05:57

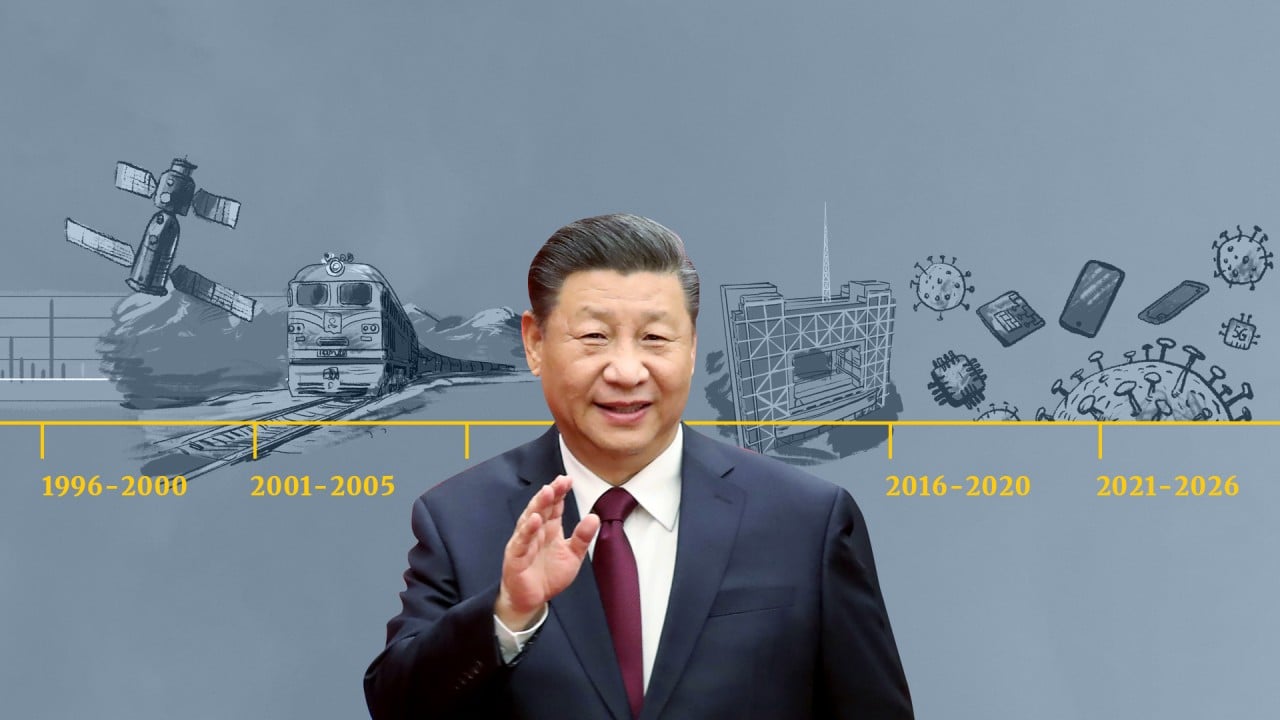

SCMP Explains: China’s five-year plans that map out the government priorities for development

The Chinese economy hit a soft patch early this year as the momentum of both consumption and investment growth weakened.

Tighter restrictions around the Lunar New Year holiday in response to the Covid-19 resurgence in January dampened consumption, hitting China’s services industry hard. Passenger volume during the peak travel season around the holiday was 76 per cent lower than the same period in 2019.

Catering sales in January and February also fell below 2019 levels despite a strong recovery in the fourth quarter. Moreover, fixed-asset investment growth in January and February was weaker than the market expected, weighed down by investment in the manufacturing and infrastructure sectors.

With the domestic coronavirus situation firmly under control again, China’s economic growth momentum is likely to show a notable recovery in the second quarter. In particular, consumption recovery is likely to be helped by the recent loosening of social-distancing measures for entertainment and domestic travel.

With the global economy expected to rebound strongly, companies are likely to invest more in their businesses, which will provide further support to industrial activities in China.

One major risk that could derail China’s economic recovery is Beijing overtightening its monetary policy, although that seems quite unlikely for now.

China’s monetary policy has become less accommodating since mid-2020 as its economy recovered from the pandemic shock. So far, the exit from loose monetary policy has been more gradual than in previous tightening cycles.

Broad credit growth, as measured by outstanding total social financing, edged up by only 13.3 per cent year on year in February, lower than last October’s peak of 13.7 per cent, but still high compared to 2019.

Total social financing includes off-balance-sheet forms of financing that exist outside the conventional bank lending system, such as initial public offerings, loans from trust companies and bond sales.

There are several reasons the withdrawal of policy support is likely to remain gradual for the rest of this year.

While China’s gross domestic product rebounded strongly in the fourth quarter to pre-Covid-19 levels of around 6 per cent, the recovery has been uneven, with small and medium-sized enterprises and the service sector lagging. These sectors are likely to be hit hard by sharp monetary tightening.

That would pose a challenge to the stability of China’s labour market. Services are more labour-intensive than manufacturing, and SMEs account for around 80 per cent of China’s urban employment. Supporting SMEs is one of the priorities of China’s latest government work report, which stresses the need to lower funding costs for smaller enterprises.

In addition, inflationary pressure is unlikely to be a concern for the People’s Bank of China. Over the course of the year, consumer prices should rise somewhat as demand recovers and energy prices increase.

But the headline inflation indicator, the consumer price index, is likely to remain below the PBOC’s ceiling of 3 per cent this year. The producer price index has also picked up recently, amid strong growth in China’s industrial sector and higher commodity prices, but it is concentrated in upstream sectors with limited impact on consumer prices.

At the same time, Chinese policymakers are only looking to keep the leverage ratio stable this year, rather than reduce it.

Higher GDP growth is likely to keep China’s debt-to-GDP ratio down. Given that nominal GDP could exceed 10 per cent growth this year, after just 3 per cent last year, only a moderate decline in credit growth to around 10-11 per cent, from the current 13 per cent, is needed to achieve this goal.

What is more, the magnitude of monetary easing this time around (from mid-2018 to mid-2020) looks modest compared with the 2008-2009 and 2015-2016 easing cycles. This also lessens the need to tighten monetary policy aggressively this year.

Policymakers have voiced concerns about a potential property bubble, although this does not seem to be a nationwide problem. While home prices are rising quickly in the top-tier cities, many lower-tier cities are still struggling with oversupply.

As a result, city-specific property policies, rather than broad-based monetary tightening, are likely to be introduced to address the more specific overheating situations.

Meanwhile, China’s targets for both the headline fiscal deficit and local government bond issuance, revealed at the National People’s Congress meeting in early March, have exceeded market expectations. Fiscal tightening is also on track to be more modest compared to 2010 and 2017.

That said, one thing we need to closely monitor is the pace of growth recovery. If China’s economic growth turns out to be much stronger than expected, especially with a fast recovery in the service sectors, it could lead to complacency among policymakers and trigger more aggressive policy tightening.

Sylvia Sheng is a global multi-asset strategist at JP Morgan Asset Management