US mulls partial ban on Chinese trains and buses, citing cybersecurity and ‘Made in China 2025’

- Senators have taken the first steps to ban rolling stock manufactured by Chinese companies with state ties as part of the ongoing US-China trade war

- The rail industry is one in which China had been making big inroads into the United States with recent sales to Boston, Los Angeles and Chicago

Trains and buses could be the next battleground in the US-China trade war, after United States senators took the first steps to ban rolling stock manufactured by Chinese companies with state ties.

A bipartisan bill was introduced on Friday that claims “China poses a clear and present danger to our national security and has already infiltrated our rail and bus manufacturing industries”.

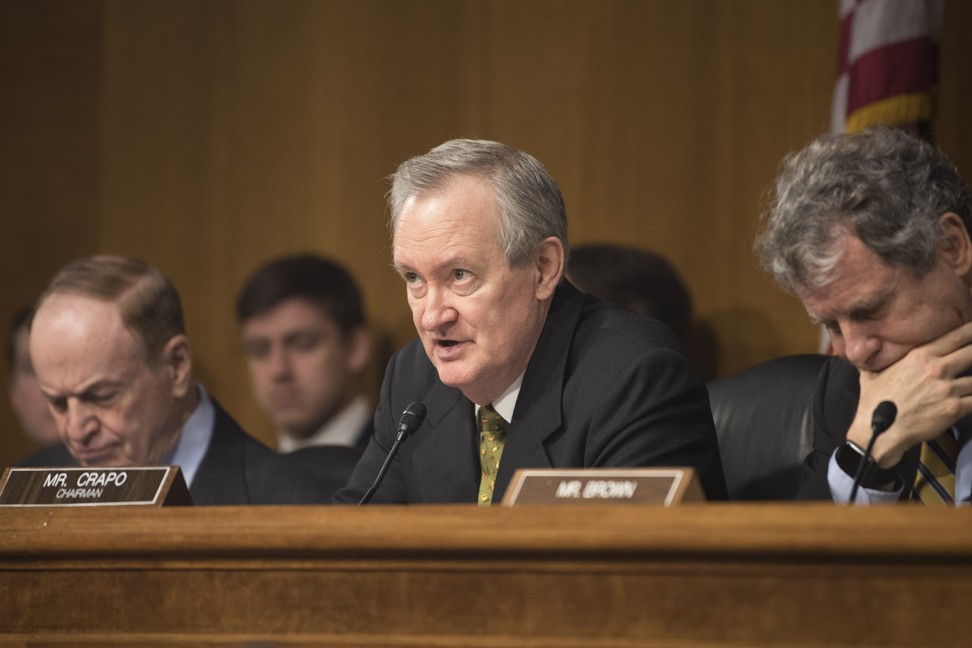

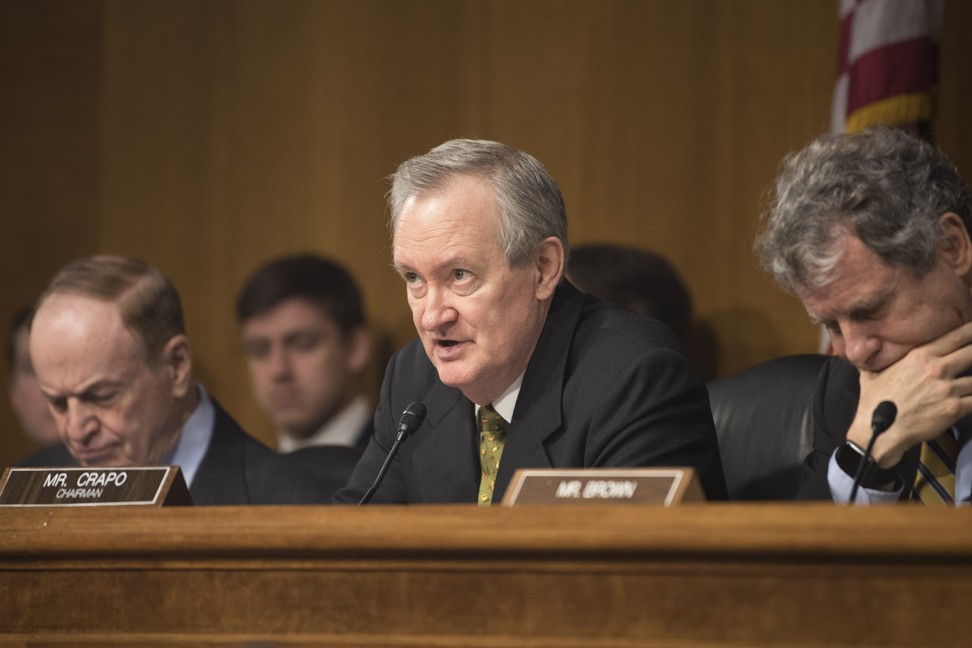

It has garnered high profile sponsorship in the form of the Republican chair of the Senate Banking, Housing and Urban Affairs committee, Mike Crapo, and the senior Democrat committee member, Sherrod Brown, who recently ruled himself out of a 2020 presidential run.

