China’s state-owned car maker gets a huge lifeline but what about private firms?

- Struggling rust-belt will benefit but the US$145 billion line of credit has raised questions about Beijing’s commitment to the private sector

- Analysts say the government needs to boost both sides of the economy at the same time

The extension of a line of credit worth more than 1 trillion yuan (US$145 billion) to a single Chinese state-owned company – vehicle manufacturer FAW Group – has raised questions about the government’s commitment to the private sector, which is being hit hard by the escalating trade war with the United States.

But analysts say that the move makes sense, given Beijing’s conflicting priorities of providing economic support for the struggling northeast rust-belt region while also seeking to boost private firms to help stabilise the overall economy.

“It is rare and hard to understand why such a big sum of money would go to a single company,” said Aidan Yao, senior emerging Asia economist at AXA Investment Managers.

FAW’s market share for traditional cars and trucks has declined in recent years, but its importance to the struggling economy of China’s northeast, as well as hopes for a new start with electric vehicles, support the decision to give the state-owned company access to so much money.

FAW said that 16 commercial banks, led by China’s policy bank China Development Bank, had signed the agreement approving the line of credit. The granting of specific loan amounts will need to be reviewed on a case-by-case basis.

A signing ceremony between FAW and the banks was witnessed by provincial party secretary Bayinchaolu, Jilin governor Jing Junhai, as well as Zhu Hexin, a vice-governor of the People’s Bank of China, and Zhou Xiaofei, a deputy general secretary at the National Development and Reform Commission.

Their attendance showed the importance of the deal for the region and the country, FAW said on Wednesday.

Meanwhile, the sheer size of the credit showered on FAW stirred debate in China after lectures from Chinese leaders, including vice-premier Liu He, to the country’s state banks to lend more to private borrowers. Opening up the vault for a state-owned car maker seems to run against Beijing’s intentions.

A key issue of the debate about the future of the Chinese economy is whether China’s state banks are discriminating against private enterprises, which account for the bulk of China’s jobs and output.

