03:05

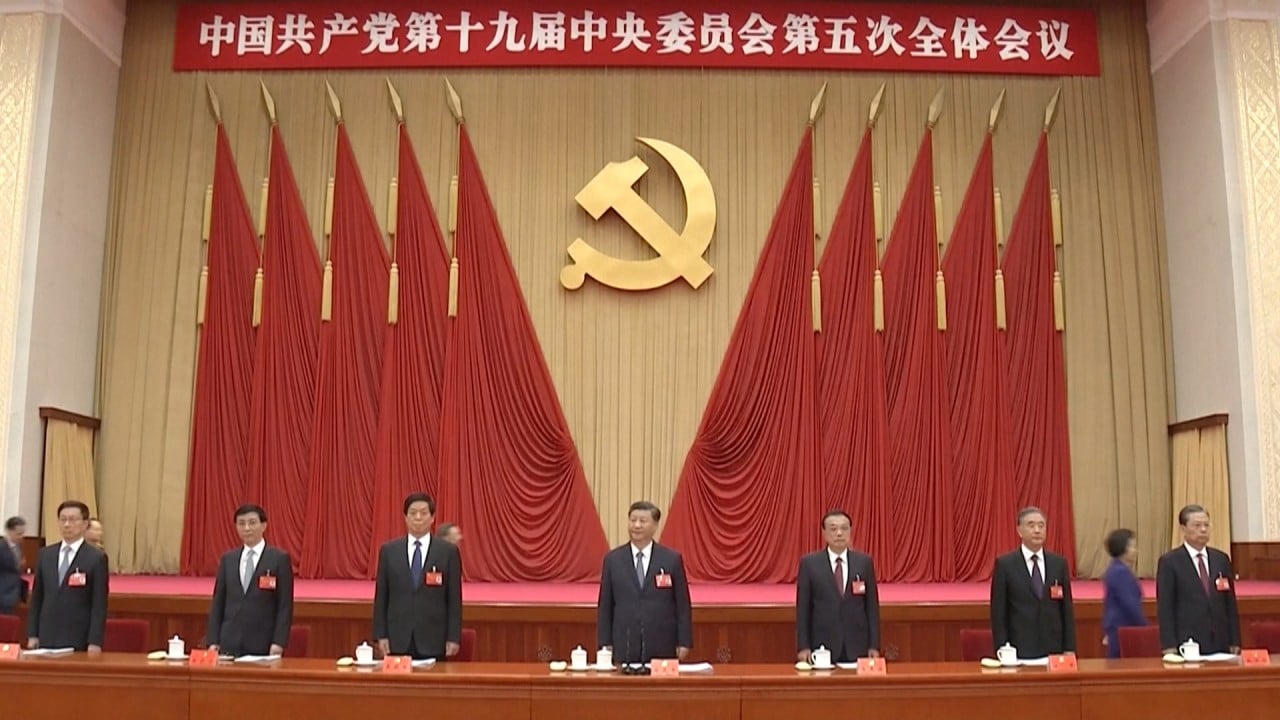

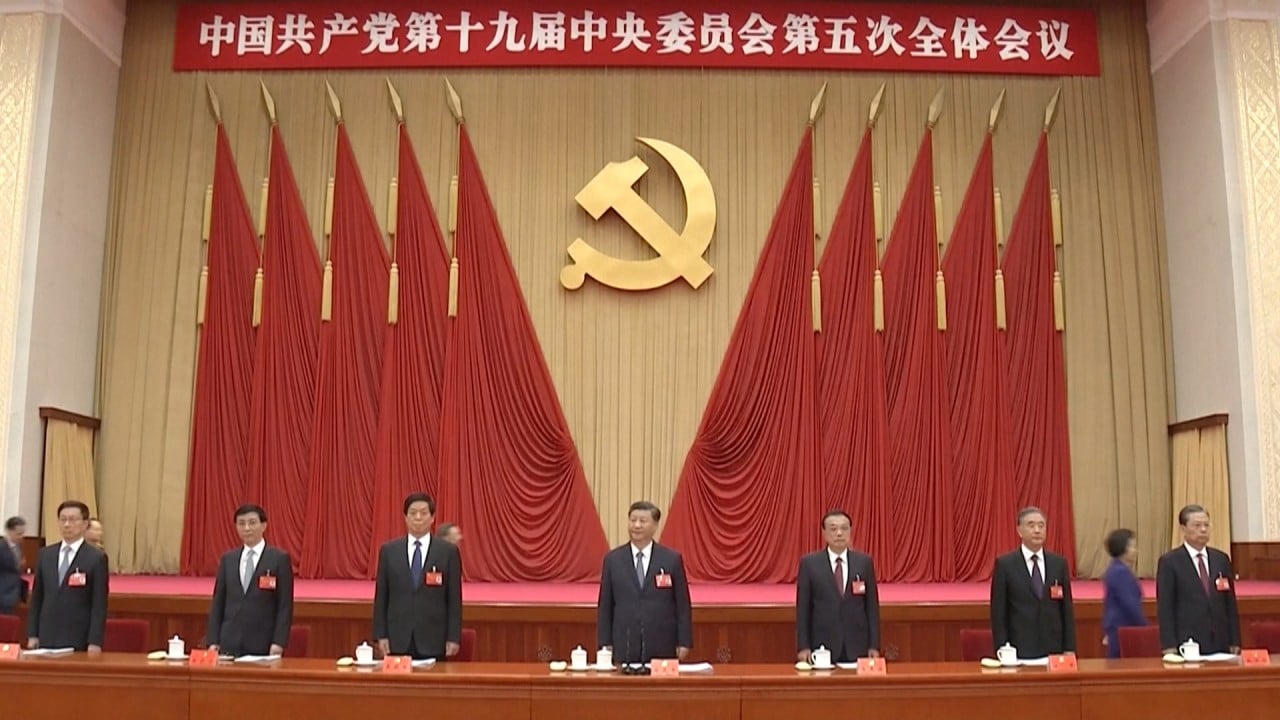

What happened at the Chinese Communist Party’s major policy meeting, the fifth plenum?

China has tweaked one word in its policy to internationalise the yuan, a change that analysts see as a sign of Beijing’s new-found caution in promoting the international use of the currency.

In a communique outlining the country’s next five-year plan for 2021-25, China’s Central Committee said it would “steadily and prudently” promote the internationalisation of the yuan, a change from the previous wording that only included “steadily”.

The slight adjustment, from Wenbu to Wenshen in Chinese, showcased Beijing’s growing concern about risks stemming from cross-border capital flows, even though China remains committed to boosting use of the yuan in international trade and investment, analysts said.

Zhang Yuyan, a researcher at the Chinese Academy of Social Sciences, said at a press conference this week China was trying to be “prudent” about the yuan’s global push because it related to exchange rate liberalisation, capital market opening and “financial security”.

03:05

What happened at the Chinese Communist Party’s major policy meeting, the fifth plenum?

“But China still has to go ahead. If you think China will be conservative or even stop the process of yuan internationalisation, you are wrong,” he said.

Steady development of the yuan was first introduced in 2016 when China began planning to open up its capital account and make the yuan fully convertible into other currencies.

According to a just-published book from the government explaining the next five-year plan, the currency’s development “must be based on the free use of the yuan, driven by the market and left up to the choice of enterprises”.

In the book, the government said there were still obstacles to convertibility and cross-border payments of the currency. “We must consolidate the foundation for its internationalisation to let more market entities accept it,” it said.

Beijing’s efforts to internationalise the yuan kicked off with a new cross-border settlement mechanism after the 2008-09 global financial crisis. Though its use in transactions has progressed, it is not yet a major challenge to the US dollar.

The proportion of global currency reserves held in the yuan rose to 2.02 per cent at the end of March, compared to 62 per cent for the US dollar and 20 per cent for the euro.

The yuan internationalisation index, released by the Renmin University of China in July, rose 13 per cent last year to 3.03 and is forecast to have risen to 5 in the first half of this year. But the Chinese currency remains well behind the US dollar at 50.85 and the euro at 26.28.

