06:23

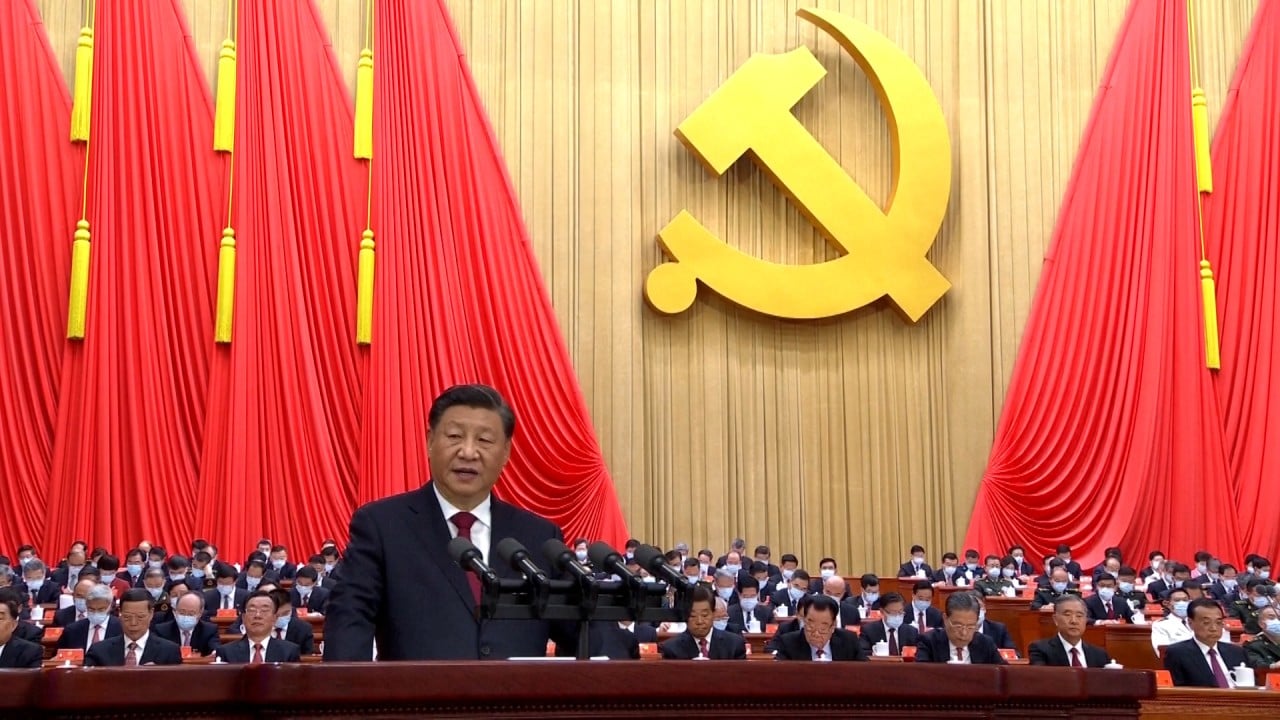

Xi Jinping charts China’s future course at 20th party congress

In the face of high healthcare costs and dwindling tax revenue under China’s zero-Covid policy, the central government is instructing local-level authorities to tap into their idle state-owned assets – if possible – to ease their financial distress.

Local administrative departments and public institutions should carry out comprehensive reviews of all idle assets – including houses, land, vehicles, office equipment, furniture and technical instruments – and formulate asset-revitalisation plans accordingly, according to a fresh set of guidelines released by the Ministry of Finance on Tuesday.

The ministry said that such revitalisations of idle assets may include putting them to better use to minimise unnecessary expenses; sharing them with the general public, especially when it comes to scientific research equipment and infrastructure; and relocating assets within or across departments or regions.

Local governments are also being encouraged to set up warehouses for unused or underutilised public assets for better management and allocation.

For the assets that cannot still be used in the public sector, they may be rented out or sold with the proper approval, the ministry said.

While cashing in on state-owned assets has long been on the minds of local government authorities, this type of official encouragement from Beijing underscores just how urgent it is to improve local fiscal conditions, according to analysts.

But the result of the new directive may be limited, especially as financial distress has been weighing heavy on local governments since the pandemic began, according to Ding Shuang, chief Greater China economist with Standard Chartered Bank.

“Lots of local governments have been doing this for a long time, and if there are still idle assets yet to be dealt with, it may mean that these assets are essentially useless – or really hard to be put into use,” Ding said.

Meanwhile, the asset-revitalisation process may be quite complicated, especially when it comes to generating revenue via renting and selling, Ding added.

“Before renting a place out, it may need an additional cash injection, such as for renovations. And when it comes to selling assets, the approval process may not be short, and the people in charge would be at risk of blame for the loss of state-owned assets. So, [those local authorities] may not be incentivised enough to carry it out,” Ding explained.

Generating fiscal income from renting and selling state-owned assets is also not sustainable, according to Luo Zhiheng, chief economist at Yuekai Securities.

In a September report, Luo pointed to some of the notable approaches local governments had already adopted: auctioning off real estate, such as resettlement housing projects; selling mining rights; and granting management rights for tourist attractions and car parks.

For example, the fiscal income from the paid use of state-owned assets in Fujian province increased by 63 per cent in the first seven months of the year, thanks to the unloading of assets such as resettlement housing – temporary homes for people who needed to be relocated for construction projects and old-town renovations.

Official data showed that, in the first eight months of this year, local governments’ revenue generated from the paid use of state-owned assets increased by 33.2 per cent compared with the same period last year.

But this is not a means of obtaining regular or stable fiscal revenue, Luo warned.

“Excessive profit-seeking by some local governments may also exacerbate resource scarcity, create bubbles, and lead to an idling of funds, which is not conducive to helping capital enter the real economy,” he said.

Local governments across China have been facing mounting fiscal challenges since this past spring, due to a sharp contraction in land sales, rounds of large-scale tax rebates and deferrals, and excessive spending on Covid-19 tests and lockdowns.

In the year’s first three quarters, the general public budget revenue of local governments saw a year-on-year decline of 4.9 per cent to 8.32 trillion yuan (US$1.14 trillion), while their expenses increased 6.1 per cent to 16.54 trillion yuan.

Apart from disposing of state-owned assets, some local authorities have resorted to slashing public services and delaying salary payments to public servants.