Bankers from Goldman Sachs 'cheated' Malaysia in 1MDB dealings, says Prime Minister Mahathir Mohamad

- The bank earned about US$600 million in fees for its work with 1MDB, which included three bond offerings in 2012 and 2013 that raised US$6.5 billion

- On Monday Malaysia’s Finance Minister said his country would seek a “full refund” of the fees, triggering the bank's shares to plummet

Bankers at Goldman Sachs “cheated” Malaysia in dealings with state fund 1MDB, said Prime Minister Mahathir Mohamad amid growing calls in the country for more aggressive steps to recoup fees earned by the bank.

The US investment bank has been under scrutiny for its role in helping raise funds through bond offerings for 1Malaysia Development Bhd (1MDB), which is the subject of corruption and money-laundering investigations in at least six countries.

The US Department of Justice has said about US$4.5 billion was misappropriated from 1MDB by its high-level officials and their associates from 2009 through 2014, including some money that Goldman Sachs helped raise.

US prosecutors filed criminal charges against two former Goldman Sachs bankers earlier this month.

Obviously we have been cheated

One of them, Tim Leissner, pleaded guilty to conspiracy to launder money and conspiracy to violate the Foreign Corrupt Practices Act.

“There is evidence that Goldman Sachs has done things that are wrong,” Mahathir said in an interview with US news channel CNBC that aired on Tuesday.

“Obviously we have been cheated through the compliance by Goldman Sachs people.”

The bank’s compliance controls “don’t work very well”, he added, without specifying details.

In additional remarks made on the sidelines of a speech he delivered in Singapore on Tuesday, Mahathir said the US Department of Justice had offered help recovering the funds.

“It takes a little bit of time but they (the DOJ) have promised that they will give back the money,” he said.

Goldman Sachs’ share price fell to its lowest in nearly two years on Monday after Malaysia’s Minister of Finance Lim Guan Eng said his country would seek a “full refund” of the fees the bank earned from 1MDB deals. Goldman denied any wrongdoing.

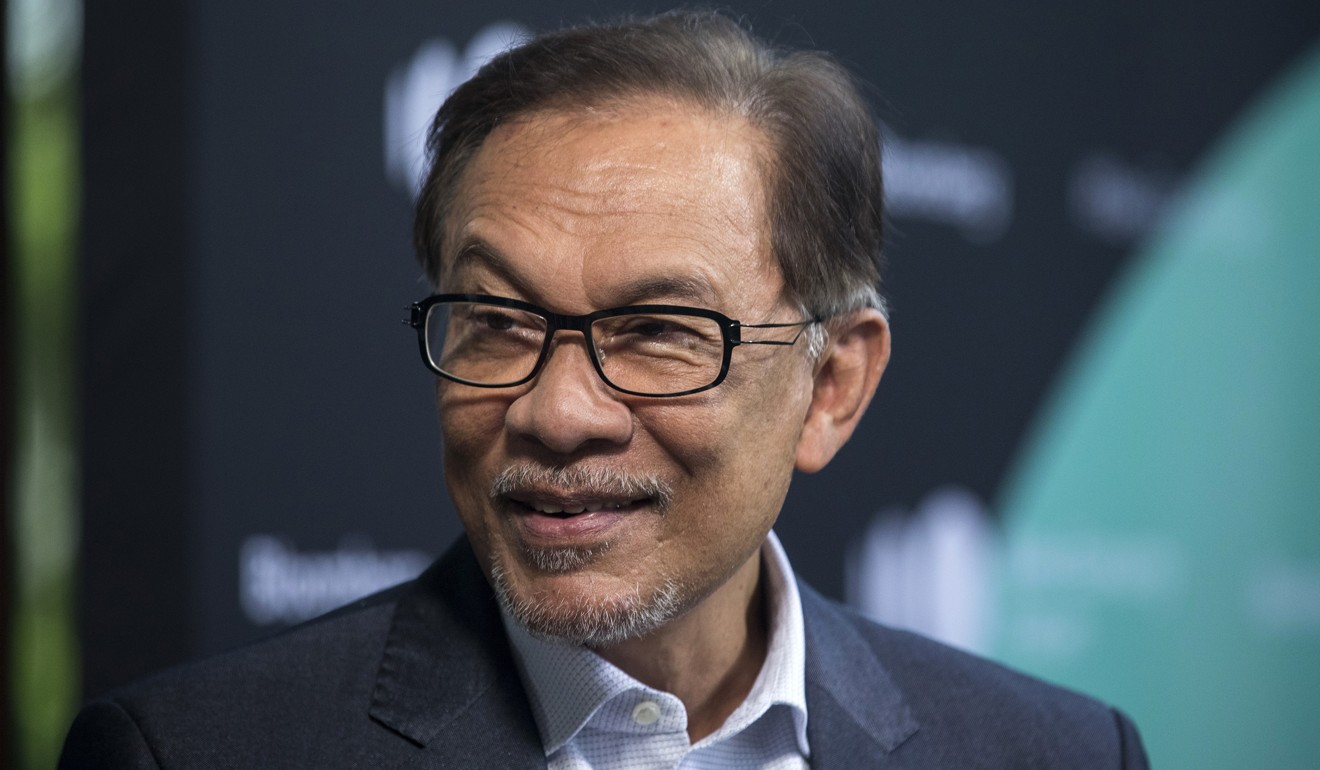

Anwar Ibrahim, the appointed successor to 93-year-old Mahathir, told parliament on Tuesday that the country needs to take “more aggressive measures” to reclaim the fees and losses “due to the effects on Malaysia’s image”.

The US bank earned about $600 million in fees for its work with 1MDB, which included three bond offerings in 2012 and 2013 that raised $6.5 billion.

Speaking to reporters on Tuesday, Lim repeated his stance that Malaysia wants to reclaim fees paid to Goldman Sachs, and added that the country will also seek consequential losses.

“The Malaysian government will want to reclaim all the fees paid, as well as all the losses including the interest rate differential,” he said, adding that the rate Malaysia paid was about 100 basis points higher than the market rate.

Critics have said the fees earned by Goldman Sachs were far in excess of the normal 1-2 per cent a bank could expect for helping sell bonds.

Goldman has said the outsize fees related to additional risks: it bought the unrated bonds while it sought investors and, in the case of the 2013 bond deal which raised US$2.7 billion, 1MDB wanted the funds quickly for planned investment.

Lim did not say how Malaysia would seek to recoup any money beyond that he will leave the matter to Malaysia’s attorney general.

Malaysia’s government, elected to power only in May, is scrambling to bring back funds that were allegedly siphoned off from 1MDB – a fund founded by former premier Najib Razak.

The 1MDB scandal was a major reason for Najib’s shock election loss. Najib has since been charged with corruption as part of Malaysia’s investigation into 1MDB. He has pleaded not guilty and denied any wrongdoing.

Malaysian financier Low Taek Jho, often called Jho Low, was charged by US prosecutors this month. Described by US and Malaysian authorities as central to the 1MDB scandal, he remains at large