06:05

One year into Covid-19 pandemic, world marks anniversary of WHO’s declaration on coronavirus

The US Federal Reserve met this week to decide on interest rates and policy projections. The meeting had been hotly anticipated, as it was expected to set the tone for the central bank’s policy response to rising bond yields (bond yields move inversely to prices).

As it turned out, there was little to see – the Fed kept the song the same. Committee members remain in harmony on interest rate hikes.

The question now for markets is: how credible is this outlook when the US economy will be supercharged by a massive stimulus boost that may cause inflation to spike?

There were no changes to the Fed’s policy setting, cash rates remain anchored in the 0-0.25 per cent range where they have been since March last year, and the bond purchase programme will continue to tick over at the rate of US$120 billion per month. This is a very loose policy setting, considering how the Fed views the outlook for economic growth and inflation in the coming quarters.

The Fed could not overlook the fairly quick recovery in the US economy this year, helped by a fast clip of Covid-19 vaccines. The higher rate of Covid-19 infections in the US, coupled with the speed at which vaccinations are being distributed, implies the country may reach herd immunity as soon as the next few months, enabling an even faster economic reopening and perhaps higher rates of inflation.

This upside risk to inflation is hard to measure exactly, given it’s still not clear how much long-term damage Covid-19 did to the US economy, and it isn’t certain just how the US$1.9 trillion fiscal package will trickle its way from US households into the economy or asset markets.

The Fed did upgrade its economic forecasts significantly to account for this effect, now expecting year-on-year growth to be 6.5 per cent in the fourth quarter. But this fiscal wave will be temporary and the economic boost will recede again in the coming years, according to the Fed, which actually downgraded its 2023 growth forecast slightly, to 2.2 per cent.

It’s a similar story when it comes to the inflation outlook. The Fed’s preferred measure of inflation, personal consumption expenditure, will rise to 2.4 per cent year on year in 2021 and remain just above the monetary policy target rate of 2 per cent until 2023.

Under the Fed’s average inflation targeting framework, a sustained period of above-target inflation should be enough to see the bank hike rates, but it clearly said that even this level of inflation is not enough, because it thinks it will only be transitory.

Forecasts are one thing, but what the Fed really wants to see is real, actual inflation. It needs price increases to be strong for many years to offset the years of below-target inflation, and appears willing to tolerate a level well over its 2 per cent target before moving rates.

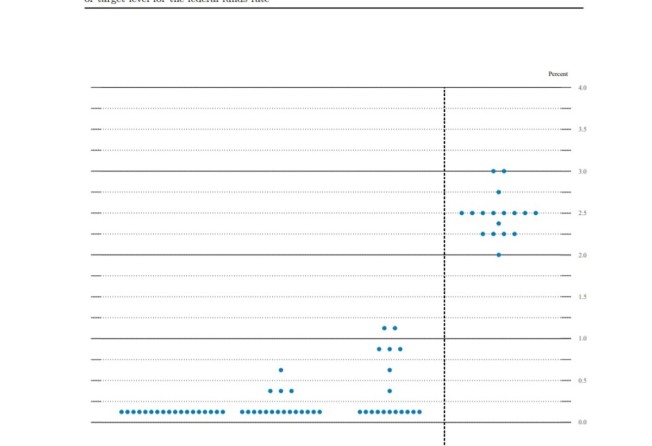

Meanwhile, the Fed’s “dot plot” had faded in significance in the lower-for-longer era, as the number of committee members predicting hikes in the coming years was non-existent. But now that things are becoming ever so slightly more hawkish, attention to the dot plot has revived.

The latest dot plot this week showed the number of committee members looking for a rate hike by 2023 has increased from four to seven. To put this in context, there are 18 committee members, so still less than half think rates will be higher over the next two years.

For now at least, the Fed is sticking with a very dovish tone. The challenge will be how the market views the Fed’s credibility, as this will be critical to ensuring that the forward guidance on rates has the desired impact on markets.

However, even as markets may dial back their rate hike expectations, the increase in inflation and the improved economic outlook implies that bond yields will still rise from today’s levels.

But higher bond yields on the back of stronger growth are far less troubling for risk assets, and fuel the rotation into value and cyclical sectors as well as pressure bond returns.

The Fed may be in tune when it comes to the extension of its hyper-accommodative policy setting, but the market is split on whether higher inflation will eventually spoil the party, forcing an early move on either bond purchases or the rate outlook. The market may not like to hear the same song if it’s sung out of tune.

Kerry Craig is a global market strategist at JP Morgan Asset Management