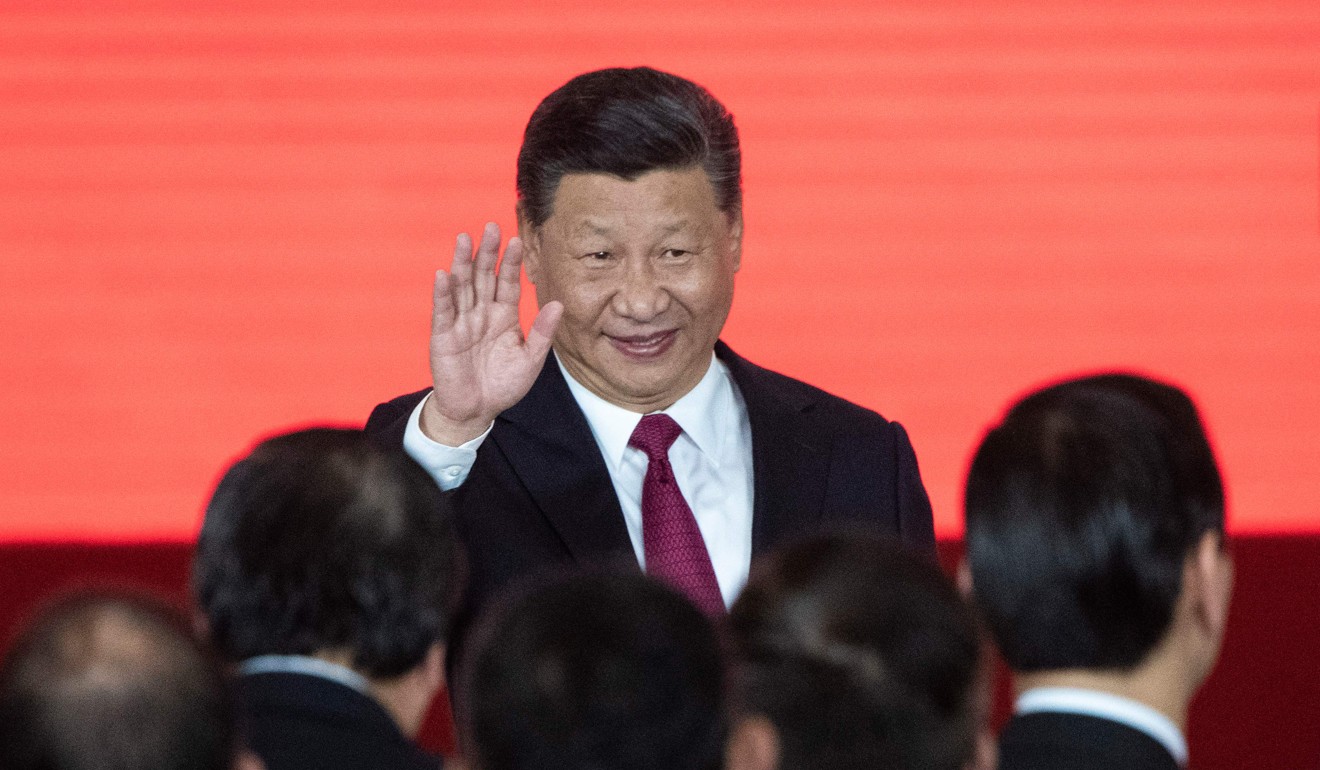

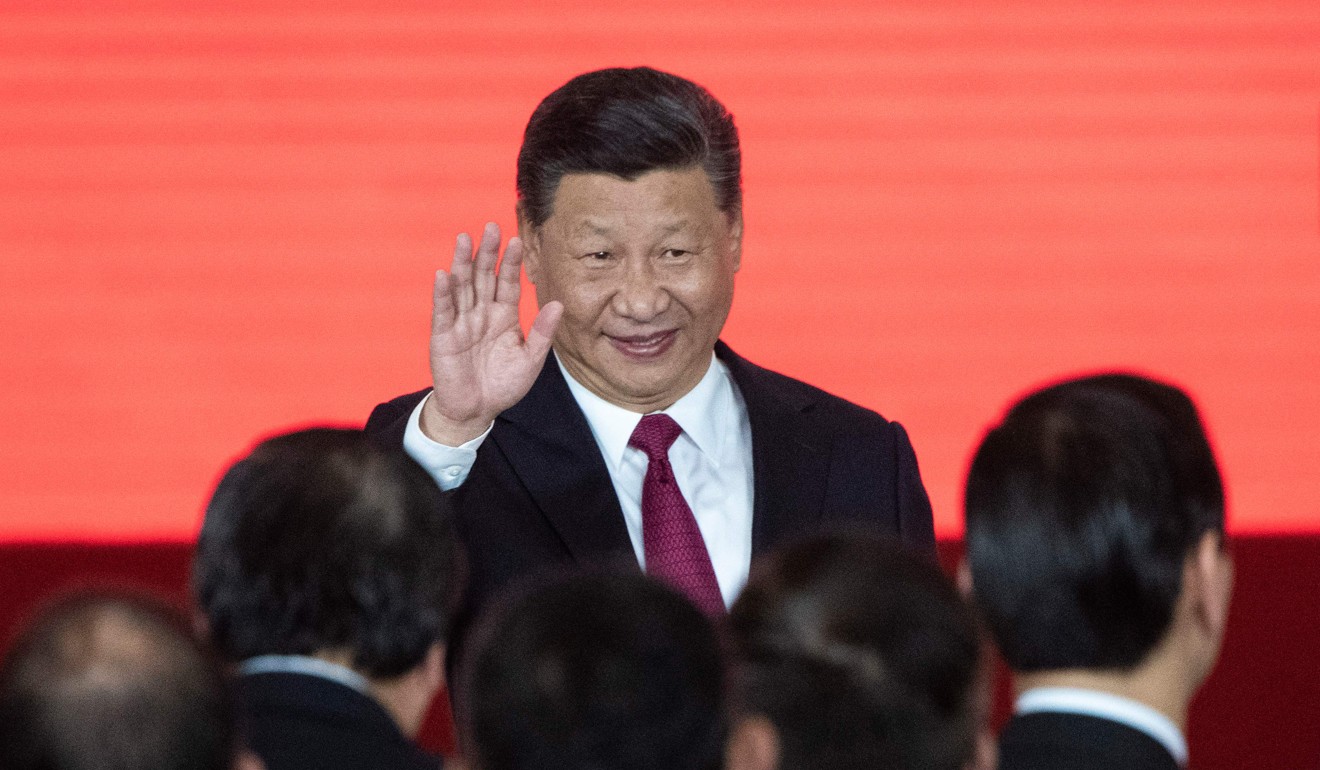

Even Chinese President Xi Jinping has weighed in, saying during his trip to Guangdong this week that the ruling Communist Party values the role of private business and “this will not change”.

