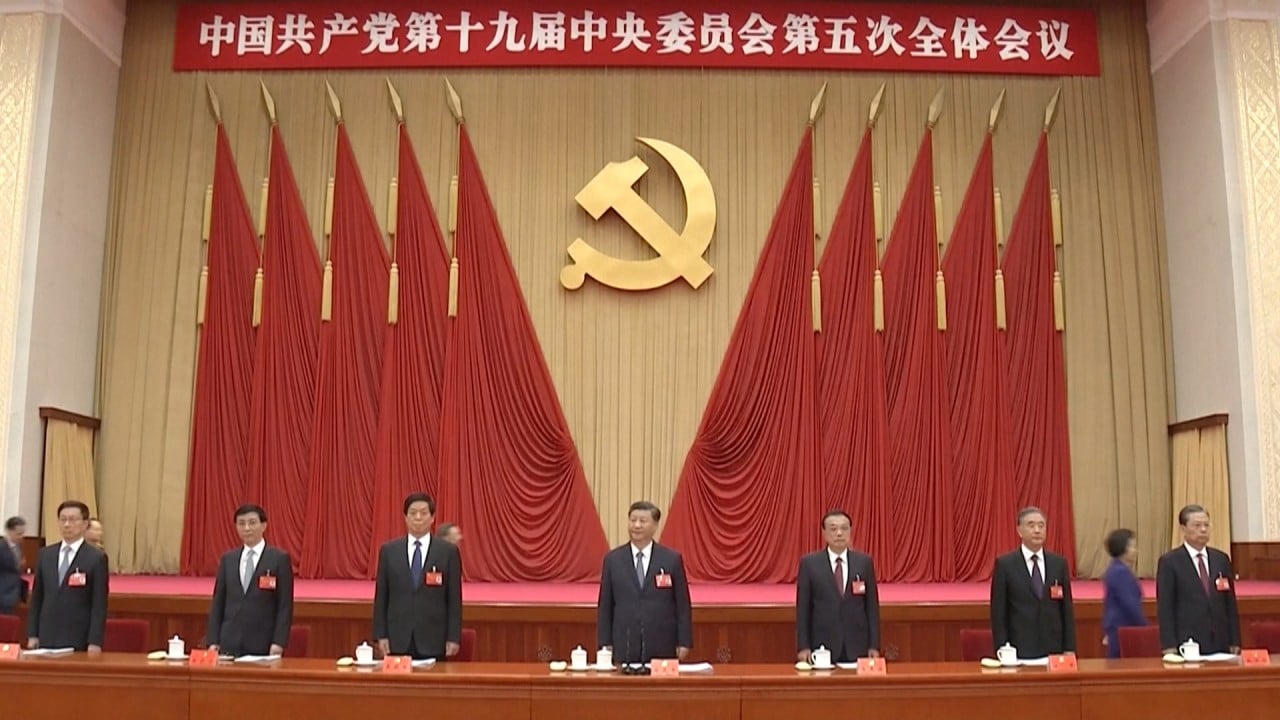

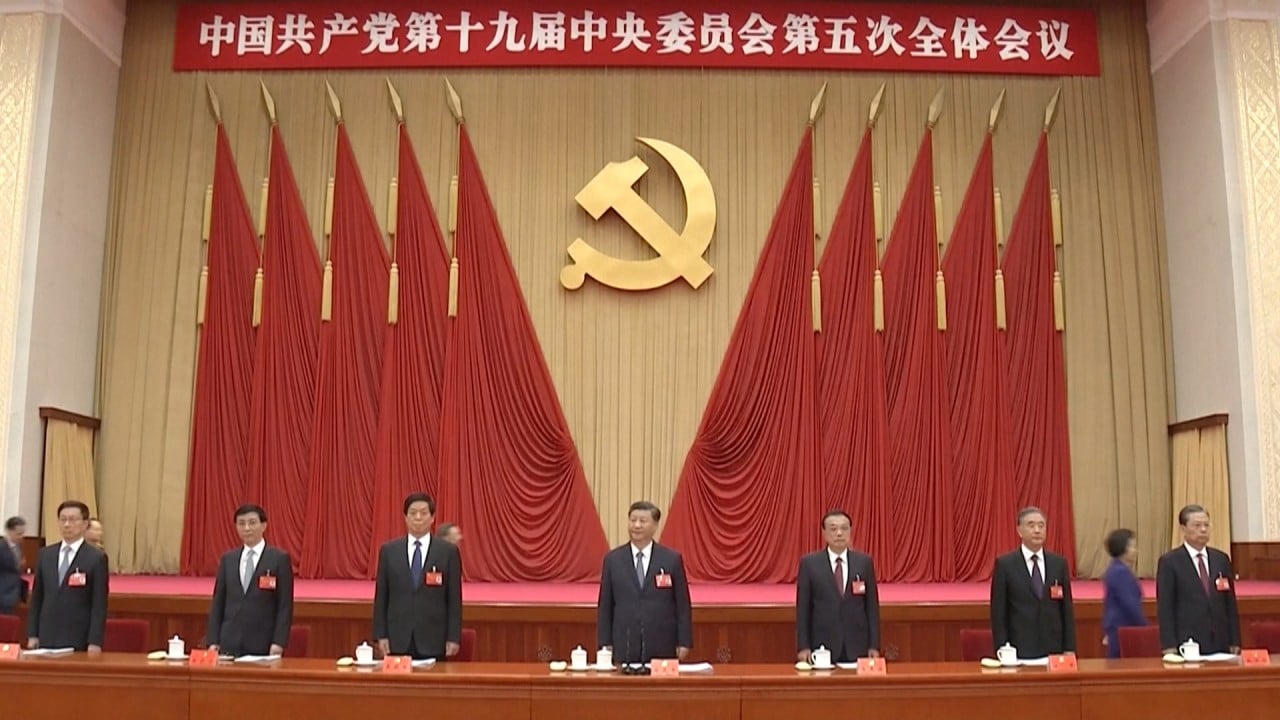

03:05

What happened at the Chinese Communist Party’s major policy meeting, the fifth plenum?

