Is China’s first tax cut in 7 years too little, too late to boost consumer spending?

China cuts individual income taxes for first time since 2011, but hopes for consumer spending boost questioned

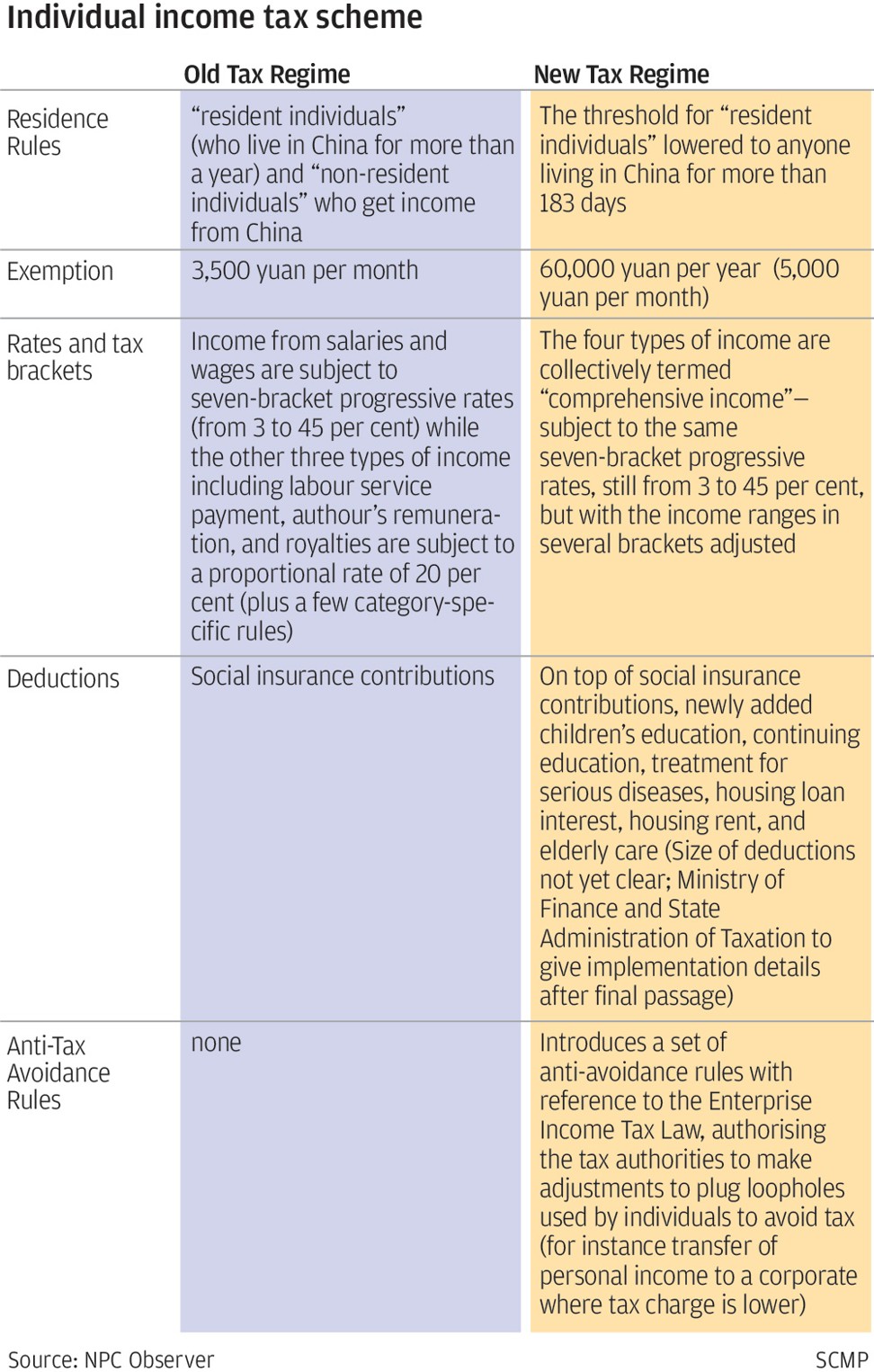

China’s taxpayers will be pocketing more of their pay from October after the country’s top legislature agreed on Wednesday to raise the income tax threshold to 5,000 yuan (US$730) per month.

Wage earners, who currently take home 3,500 yuan per month before tax, are waiting to learn how much tax deductions will be expanded from 2019, according to People’s Daily.

