Chinese tycoon Huang Xiangmo ‘distanced himself from business empire’ to dodge Australia tax bill

- Tax office accuses Huang of restructuring affairs to distance himself from his Australian business empire and ‘grossly understating’ his income

- Notices sent to major casinos in bid to claw back money held on tycoon’s behalf

The Australian Taxation Office has accused controversial Chinese businessman Huang Xiangmo of intentionally setting up complicated business structures in Australia to frustrate efforts to recover money from him.

In documents filed with the federal court, the ATO, which has hit Huang with a A$140 million (US$104 million) tax bill, said it had concerns that Huang “intentionally structured his asset holdings in such a fashion so as to delay or hinder recovery by creditors”.

“For example, the commissioner [of taxation] is concerned that the trusts and corporate entities associated with Mr Huang mask the true level of control Mr Huang is able to exert over those trusts and corporate entities,” the senior ATO officer Yi Deng said in an affidavit filed with the court.

The affidavit and an outline of the ATO’s arguments, released by the court on Tuesday evening, also reveal the ATO’s concerns that Huang had restructured his affairs to distance himself from his Australian business empire and had “grossly understated” his income.

They reveal that Huang’s wife, Huang Jiefang, and their son, Jimmy Huang, have both recently left Australia.

And they also show the ATO became aware of two offshore bank accounts held in Huang Xiangmo’s name only through casino records and issued notices to the Star casino group in a bid to claw back any money it holds on his behalf.

The ATO has issued notices to casinos around Australia seeking money it says Huang owes the tax office.

The tax office has issued garnishee notices relating to Huang’s tax bill to Star casino in Sydney, Crown in Melbourne, and the company behind Treasury Casino in Brisbane and The Star on the Gold Coast.

The documents were filed by the ATO in support of a freezing order over Huang Xiangmo’s assets and the couple’s Mosman mansion, which was granted by the federal court judge Anna Katzmann last week.

“The ATO formed the opinion during the audit into Mr Huang’s taxation affairs … that Mr Huang had ‘grossly understated’ his income and made false or misleading statements to the Commissioner in respect of the income tax returns with ‘recklessness’,” the ATO said in its submissions to the court.

It argued Huang has both “the means and the motives” to liquidate his Australian assets and move the money out of the country to avoid his tax bill. Since being audited he has moved increasingly large sums out of the country, the ATO said.

The tax office argued Huang cannot currently return to Australia and has taken steps to sever his connection with the country. He has moved more than A$46 million (US$31 million) out of the country since his visa was cancelled in December 2018, and resigned from 17 of the 18 Australian directorships he held.

The final remaining company – Federation of Australian Guangdong Community Limited – appears no longer to be trading.

“Mr Huang has significant business operations in China and Hong Kong and so has in place structures and operations that allow him to easily move assets between jurisdictions. As such, Mr Huang has the ‘means’ to frustrate the court’s processes,” the tax office argued.

“In addition to the requisite ‘motive’, Mr Huang also has more than ample ‘means’ to effect a dissipation of funds by moving assets offshore and beyond the reach of the commissioner or this court.”

In arguing for the freezing of Huang’s Australian assets, the tax office said any tax liability assessed against Huang would not likely be enforceable in either Hong Kong or mainland China.

But the tax office conceded it was likely that Huang’s Australian assets would be insufficient to cover the A$140 million (US$95 million) it is calculated he owes the tax office.

Huang’s legal team has indicated he will fight the freezing order and he is expected, too, to challenge the ATO’s tax assessment. At a preliminary hearing in the federal court in Sydney last Friday, Huang’s barrister, Gerald Ng, asked for the “ultimate fate of the freezing orders” to be heard “with some degree of expedition”.

The case is expected back before court early next month.

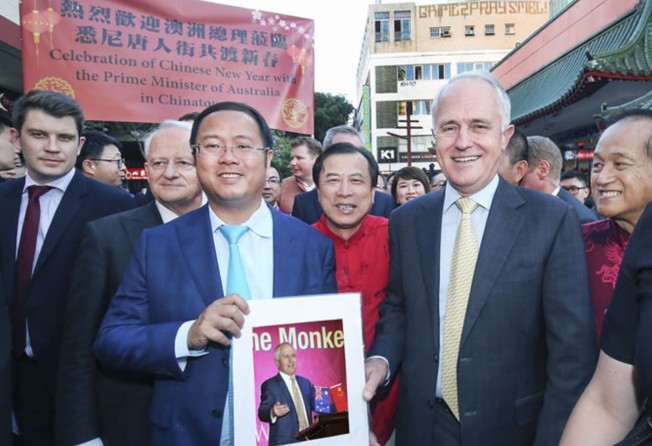

Huang, a Chinese billionaire property developer who arrived in Australia in 2011, assiduously cultivated influence with both sides of Australian politics during this time in the country, donating A$2.7 million (US$1.8 million) to both the Liberal and Labor parties and appearing in photographs with prime ministers and ministers.

Labor senator Sam Dastyari was forced to resign from parliament after revelations he had asked Huang for money to pay personal legal bills and warned Huang he was under surveillance.

Huang’s permanent residency visa was summarily cancelled last December by the Morrison government on character grounds and his application for Australian citizenship withdrawn.

The Australian Security Intelligence Organisation had warned political parties against accepting any more money from Huang.

Of particular concern was his long-running involvement with the Australian Council for the Promotion of the Peaceful Reunification of China, which has been accused of being a front for Chinese government efforts to expand its global influence.

Despite his exile from Australia, Huang has re-emerged as a key figure in the Independent Commission Against Corruption’s (ICAC) current investigation into Labor party donations this month.

ICAC has heard allegations that Huang gave the New South Wales branch of the ALP A$100,000 (US$68,000) – personally delivered in cash in an Aldi shopping bag – in breach of electoral regulations which prohibit property developers donating.

From Hong Kong, Huang has denied being the source of the money but has refused to give evidence to ICAC.