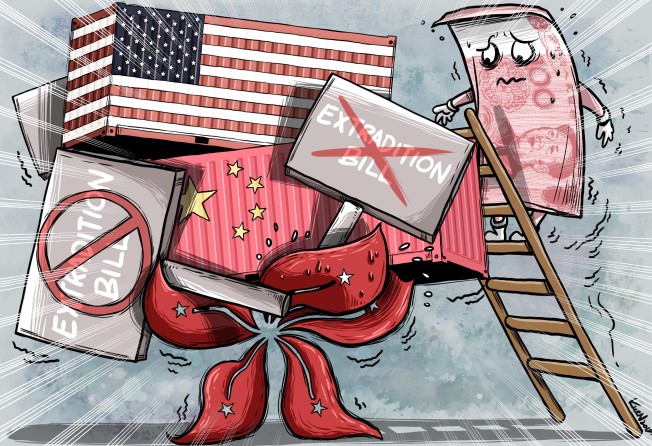

China’s yuan exchange rate drop could roil already strained Hong Kong-protest hit economy

- The yuan fell below the key level of 7 to the US dollar last week for the first time in 11 years, and could hit tourism and retail spending from mainland Chinese visitors

- Investment flows into Hong Kong may increase through Stock Connect if investors expect the yuan to fall further amid the US-China trade war and Hong Kong protests

Hong Kong’s economy, already straining under the weight of anti-government protests as well as the US-China trade war, is now set to feel the pressure of a weaker Chinese yuan.

Retailers, restaurants, hotels and real property agents will be the first to feel the impact after the Chinese currency fell below the key level of 7 to the US dollar last week for the first time in 11 years. It is set to depreciate further, and with the Hong Kong dollar pegged to the US dollar, it makes visiting the city more expensive for visitors from mainland China.

The move by the People’s Bank of China (PBOC) invited speculation that China would continue to let the yuan depreciate to cushion the impact from the escalating trade war with the United States, but at a measured pace to avoid massive capital flight.

The impact could also spread to Hong Kong’s financial markets as expectations of a cheaper yuan, a sign of the gradual weakening of China’s economy, has in the past encouraged international speculators to place large bets against the yuan in Hong Kong. China’s closed capital account provides a firewall against such attacks, but Hong Kong, as a free financial centre, offers an ideal playground for speculators.

Mei Xinyu, a researcher affiliated with China’s Ministry of Commerce, wrote on Monday that Hong Kong could be the key battlefield in a “financial war” between China and the US, with Hong Kong-traded stocks of Chinese companies particularly vulnerable to attack.

Hong Kong has already proven its resilience in the last two rounds of yuan depreciation. In 1998, amid heavy international betting on yuan depreciation, the city faced down investors like George Soros with an unprecedented HK$118 billion (US$15 billion) stock-buying spree to prop up equity prices and defend the currency peg.

And in the last yuan depreciation cycle in 2015 and 2016, Hong Kong fared well thanks to a large exodus of funds from the mainland into its stocks and real estate markets.

The Hong Kong dollar has been pegged at 7.8 to the US dollar since 1983, and since 2005, the Hong Kong Monetary Authority forced to step in to buy the local currency to prop it up once it reaches 7.85, or to do the opposite if the city’s currency strengthens to 7.75.

This may not be a good sign for Hong Kong because it may deter tourists, hit spending, and also add downward pressure to already weak exports

The prospect of weaker consumption and a drop in tourism is a concern for the city’s top economic official, with Financial Secretary Paul Chan Mo-po warning earlier this month that the economy was at risk of falling into recession, defined as two consecutive quarters of negative growth.

Hong Kong’s economy grew 0.6 per cent in the second quarter of 2019 compared to a year earlier, but it fell 0.3 per cent on a quarterly basis, well below the 1.3 per cent gain in the first quarter.

As a major free port city handling a large re-export and reimport business, the city has been hit hard by the US-China trade war, with exports falling 5.4 per cent and imports dropping 7 per cent in the second quarter.

Chan said last week that even though the weaker yuan could help Chinese exports, and so benefit Hong Kong, it would also discourage spending by mainland tourists.

“There is a wave of rate cuts across the globe, which makes the US dollar relatively attractive compared to other currencies. I think in this case, the US dollar will remain resilient, which makes the Hong Kong dollar relatively stronger. This may not be a good sign for Hong Kong because it may deter tourists, hit spending, and also add downward pressure to already weak exports,” said OCBC Wing Hang Bank economist Carie Li.

In the first half of the year, the number of tour groups from mainland China visiting Hong Kong rose 34 per cent from the same period last year, but the growth slowed to 1.6 per cent in July, according to the Travel Industry Council of Hong Kong.

And in the first seven days of August, the number of tour groups from mainland China dropped 40 per cent compared to the same period a year earlier, with the drastic drop attributed mainly to the recent protests across the city, the council added.