Beijing’s new and more pragmatic approach to yuan internationalisation is in line with its prioritisation of security across the economy and in finance, technology and food supply for the next five years.

To counter foreign uncertainty – particularly hostility from the US – the world’s second largest economy will rely on its “dual circulation” strategy, which will focus on the domestic market and home-grown technological innovation for growth.

Promoting international use of the yuan is complex and involved creating offshore settlement mechanisms and opening up the capital market, said Zhang. But he denied the internationalisation plan had been abandoned.

Guan Tao, a former director of the international payments department at the State Administration of Foreign Exchange, said the yuan’s position internationally was lower than expected and the market should not expect it to challenge the US dollar in the near term.

“The yuan is just a new international currency, gradually moving toward subcentral currencies like the euro or British pound from being a peripheral currency,” he wrote in a recent article.

Guan, who is now chief economist of investment bank BOC International, said overseas investors were increasingly holding yuan-denominated financial assets. Foreign investors snapped up a net 900 billion yuan (US$137.2 billion) in Chinese bonds in the first nine months of the year, government data showed.

“The two issues – yuan internationalisation and capital account convertibility – have been integrated into one, which will be driven by the onshore market rather than the offshore,” he said.

05:02

Coronavirus backlash further fraying China’s ties to global economy

The Chinese government has not set any targets for yuan convertibility or overseas use.

Beijing has proposed developing the currency by using it first in trade, overseas investment in countries taking part in the Belt and Road Initiative, and inbound investment in the domestic capital market.

At the same time, development of infrastructure such as yuan cross-border settlement mechanisms could be put higher on the agenda, the government said in its five-year plan book.

Raymond Yeung, chief Greater China economist at ANZ Bank, said the government appeared to see risk in offshore yuan markets like London and Singapore, so would not expend huge effort to boost their size like it had done in previous years.

“For the sake of control, it will encourage inward yuan-denominated investments,” he said.