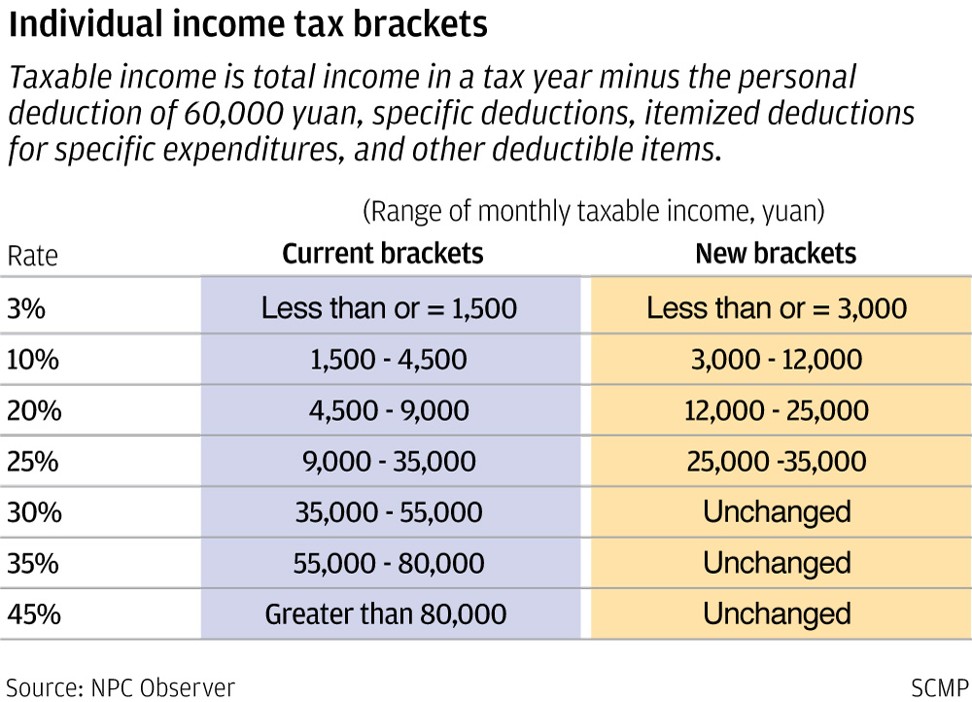

The higher threshold, and the proposed tax rates with the highest bracket at 45 per cent, were unchanged from a previous proposal, which economists argued was too modest to increase consumer spending power.

The implementation date of the tax cut was brought forward to October 1 from January 1.

“The revised bill is comparatively mature and [we] agreed to approve and implement it as quickly as possible to let people enjoy the tax cut,” the official newspaper reported on Thursday, citing several participating lawmakers.

The Standing Committee of the National People’s Congress, China’s legislature, is scheduled to give final approval to the proposal on Friday. It will be the first tax cut since 2011.

The tax cut is part of the government’s plan to stabilise the world’s second largest economy, which has started to slow due to the effects of Beijing efforts to reduce risks in the financial system and the effects of the trade war with the United States.

Chinese leaders are now looking for domestic growth drivers, including infrastructure spending and increased consumption, to underpin growth.

National retail sales have slowed this year, with the annual growth rate falling to 8.8 per cent in July, down from 9.0 per cent in June, according to the National Bureau of Statistics.

There was great disappointment among China’s online community after the amendment to the tax bill was announced, especially from residents of the biggest cities, who pay the vast majority of national income tax.

Despite repeated calls for a larger tax cut, the latest amendment failed to lift the symbolic tax-free threshold beyond the 5,000 yuan initially proposed. Chinese netizens submitted more than 100,000 comments to the legislature on the tax proposal.

There are concerns the tax burden for some could actually increase under the new bill. Beijing has made clear that it intends to crack down on tax avoidance, saying it will increase scrutiny of all income -- including salary, investment income, remuneration and other items -- in applying the new tax law.

Tax bureaus currently depend largely on employers to collect personal income tax. As they have few means and little motivation to check individual’s comprehensive incomes, it has relied on salary earners, while entrepreneurs and the self-employed can often avoid significant amounts of tax.

For instance, dozens of Chinese movie stars were recently forced into embarrassing disclosures that they have two contracts, one based on actual income and one with lower income for tax purposes, allowing them to evade much of their tax obligation.

State media reports and government statements have largely concentrated on the special deductions, which will allow taxpayers to subtract from their taxable income some spending on home mortgage, children’s education and parental elderly care.

However, the size and scope of the deductions is not yet clear, and will be decided by the State Council, the government cabinet, on the advice of the Ministry of Finance, after the final passage of the tax law on Friday.

Some lawmakers expressed concerns that without specific details on the tax deductions, taxpayers would find the new law disappointing and fail to boost spending.

“How will the special deduction items work? If they can’t be made clear, the law will be discounted” by taxpayers, lawmaker Song Kun was quoted as saying in the review session.

Ministry of Finance reported that tax revenue grew 14 per cent to 10.8 trillion yuan in the January-July period, far faster than GDP or income growth. Personal income tax revenue increased 20.6 per cent year on year to 922.5 billion yuan in the same period, already exceeding the intake from the whole of 2015.