Signs point to a Chinese stock market turnaround after two hard years

- Glimmer of hope as China eases its Covid-19 policy and issues a rescue plan for the property sector – but investors must be realistic about the pace of reopening and recovery

Recent policy announcements from the Chinese authorities on both Covid-19 policy and extending liquidity to the real estate market are not magic wands that yield immediate results. Patience is key as we await economic recovery. But this could be a critical turning point after the disappointing market performance in the past two years.

The Chinese equity market has been hampered by internal and external factors in the past two years. The economic slowdown in 2020 following the Covid-19 pandemic was by design, to avoid overheating. Yet this coincided with a rapid change in the regulatory environment in the technology sector, and tougher financial rules for real estate developers.

Then, in the second quarter of this year, stringent city lockdowns further dampened consumer and business confidence. All this has strained the economy. On the external front, the war in Ukraine, the risk of some Chinese companies being delisted from US exchanges and the tense US-China relationship have dampened international investor sentiment.

The result of these complications is that Chinese equities underperformed their peers in Asia and major markets last year, and have done so far this year.

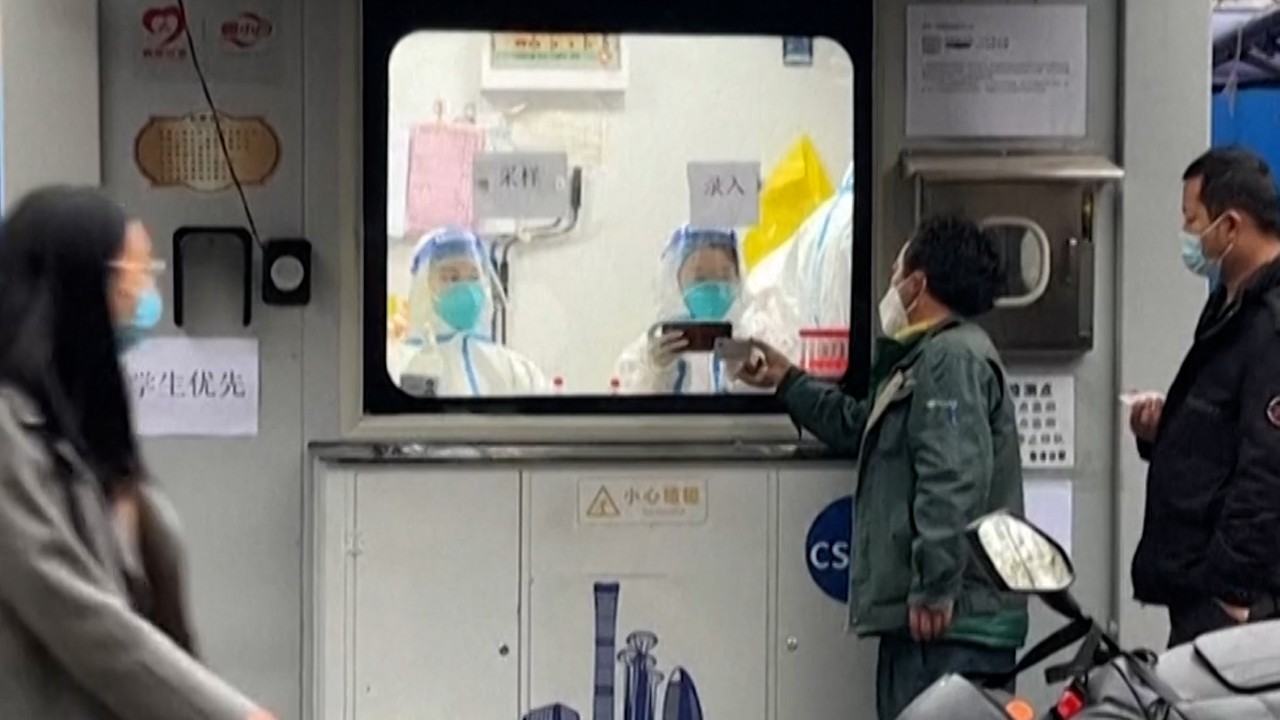

Investors have, however, seen a glimmer of hope in addressing some of these issues in the past few weeks. On November 11, the State Council announced a 20-point plan to fine-tune its Covid-19 policy, including reducing the quarantine period for inbound travellers, stepping up vaccination and preparations for medical facilities and medication.

These are necessary conditions to open up borders and facilitate the movement of people across provinces. It is interesting that this announcement comes as the number of infections is again picking up, especially in Guangdong province.

Having said that, it is important for investors to be realistic about the pace of reopening, especially with potential surges in both flu and Covid-19 cases as winter approaches. Daily cases of Covid-19 have risen to over 20,000 and some cities have reintroduced policies to limit the movement of people.

Still, the recent Covid-19 announcement should pave the way for a gradual relaxation in policy while keeping severe cases and deaths manageable.

At the same time, the central bank and regulator have announced a 16-point rescue plan for the property sector, which essentially points towards better access to financing for both developers and buyers, and for development projects to be completed.

Although this is a subtle shift from pressuring developers to improve their balance sheets and deleverage, it is necessary, considering the importance of the real estate market to the broader economy and financial system. Some flexibility can go a long way to ensuring that economic growth can be maintained.

China has also returned to the world stage. While the three-hour meeting between President Xi Jinping and his US counterpart Joe Biden on the sidelines of the G20 summit in Bali is unlikely to completely resolve the long-standing challenges between the two countries, it does represent a diplomatic re-engagement after a difficult summer. Xi also met European and Asian leaders, engagements that hopefully address some investors’ concerns over decoupling.

On the delisting risk for Chinese companies in the US, the Public Company Accounting Oversight Board has completed a seven-week audit of these companies. While the outcome remains uncertain, the collaboration is a positive sign that regulators are genuinely looking to reach a workable solution.

Again, it is important to reiterate that these challenges are considerable and that progress has been modest, though in the right direction. China’s economy should be on track to recovery next year, in contrast to the US and European economies that are facing recession headwinds as a result of high inflation and interest rates.

Investors should not dismiss the Chinese market despite its disappointing performance over the past two years. A lot of the bad news is already reflected in asset prices and the Chinese market should again be worthy of attention.

Tai Hui is chief market strategist for the Asia-Pacific at JP Morgan Asset Management