Why Hong Kong’s full reopening will be in China’s best interests

- While Hong Kong keeps chasing the goal of ‘zero Covid’, its peers and competitors are moving on and normalising economic activity

- Fully reopening is more urgent and more feasible than ever, and doing so will be to both Hong Kong and China’s great benefit

Hong Kong is still in its labyrinth of Covid-19 restrictions as the world moves forward, though it is no longer 2020 and the whole world is not under lockdown. Now, its regional peers are moving swiftly towards normalising economic activities.

With the high economic stress and low mortality rate from Covid-19, it is not only more urgent but also more feasible than ever for Hong Kong to fully reopen. The “3+4” scheme was an encouraging step, but nothing will change as long as inbound quarantine requirements remain in place. Compulsory tests and the health code system have also eroded Hong Kong’s attractiveness, quality of living and competitiveness.

Many have already discussed the obvious benefits of Hong Kong reopening fully. Since Hong Kong’s long-standing role is linking China and the West, this is also in the best economic interests of China.

Beijing’s mandate for Hong Kong is to retain its status as an international financial, trade and logistics centre while accelerating innovation and technological development. The key word here is international – the core value that defines Hong Kong. Yet, the current policy is not only counterintuitive but keeps Hong Kong from realising its full potential.

Given its special role, Hong Kong can keep its flexibility and adopt policies that are different from the rest of China, and handling the pandemic should be no exception. As a small and open economy, there is only so much Hong Kong can endure as much of its economic activity comes from cross-border interactions. From finance to tourism, these pillar industries are important for Hong Kong’s economic growth and employment.

Stresses have also become apparent as economic pressure begins to bite tax revenue. With the unsustainable pandemic-related spending and stimulus, Hong Kong will feel the heat of a widening fiscal deficit, with negative consequences for long-term government resource allocation.

China aims to achieve domestic growth with its dual circulation model, but the Hong Kong government should not forget there is also an external ring in this economic model. A fully reopened Hong Kong will allow Chinese firms to maintain their necessary interactions with the world in a less disrupted way.

There are many challenges and reasons behind globaly supply chain reshuffling and investment reallocation. Hong Kong’s situation will only get worse without meaningful exchanges with the world, though, leading to a deterioration in its business ecosystem.

It is also better for global firms to keep their relationships and investment flows with their Chinese counterparts. The missing on-the-ground interaction often means more information asymmetry, affecting decision-making in the headquarters. With the difficulty of accessing the mainland, Hong Kong can again be a compromise solution as it can fully reopen to all and it is close to Chinese firms. This will be a big step towards business as usual and beneficial for Hong Kong residents.

Unlike the mainland, Hong Kong does not have a large domestic market to resist the drag of economic recession. It has been more than two years since the pandemic began and the government is still in two minds about reopening. The risk is that Hong Kong could be stuck in the middle, losing competitiveness with its Asian peers. It is a difficult choice, but the government cannot wait forever.

Even though Hong Kong cannot fully reopen its mainland border, it can still keep businesses going by fully reopening to the rest of the world. The policy change will create constructive momentum in China-related businesses, from conferences to exhibitions.

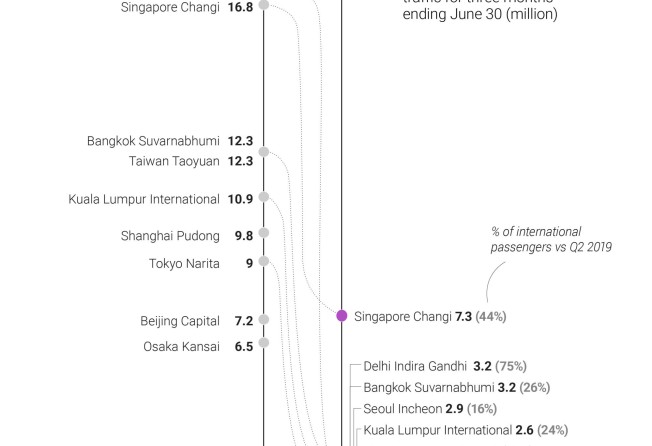

The aviation sector is a close proxy in comparing economic activities, and the best comparison in Asia is Singapore. As of the first week of July, Changi Airport had recovered around 55 per cent of its weekly passenger traffic compared to 2019 pre-pandemic levels. The number of flights is expected to reach 80 per cent of pre-pandemic levels by the end of the year as Singapore holds more international events, such as the Fintech Festival held alongside that of Hong Kong in early November.

Meanwhile, the figures for Hong Kong International Airport remain a shadow of what they were before the pandemic. The direct costs and externalities of Hong Kong’s pandemic restrictions have clearly outpaced its economic benefits.

Still, it is good to see the Hong Kong government has finally realised the problem. Planned events such as the finance summit and Hong Kong Sevens can bring a fresh start. The last thing Hong Kong now needs is more pandemic restrictions, both domestically and externally.

If Hong Kong’s leadership is still thinking of relaxing rules selectively and keeping its current local rules, it will not change the picture of the city’s relative competitiveness rapidly deteriorating, especially vis-à-vis Singapore. Hong Kong does not need another show staged by the government. It needs real changes in policies to fully reopen and keep business activities flowing.

Gary C. Y. Ng is senior economist for Asia-Pacific thematic research at Natixis