The trade war has pushed China towards further globalisation, domestic technology development and policy reforms

- China’s trade war with the US could hold back technological development and sow distrust between the world’s two biggest economies. But Beijing has used the rivalry as an opportunity to open up to other countries and stimulate domestic innovation

The world has been watching developments in the Sino-US relationship with trepidation. Fears of increasing disengagement between the two economic superpowers have given rise to uncertainties about the global economy and financial markets.

At the eye of the storm has been the bilateral trade relationship, within which escalating tariffs over the past 18 months have curtailed trade flows. Although the imminent phase one deal brings some relief, the two sides are still far from striking the kind of comprehensive agreement needed to restore normality.

Trade is not the only area of contention. Cross-border investment has come under increasing scrutiny in the US, with many investments from China deemed national security threats. This has led to an 88 per cent plunge in Chinese investment in the US since 2016.

Nor are exchanges of people exempt from the increasingly strained relationship. The number of first-time students arriving from China to the US has fallen by 33 per cent since 2016, and the number of Chinese tourists dropped by 16 per cent in the year to end of 2018. There are numerous reports of Chinese scholars, business executives and government officials denied visas to enter the US.

These restrictions will have a short-term economic impact, but more concerning are the long-term consequences of reduced movement of people between the two countries, fuelling further misunderstanding.

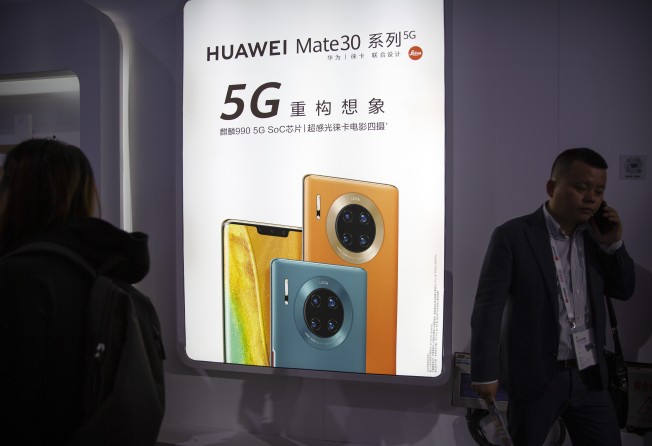

The final area of disconnect is in technology, which has received almost as much attention as the trade conflict. Aside from the ban on Huawei and its 5G equipment, the list of Chinese tech firms on the US blacklist has grown rapidly this year. Continued disengagement in this area could slow technological progress in both countries as it hinders cooperation, knowledge-sharing and healthy competition. But the ultimate fear is that the world could be split between two incompatible tech ecosystems, with enormous inefficiencies for economies and societies at large.

In his 2019 New Year’s address, Chinese President Xi Jinping warned that China and the world are experiencing once-in-a-century changes. So far, these changes have come mainly in the forms of challenges and headwinds.

But every cloud has a silver lining. Looking beyond the short-term struggle, there are encouraging signs that structural changes have accelerated in China because of increasing external pressures. Below are three changes that we think will profoundly affect China’s long-term development.

First, Beijing has responded to rising protectionism by further embracing globalisation and opening up. In trade, the Chinese government has undertaken two rounds of tariff cuts on non-US imports over the past year, despite retaliating against US tariffs. China also hosted its second International Import Expo amid the heat of the trade war to demonstrate its continued commitment to economic opening.

In investment, the so-called negative list of industries subject to restrictive FDI conditions – has been slashed from 180 to 40. Amid that push, liberalisation in the financial industry has been notable, with a continued opening up of onshore markets leading renminbi assets onto global indices, and the scrapping of foreign ownership caps for joint ventures in banking, broking and insurance.

Second, concerted efforts have been made to indigenise technology against a growing tech decoupling between China and the US. On the official front, financial support for research and development have increased via tax waivers and subsidies. In June, a new technology innovation board – dubbed “China’s Nasdaq” – was launched to facilitate fundraising for tech start-ups.

The government has also introduced 5G networks ahead of schedule and issued an ambitious blueprint for the Greater Bay Area, benchmarking it against Silicon Valley technologically.

R&D spending in the private sector has responded, with A-share listed companies growing by more than 20 per cent annually since 2018. Companies subject to US sanctions, such as ZTE and Huawei, have ramped up the development of in-house substitutes for US components. Huawei’s latest smartphone, the Mate 30, now boasts its own chips and operating system, with reportedly no US parts.

Finally, Beijing has accelerated domestic reforms to put its house in order. Two sets of policy changes are noteworthy: faster urbanisation and corporate-sector reforms aimed at unleashing new growth potential; and shifting tactics in countercyclical policies – moving away from monetary and housing stimulus to fiscal easing – to manage the systemic risks associated with debt and asset bubbles.

None of these reforms are new, but the urgency of their implementation has been driven by the changing external environment. A broadly successful delivery of the changes will, in our view, help to arrest the trend decline in productivity growth and provide a cushion for China’s structural economic slowdown. Nevertheless, the onus will ultimately be on Beijing to deliver reforms in a bolder and more resolute manner while navigating the treacherous external environment with caution.

Aidan Yao is senior economist, China, at AXA Investment Managers