The Transit Infrastructure Vehicle Security Act seeks to ban federal funds from being used to buy “railcars or buses manufactured by Chinese owned, controlled, or subsidised companies”.

The US rail industry is one in which China has been making big inroads over recent years. The state-owned China Railway Rolling Stock Corporation (CRRC) has won a number of high profile contracts, using low prices to muscle out rival bids.

In December, the Massachusetts Bay Transportation Authority took delivery of a batch of 400 CRRC-built carriages for the Boston subway system, having signed a US$843 million contract in 2014.

In March 2017, CRRC was the successful bidder for the supply of 45 double-deck carriages for the Southern Pennsylvania Transportation Authority, to service Philadelphia. The following month, it won a US$647 million contract to sell 282 carriages to the Los Angeles subway system.

But CRRC’s biggest coup came in July 2016 when it was awarded a US$1.3 billion contract to build 846 carriages by the Chicago Transit Authority.

According to the act, these bids have been heavily subsidised by Beijing and are “well-below competitive market price to win contracts throughout the United States”. It also seeks to draw a link between Chinese exports of rolling stock – a catch-all term used for railway vehicles, trucks and mass transit vehicles – and the cybersecurity fears that are at the heart of the US-China trade war.

The act would force any company supplying US rail networks to establish “a process to develop, maintain, and execute a written plan for identifying and reducing cybersecurity risks”, amid fears that the security systems on railcars can be used to feed surveillance back to Beijing.

CRRC is a publicly-traded company, but its parent CRRC Group – the world’s largest rail manufacturer – is a state-owned enterprise (SOE). Under the proposed bill, the firm would therefore be banned from signing future US contracts should there be federal funding involvement.

US President Donald Trump’s “buy American” policy forces 60 per cent of components to be made on American soil. In order to meet these requirements, CRRC has production and assembly plants in Illinois, North Carolina and Massachusetts, but many of the components, including the carriage frames, are imported from China.

A report last year, written by research firm Oxford Economics paid for by the Rail Security Alliance, an industry body and lobby group, estimated that competition from Chinese SOEs “advantaged by the subsidies and support they receive from their home country”, puts 65,000 US manufacturing jobs at risk.

The study drew on the example of Australia, where cheap imports from China caused Australian rolling stock manufacturers to shutdown or move their operations overseas.

“Over the past roughly 15 years, Australia experienced a rapid decline of domestic railcar production and increased reliance on foreign-produced railcars from Chinese SOEs and other Southeast Asian countries,” the study said.

The bill, which was introduced by senators John Cornyn, a Republican, and Tammy Baldwin, a Democrat, aligns China’s US rail ambitions with its ‘Made in China 2025’ plan, an ambitious blueprint for upgrading the nation’s industrial make-up.

“China has made clear its intent to dismantle US railcar manufacturing in its ‘Made in China 2025’ plan – our economic and national security demands that we address Chinese attempts to dominate industries that build our nation’s critical infrastructure. That’s why I’m joining my colleagues on both sides of the aisle to introduce legislation to hold China accountable because we need to do all we can to support American workers and American-made products,” Baldwin said.

Should any American transit agency breach the terms of the act – should it pass into law – they would lose federal funding for that year.

“Issuance of any new contract to buy rail rolling stock from a manufacturer owned by a Chinese company during a fiscal year – even if done solely with the agency’s non-federal dollars – would cause the transit agency to lose all of its federal state-of-good-repair mass transit dollars for that year,” said Jeff Davis, senior fellow at the Eno Centre for Transportation, a Washington think tank.

CRRC has already felt some effects of the trade war, since certain components that are imported to their US manufacturing bases from China have already been hit by tariffs.

China has made clear its intent to dismantle US railcar manufacturing in its ‘Made in China 2025’ plan – our economic and national security demands that we address Chinese attempts to dominate industries that build our nation’s critical infrastructure.

In an interview with the state-run China Daily last year, CRRC Massachusetts vice-president Jia Bo said: “The steel products that will be used in CRRC [Massachusetts] production partly come from the US and partly come from China.”

He added: “As rail equipment has been included into Section 301, we are concerned about whether it will affect the rail equipment, and thus affect a whole market change later.”

China exports very few buses or finished vehicles in general to the US. In 2017, Tang Yuxiang, the chairman of the world’s biggest bus company, Zhengzhou Yutong Bus Company, said his company would not push for sales in the US due to trade tensions.

“We won’t do business in North America. China and the US don’t have a very good relationship. We would like to go to the markets that are friendly to China,” he told Bloomberg.

While the passage for a bill to become law in the US is often a lengthy and cumbersome procedure, Davis, writing about the bill in a blog post, said that the high-profile support for the Transit Infrastructure Vehicle Security Act might help it proceed more quickly.

“The fact that the legislation has the backing of chairman Mike Crapo and ranking member Sherrod Brown means that its approval by the banking panel during the next surface transportation reauthorisation bill is all but assured,” he wrote.