02:28

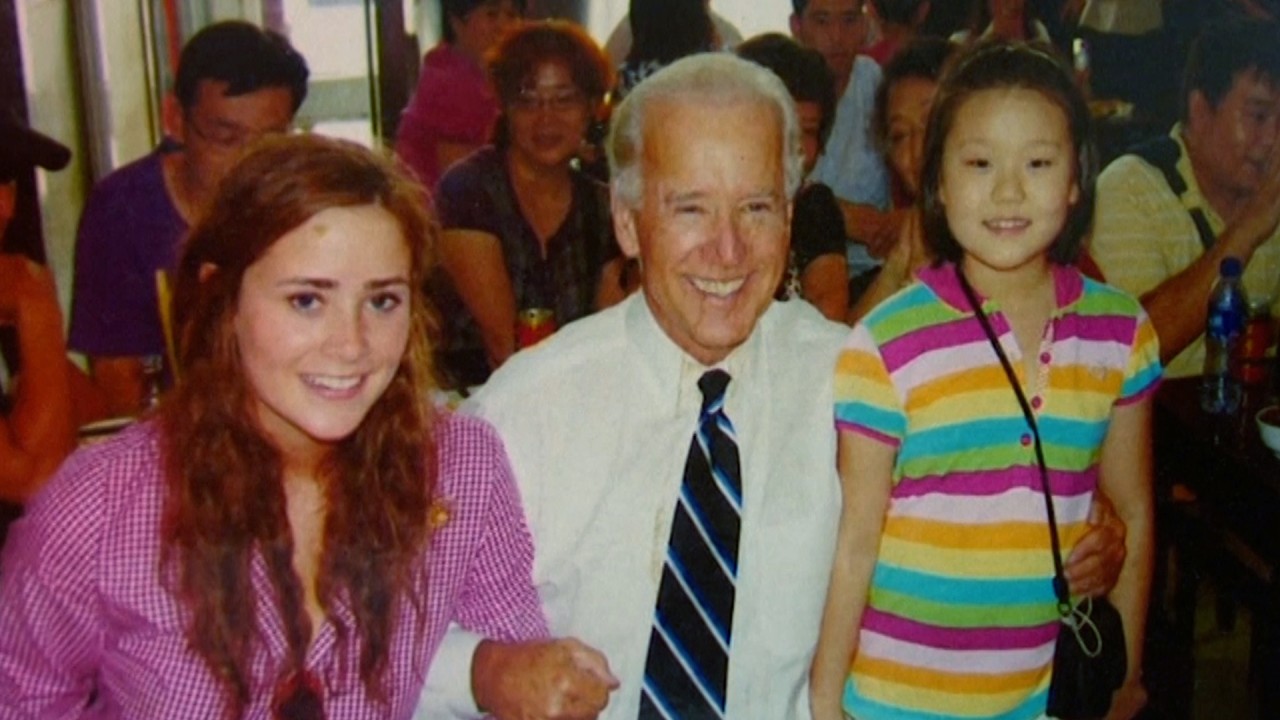

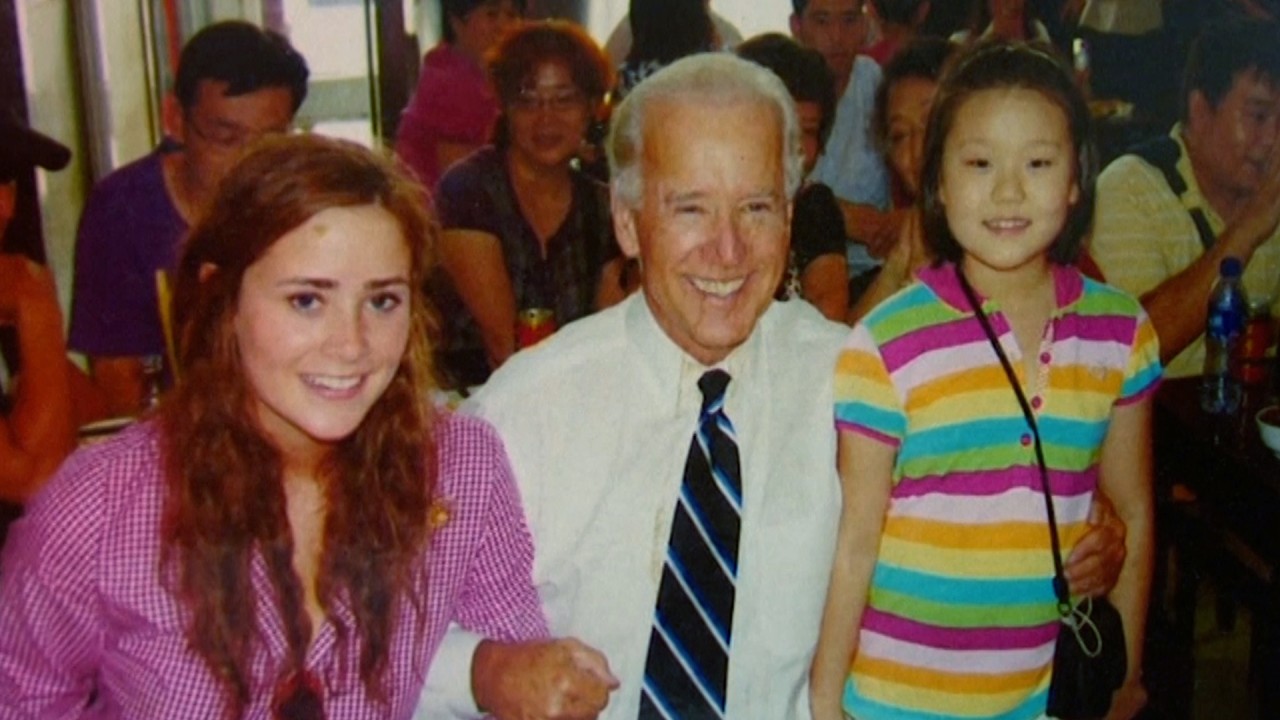

Beijing noodle restaurant celebrates US election win for Joe Biden and invites him back

Suddenly the world seems a better place and there is growing hope for a return to normality. After the landmark election of Democrat Joe Biden as the next US president, the global picture looks a lot brighter and there is budding optimism, once the Covid-19 pandemic is resolved, that the world can finally get back on its feet.

Judging by the way the outlook is already shaping up, 2021 could prove a bumper year for global growth, with China’s economy in the vanguard of recovery. China could easily surpass expectations of 8 to 9 per cent growth next year as the economy bounces back from the coronavirus.

Factory production is getting back into full swing, exports are surging and consumer confidence is picking up sharply. With Beijing turning its attention towards the domestic economy as the blueprint for future prosperity, could China’s consumers provide the answer for a faster domestic-led recovery and lead the way to mass consumerism?

While some expect China’s economy could eventually end up looking more like that of the US, where the consumer is king and consumer demand holds the whip hand in growth, it is not a direction Beijing wants to take at this juncture.

The thrust of the government’s 14th five-year plan, covering 2021 to 2025, is that China’s position as the world’s foremost industrial powerhouse is to be consolidated through greater reliance on domestic growth, and home-grown technology and innovation.

02:28

Beijing noodle restaurant celebrates US election win for Joe Biden and invites him back

These are the hallmarks of China’s so-called “dual circulation” strategy to bring out the best of China’s internal markets, while insulating the economy from the vagaries of geopolitics. Beijing is quite right to switch its strategy to self-reliance while the downside risks of external sanctions and global turbulence persist.

Even though future growth priorities will shift towards domestic strengths, China will continue to cement its pole position in global trade. Right now, this is filling a vital role in China’s recovery efforts with exports rising 11.4 per cent over the year to October, the highest rate of expansion in 19 months, compared with 9.9 per cent in September.