At the same time, the Chinese government is not giving up its support for state-owned behemoths, known as the country’s industrial champions, despite loud complaints at home and abroad.

Companies like FAW are still seen as the backbone of the national economy and the foundation of China’s economic model.

Started as First Automobile Works, the firm is the producer of the famous “Red Flag” car, once the country’s pride. The company is also part of a joint venture with Audi, Volkswagen’s luxury brand, whose cars have been the popular choice of Chinese government officials for years.

FAW is ranked 125th on the 2018 Fortune Global 500 list, and reported annual revenues of US$69.5 billion in 2017, equivalent to about one-third of GDP for Jilin province, where it is headquartered.

The announcement of the line of credit comes as China is desperate for anchors to stabilise its economy, with the country’s economic growth and capital markets weighed down by the escalating trade tensions with the United States.

It comes only two months after Xi’s visit to the rust-belt region, during which he promised more economic support.

The decision surprised many observers, given Beijing’s vocal campaign over the past few weeks to get banks to lend more to private firms.

But analysts said the decision to extend the line of credit to FAW made economic and political sense because China had a long list of urgent economic priorities, which require support for both public and private firms, even though the process seems contradictory at times.

“An ideal situation is for all regions to go forward hand in hand … but in reality, nothing is easy,” said Shen Jianguang, chief economist at JD Finance.

Beijing hopes to help provinces like export hub Guangdong thrive by restoring confidence among private entrepreneurs, who have a long history of success there. To do this, it has proposed changes to banking regulations to promote more lending to private firms while promising to help moderate their cost increases.

On the other hand, it cannot let the country’s state firm-dominated industrial base in the northeast collapse, Shen said.

The government’s dual message was on display on Thursday after the FAW announcement, when Xi visited a private car parts manufacturer in southeast Guangdong and reiterated Beijing’s support for the private sector.

In late September, he toured three northeast provinces and reassured officials there that rejuvenation of the region remained a strategic priority for Beijing.

The northeast region was the cradle of China’s heavy industry in the 1950s, aided by financing and know-how from the neighbouring Soviet Union; industrial infrastructure inherited from Japan’s second world war puppet state of Manchukuo; and massive investments from the new People’s Republic of China.

But the region’s unprofitable state-owned industrial firms were the focus of Premier Zhu Rongji’s economic reforms in the late 1990s, when many state companies were closed and millions of industrial workers lost their jobs.

The region’s economic development has since lagged behind other parts of the country, as resources have dried up and the remaining state-owned companies have become uncompetitive.

Over the past decade, Beijing introduced a series of specialised funds and favourable economic policies in an effort to boost growth in the region.

But in the first half of this year, the economies of Liaoning, Heilongjiang and Jilin provinces together grew just 4.7 per cent, well below the national rate of 6.8 per cent.

FAW is the one of the few industrial powerhouses left in the region.

The company said it had no specific short-term plans to utilise the new line of credit, according to Caixin magazine.

FAW said it would work with the banks in a number of business areas including capital management, international financial services, new-energy vehicles, the “internet of things”, as well as the development of its existing Red Flag series cars.

The line of credit is also a boost for the rest of China’s car industry, which is expected to report a decline in sales this year for the first time since 1990. Major domestic car makers have recorded repeated and significant profit drops during the first three quarters of the year.

The sector will face bigger pressures in future, with China’s promise to open up the car-making sector to full foreign ownership by 2022.

Still, analysts have noted the awkwardness of the move, with small private firms the first to suffer in the trade war and while the government is in the midst of a campaign to cut the nation’s debt.

Such a large infusion of liquidity will boost sentiment about the overall economic outlook, but the effect will be limited by placing all the funding with a single company – unless the FAW loan is a signal that there will be a series of industrial consolidations in the region, AXA’s Yao said.

He noted that in China, banks always prefer to lend to state companies because their government backing is an implicit guarantee of repayment.

In addition, lending to state firms saves due diligence and credit monitoring time because they can take on larger loans, not to mention the political significance of supporting government firms, he said.

“Private companies are first in the chain to suffer when economic growth slows down and bankers become risk-averse.

“A big credit easing would help to reverse the situation. But Beijing is staying away from doing that, because it is struggling to balance de-risking via cutting debt levels with maintaining growth,” Yao said.

“China’s monetary policy has shifted to an easier stance, as China tries to cope with the pressures produced by the trade war. There is increased liquidity, but how to make the best use of this still lacks details,” Shen said.