A Hong Kong Tourism Board spokesman said the number of bookings in August and September had also dropped significantly, indicating further weakness in the sector.

“Tourism performance, including visitors’ spending, is affected by a host of factors and the currency exchange rate is one of the keys. Since the Hong Kong dollar is pegged to the US dollar, the devaluation of the yuan against US dollar may affect mainland visitors’ spending in Hong Kong as well as their desire to visit Hong Kong,” the spokesman said.

In Times Square, one of main shopping centres in the city, G-Shock Casio store employee Kevin Lam said he had seen less impact from the yuan’s devaluation and more related to the protests. It was echoed by freelance promoters, some of whom said sales had dropped by 50 per cent.

Since the Hong Kong dollar is pegged to the US dollar, the devaluation of the yuan against US dollar may affect mainland visitors’ spending in Hong Kong as well as their desire to visit Hong Kong

But despite the negative effects on the Hong Kong economy, a weaker yuan could prove to be a benefit for Hong Kong’s financial sector.

“If the US makes it difficult for Chinese firms to raise capital in the US, more Chinese firms may come to apply for listings in Hong Kong, to have their [initial public offerings] there. That would have a positive impact on Hong Kong,” said Rory Green, China economist from TS Lombard, an independent investment advisory firm.

Many economists expect the PBOC to allow the yuan to depreciate to 7.2 against the US dollar later this year to offset the impact of the new 10 per cent tariff that the US plans to impose on US$300 billion worth of Chines goods starting from September. If that tariff is later increased to 25 per cent, meaning all Chinese goods exported to the US would be subject to the higher tariff rate, the yuan could weaken further to 7.5 against the US dollar, they added.

“In the financial market, it is really a question of whether Chinese investors think there will be [downward] pressure on [the yuan] and so they will want to allocate part of their assets towards Hong Kong,” said Gary Ng, an economist from French bank Natixis.

Mainland Chinese investors using Stock Connect – a cross-border investment channel that allows Chinese citizens to trade Hong Kong-listed stocks and foreigners to trade mainland-listed stocks – showed that net inflows from mainland China into the Hong Kong stock market reached HK$10 billion (US$1.3 billion) in the first week of August in contrast to HK$16 billion for entire month of June.

However, economists remained cautious about the extent to which China would allow capital outflows into Hong Kong, given the massive capital flight that occurred after the yuan’s devaluation in 2015.

In August 2015, the PBOC reformed its daily exchange-rate guidance mechanism to increase the influence of market factors into the calculation of the yuan daily trading range, unleashing a flood of capital outflows.

“Looking ahead, further [yuan] weakness is possible and perhaps probable. But that movement is likely to be driven by market forces, as investors rightly worry that both US tariffs and weakening global demand will pressure Chinese exports,” said Gabriel Wildau, an analyst from consultancy firm Teneo.

Since 2015, China has drastically tightened restrictions on capital outflows, and there is no sign that these restriction have been loosened.

As one of main pillars of Hong Kong’s economy, the property market has also been hit recently by the protests and the trade war. A weaker yuan may deter mainland Chinese investors from purchasing homes in Hong Kong, although that will not have a significant impact on the market considering the proportion of non-local buyers has declined significantly in recent years.

According to Qfang Network Agency, the share of non-local property buyers – most of whom are from mainland China – dropped to 2.7 per cent in the first half of this year, compared to 93 per cent first-time buyers from Hong Kong.

Wong Leung-sing, senior associate director of research at Centaline Property Agency, said when the yuan weakens, the demand for Hong Kong property from China drops.

But, Wong added, that the actual impact from the currency change is limited because the demand for small-to-medium sized houses is dominated by local buyers, while buyers of luxury properties have very high incomes and so are less sensitive to fluctuations.

A weaker yuan exchange rate may also impede China’s efforts to make the yuan a viable international transaction currency, analysts said.

In the near term, uncertainties from the US-China trade war could hit the offshore yuan business. People may become more conservative about using the yuan

Xia Le, chief economist for Asia at Spanish bank BBVA, warned that the unpredictable trade negotiations between the US and China concerning the yuan could further reduce yuan deposits in Hong Kong, and so reduce its use in international trade transactions.

Hong Kong is by far the yuan’s largest clearing centre outside China. In June, yuan deposits in Hong Kong fell 3.2 per cent, the largest monthly decline since 2017, to 604.2 billion yuan (US$85.5 billion) from May, while trade settlements in the yuan dropped 7.8 per cent to 440.6 billion yuan, according to the Hong Kong Monetary Authority.

“In the near term, uncertainties from the US-China trade war could hit the offshore yuan business. People may become more conservative about using the yuan,” Xia said.

Additional reporting by Lam Ka-sing and Laura Zhou