Strategising to stake a niche in the storage business

New businesses are born and developed every day in Hong Kong, which has been hailed as one of the most exciting places for startups businesses. Several valet storage companies have mushroomed in the past few months in the race to provide the best service to the millions of people struggling with small, crowded living spaces.

Most of these start-up companies boast tailor-made, flexible storage price-points and arrangements made possible by the proliferation of technologies.

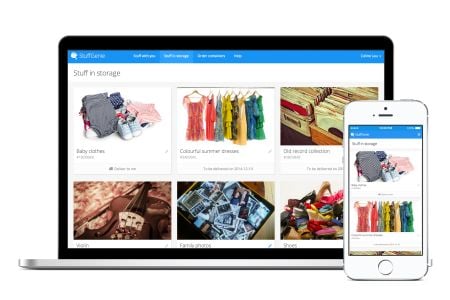

They offer more control for users during the whole process. Storage boxes are delivered and collected at the door. The users can keep track of their inventory any time as they photo the contents of the box and upload the images to their online accounts.

The users can also store however small or large a quantity at different time intervals ranging from weeks to months, at an entry fee that is little more than the price of a Starbucks coffee. They can even recall the boxes whenever they want with just a flick of their finger on their smartphones or tablet devices.

Norman Cheung, co-founder and CEO of Boxful, says there is a void in the self-storage market because people are put off by traditional warehouse services, which usually require users to make the trip back and forth to the warehouse, and offer a limited choice in storage space and lease duration.

Cheung and co-founder Carl Wu were quick to act on their idea. It took them only about 10 weeks to build the business from scratch and secure US$1.5 million in venture funding that allowed them to invest in the technology, enter into long-term leases with warehouses, hire their own fleet of vans, and roll out various marketing campaigns including print advertisements and social media advertising.

Cheung is ambitious about creating a lifestyle change in the market by educating the public about the creative solutions to the ubiquitous problem of the shortage of storage.

“On average, an individual in Hong Kong only has 0.5 square feet of self-storage space,” he says. “On the other hand, new flats on the market tend to get smaller and smaller.

“We want to tell people that there is an easy, affordable solution, and they will have a better lifestyle because of it,” Cheung adds.

Miles Davison, co-founder of another valet self-storage company, StuffGenie, has a similar vision. Previously a general manager overseeing the logistics of a lifestyle company in Shenzhen, he started the company with his brother, Charlie, a web developer.

However, the two took a different approach to starting their business: instead of raising funds through other investors, it was privately funded. After laying down the business framework and systems, the Davisons quietly rolled out the service by first testing it with family and friends, before launching it in the wider market.

Integrating the founders’ professional experience in logistics, warehouse management and web development, the company also boasts its own technology system capable of keeping track of the location and condition of the goods in storage. In order to maintain a high level of professionalism, the Davisons also train their staff and partners, including the van drivers, in how to use their box scanners and warehouse management system.

“We are aware that there is a lot of competition in the market. And that is why we believe in the importance of word-of-mouth,” says Miles Davison. “The high quality of customer service is going to be the key differentiator for StuffGenie in the market.”

Kevin She, founder and CEO of SC Storage, Hong Kong’s first personal storage company, shares a few tips on how start-ups can stay in the game. Founded in 2001, the company now boasts 50 branches in 20 districts, making it the largest player in the market.

She urges start-up businesses to think about ownership and their appetite for risk. Being a risk-taker himself, She ran a highly leveraged model by funding a rapid expansion in the market through bank loans. However, he did not consider raising funds by selling the equities of his company to other investors.

“Selling equities is the most expensive form of fundraising,” he says. “You may have an investor who helps you out by buying 10, 20 or 30 per cent of your shares, but what happens when your business becomes successful and generates millions of dollars of revenue? The shares you have sold will be worth so much more then, and it may not be easy for you to buy them back.”

While the speed in setting up a business is important for enjoying the “first-mover advantage”, She also warns never to skimp on the time invested in drafting legal documents and seeking counsel when it comes to business agreements. Sad as it seems, he has witnessed entrepreneurs being cheated out of business because they had misplaced trust in their partners when signing a piece of paper.

Asked if there is one thing he would have done differently with his business, She says he would have been more low-profile at the start.

“When you have a good idea, keep it as quiet as you can until you are ready to roll out your business, and then grow as rapidly as you can,” he says. “It is not only about doing the right thing, but also doing it at the right time.”