A series of bond defaults by state-owned firms has highlighted the “grey rhino” risks threatening China’s economic prospects, raising alarm bells about high national debt that has grown to more than three times gross domestic product (GDP).

Yongcheng Coal & Electricity Holding Group, a mine operator owned by the Henan provincial government, defaulted on payment for a AAA rated 1 billion yuan (US$152.2 billion) commercial paper earlier this month, rocking investor confidence and stirring concern about domestic rating agencies.

Though the default was small relative to China’s total US$13 trillion bond market, it underscored China’s debt problem, which is considered a grey rhino risk that could take a significant toll on the economy if unaddressed.

China’s bond market has also recently seen defaults by an integrated circuit maker and a car manufacturer.

03:05

What happened at the Chinese Communist Party’s major policy meeting, the fifth plenum?

The central government has tried to reduce the country’s overall debt level since 2016, but it was allowed to grow faster this year to rescue its coronavirus-hit economy. Beijing expanded its fiscal budget deficit and lifted the debt limit for local governments to boost spending on infrastructure to steady the economy.

The Institute of International Finance estimated last week that China’s total domestic debt, including financial loans, hit 335 per cent of GDP in the third quarter of 2020k.

In November, China’s National Institution for Finance and Development, a government-linked think tank, put the nation’s overall debt at 270.1 per cent in the third quarter, from 245.4 per cent of GDP at the end of 2019.

Yongcheng Coal has until Tuesday to make its bond payments and failure to do so may lead to a cross default by its parent company, Henan Energy and Chemical Industry Group, one of the largest state-owned firms in Henan. Chinese broker CICC said in a report last week that 25.6 billion yuan of bonds might be at risk in the case of a cross default.

While time is ticking for Yongcheng Coal, there are broader concerns over whether local governments, many of which are under increasing financial stress, will be able to bail out the state firms they own, particularly those in the coal industry that has been ordered by Beijing to reduce overcapacity, cut debt and lift efficiency.

State-linked firms have long been considered immune from credit default events because of government backing. Yongcheng Coal’s default risk has triggered a sell-off in bonds and issuance of some new bonds to be scrapped, including among other state firms in the coal sector.

Wang Yixin, deputy governor of coal-heavy Shanxi province, has sought to reassure the public “there’s absolutely no problem” with near-term bond repayments, according to a statement published to the Shanxi government website.

“The idea of non-payment of debts has never appeared in our minds, and the heads of provincial state-owned enterprises are never allowed to have such ideas,” Wang told a group of financial institutions last week.

Local authorities took immediate measures to prevent further risk after the Yongcheng Coal bond default, Wang said.

01:00

16 miners killed, one rescued after fire in coal mine in Chongqing, China

A number of state-owned companies in Shanxi, including energy producer Jinneng Group and Shanxi Coal Import & Export Group, have had to cancel new bond sales, citing market volatility triggered by Yongcheng Coal.

Former minister of finance Lou Jiwei said China must cut its debt with a timely exit from its accommodative coronavirus stimulus policies, warning economic recovery might be accompanied by a brewing debt crisis.

“Once the economy recovers, too much liquidity needs to be returned,” Lou said at a summit in Beijing last week. “There is also the risk of debt collapse. We should resolutely reduce leverage, especially within financial institutions.”

Yongcheng Coal received a AAA investment grade credit rating by Chinese agencies because of its backing by a large state firm.

But according to a report by Fitch Ratings last week, weaker state firms in sectors with overcapacity or commercialised sectors such as the coal and chemicals sector Yongcheng operates in face higher default risk due to a lower probability of receiving state support.

01:47

China GDP: economy grew by 4.9 per cent in third quarter of 2020

China’s market regulator, the National Association of Financial Market Institutional Investors, said on Friday it was expanding its investigation into bond sales, probing Industrial Bank, China Everbright Bank, Zhongyuan Bank, China Chengxin International Credit Rating and Xigema Certified Public Accountants. Haitong Securities was also put under investigation last week.

Larry Hu, chief Greater China economist with investment bank Macquarie, said in a research note last Friday the People’s Bank of China was not likely to intervene as it does not view the default of Yongcheng Coal as a systemic risk and expects more stress in the credit market next year.

“For 2020, thanks to the ultra-loose monetary policy early this year, its share of bond defaults only happened toward the year-end. Indeed, it’s the exit of such a policy which triggered the recent defaults,” Hu said. “In our view, the PBOC will ignore them and stick to its current priority, which is to exit its ultra-loose monetary policy.”

Additional reporting by Orange Wang

(In the 17th paragraph of this story, we incorrectly attributed a statement to Fitch Ratings regarding Yongcheng Coal.)