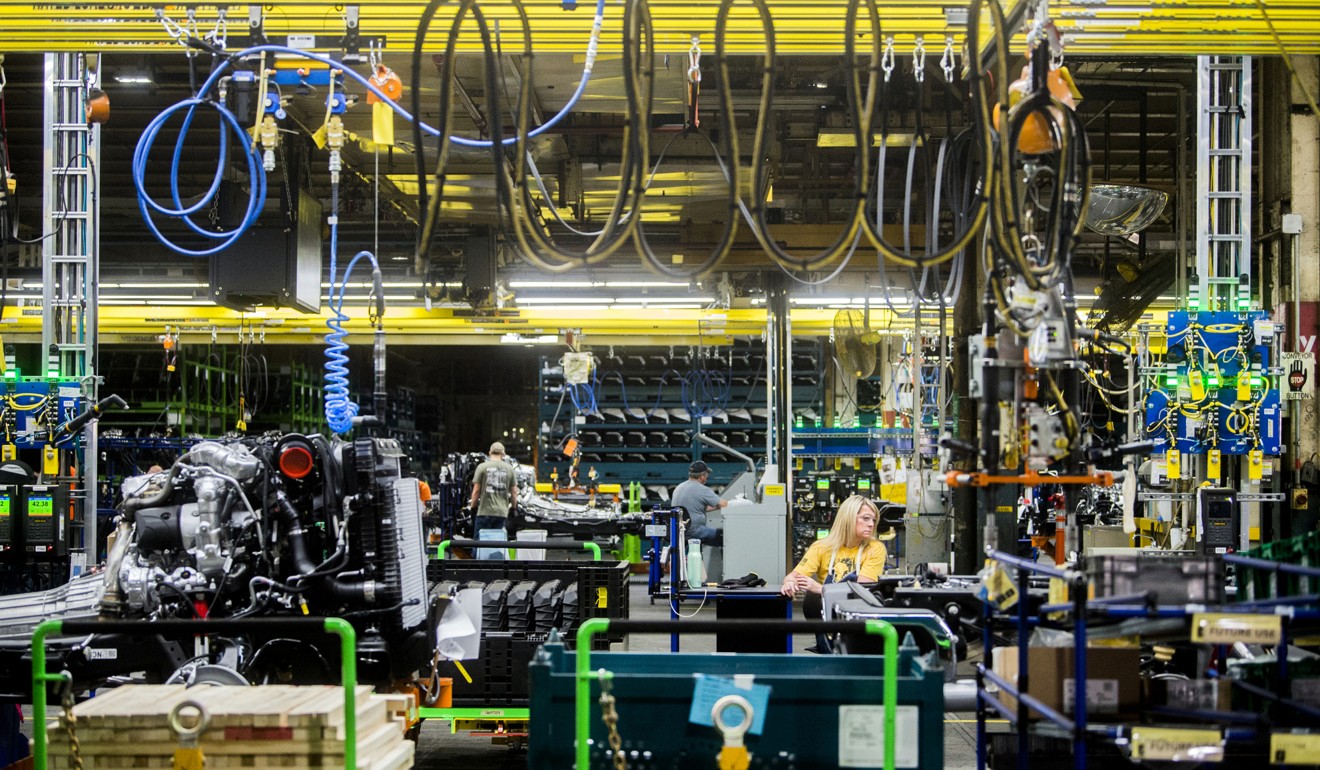

What is more, the economic evidence to validate the pessimism of bond investors is beginning to stack up. A key gauge of US manufacturing activity contracted last month for the first time since 2016.

While manufacturing accounts for only 11 per cent of America’s economy, the risk is that a sustained decline in output could trigger a broader slowdown, hitting private consumption, the mainstay of America’s economy.

It is not an exaggeration to say that the confidence of US consumers – whose spending accounts for up to 70 per cent of America’s GDP – has become the single most important factor influencing the outlook for the global economy and markets.

Not only will consumer sentiment determine whether America is heading for a recession, it will have a strong influence on trade talks and will be a key factor deciding the outcome of next year’s presidential election.

The latest batch of data provides some ammunition for the bears.

The publication of a survey on US consumer sentiment last Friday showed that confidence last month suffered its steepest decline since 2012, with the gauge dropping to its lowest level since 2016.

However, unlike the resoundingly bleak data on manufacturing activity, other surveys point to continued confidence.

Data from the US Commerce Department last Friday revealed that personal spending accelerated in July. This came on the heels of an earlier report that showed retail sales grew in July at their fastest pace in four months.

While the US economy has slowed markedly, America is in danger of talking itself into a recession

Make no mistake, the all-important US consumer, while less upbeat than at the start of this year, is still spending.

This is because America’s labour market remains the envy of the world, with unemployment close to a 50-year low and wages and salaries growing at their fastest pace since 2007, according to data from Bloomberg.

This explains why the Federal Reserve, which holds its next policy meeting on September 17-18, is split on the need for cuts in interest rates.

Quite aside from the fact that it is difficult to make a convincing case for a further 100-basis-point cut by the end of next year – the degree of loosening bond markets are currently pricing in – when America’s labour market remains red-hot, the Fed’s shift towards a dovish stance has, if anything, heightened concerns about a sharp downturn.

While the US economy has slowed markedly, America is in danger of talking itself into a recession.

Much of the blame lies with Donald Trump, whose trade war put an end to the period of synchronised global growth and has contributed to the surge in volatility in markets.

For a president who pledged to “make America great again”, Trump’s willingness to continue playing fast and loose with the economy as he gears up for re-election defies belief.

Still, the fact that household spending in America – currently the single most important motor of the global economy – is holding up despite the dramatic escalation of the trade war, is cause for optimism.

All the more reason to ensure that fear of a US recession does not turn into reality.

Nicholas Spiro is a partner at Lauressa Advisory