Buoyant global demand for China’s exports is providing a huge lift to domestic employment, boosting wages and spending power in the process. This has pushed retail sales growth into rapid recovery, from a year-on-year contraction of 20.5 per cent at the height of the Covid-19 crisis in January to a year-on-year increase of 3.3 per in September.

In the next few months, the trend should continue to improve and retail sales growth could easily accelerate to the pre-pandemic levels of 8 per cent that prevailed at the end of last year.

Consumers are already a force to reckon with in China’s economy and can be expected to make a bigger contribution to recovery in the coming months. Consumer spending in China might account for a smaller percentage of GDP than in the US, but it still remains a vital backbone of domestic demand, with plenty of potential.

In the years preceding the Covid-19 crisis, private consumption grew by 6.8 per cent in 2017, 9.5 per cent in 2018 and 6.8 per cent in 2019, either matching or surpassing the overall growth rate for China’s gross domestic product.

As the crisis began, Beijing was quick to introduce cheap credit, tax cuts and employment support measures which underpinned consumer confidence. It was this quick response which prevented a deeper stall even as the economies of the US, Europe and Japan lapsed into recession.

The US model of a predominantly consumer-driven market economy has no appeal for Beijing, given the prevailing systemic risks. The US is perceived as too vulnerable to cyclical downswings in employment and too reliant on consumer’s negative saving and excessive borrowing as growth drivers. That’s far too risky for China’s vision of sustainable capital-intensive, productivity-driven growth.

China would rather keep its internal savings rate high to maintain strong investment in domestic research and development, rather than see it frittered away in reckless retail spending sprees. In 2019, the average household savings ratio in China was running at 38.2 per cent compared to 7.5 per cent in the US, a major comfort for consumers in times of hardship and stress.

China’s consumer markets are evolving but Beijing’s priority remains home-grown technological innovation as the major engine of growth. For now, mass consumerism will just have to wait its turn.

David Brown is the chief executive of New View Economics