China clashes with G20 business lobby group over support for state-owned companies

Disagreement over Beijing’s support for SOEs exposes fundamental divisions between China and world’s other leading economies

A rare open row has broken out between Beijing and an international business group affiliated with the Group of 20 over the role of state-owned enterprises, reflecting a fundamental division between China’s views and those of other major economies.

Business 20, an advisory group that represents the views of the private sector, last week issued a communique calling for an end to state-related competitive distortions, but the wording met with strong objections from a Beijing-backed business group.

On Friday, the China Council for the Promotion of International Trade, a semi-governmental trade advocacy group, insisted that the B20 proposal should not be submitted to G20 leaders at their next summit and demanded revisions to the sections covering state-owned enterprises (SOEs).

It claimed that the proposal had ignored concerns expressed by Chinese business delegates at a B20 meeting in Argentina on Friday, adding that it one-sidedly highlighted market distortions, excess capacity and corruption in the SOE sector.

G20 leaders will discuss the communique when they meet in Buenos Aires on November 30 and December 1, but the quarrel exposes the deep divisions between Beijing and other countries over the management of its state-owned behemoths.

It also casts a shadow over the future of the G20, which emerged as a new global governance platform after the 2008 financial crisis to give China and other emerging economies a seat at the table when the world’s economic future is at stake.

Although the world’s 20 biggest economies have often found it hard to agree upon binding targets or concrete action, up to now they have managed to voice a consensus on general principals such as promoting growth and employment despite the divisions the latest spat exposes.

The B20 is an advisory group to with no formal powers, but it represents the voice of the international business community and makes policy recommendations to G20 governments.

Chinese business executives who joined the B20’s 156-member trade and investment task force this year included Guo Ningning, executive director of the Agricultural Bank of China, one of the country’s biggest state-owned banks, and Sun Yongcai, vice party secretary at the state-owned train manufacturer CRRC.

An earlier paper on the B20’s trade agenda, which provided a basis for its communique, suggested G20 leaders should reach an agreement about government-driven competitive distortions.

“The agreement would require significant lessening, limitation, and/or complete elimination of policies that accord preferential treatment to SOEs,” the paper said.

“We suggest it would be advisable to immediately create a working team to advice G20 leaders on the specific technical alternatives.”

In China’s case, such a measure could target the subsidies, debt relief and favourable loans given to state-owned companies.

The Chinese government has traditionally played an active role in B20 and G20 meetings.

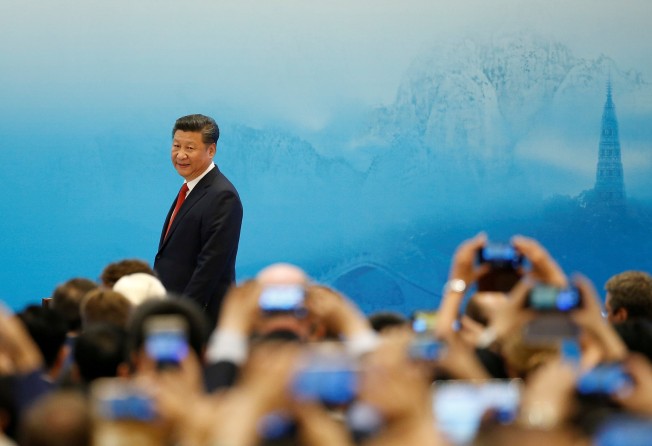

In September 2016, President Xi Jinping attended the opening ceremony of the B20 Summit in Hangzhou in eastern China.

In his speech he said G20 economies should “jointly foster open and transparent global trade and investment governance to cement the multilateral trading regime”.

If the B20’s advice on SOE reform does appear in the final G20 communique later this year, it may force China to ditch the multilateral approach Xi has long espoused, Zhao Xijun, a professor of finance from Renmin University in Beijing, said.

“If such communique does change other countries’ policies toward China, then Beijing might have to negotiate with them one-by-one, inevitably shifting from multilateralism to unilateralism or bilateralism,” Zhao said.

Domestically, the debate about the favourable treatment Chinese SOEs receive surfaces every few years, particularly when the economy starts to slow down.

The situation has been exacerbated this year by the trade war after US President Donald Trump singled out state policies as one of the factors that unfairly distorted free trade.

In an attempt to assuage the criticism, Xi said last month that SOEs should become more competitive and pledged “unswerving support” for private companies.

But for some economists and close China watchers question whether Xi’s words indicate any real intention of introducing market forces and remain unconvinced by China’s road map for reforming SOEs.

“It was very clear to me that China is really under pressure to introduce more market-friendly measures, especially as regards production.

“This obviously clashes with SOEs, and mixed ownership reform is not something the West believes in,” Alicia Garcia Herrero, chief economist of Natixis, said.

Last month Herrero attended an event on trade relations between China, the US and EU organised by the Brussels-based think tank Bruegel. She said the Chinese officials who attended the event, including Zhou Xiaochuan, the former governor of the central bank, argued that state behemoths such as Sinopec or Industrial and Commercial Bank of China, should be treated as private entities because they were listed on the stock market.

But she said the low number of publicly held shares in those companies made it nearly impossible to convince the West with such argument.