Why the White House’s approach to China trade talks may make it harder to reach a deal

Internal divisions may hamper chance of agreement while tariffs on close US allies could embolden China to take a tougher line

China and the US left the thorniest issues untouched during their latest round of trade talks, with the White House’s internal divisions hampering the chances of reaching a deal, business insiders and observers have said.

Analysts also said that Donald Trump administration’s decision to impose tariffs on its aluminium and steel imports from its allies may have heightened the risk of a global trade war by alienating its potential supporters and emboldening China to take a tougher line with the US.

Although China had previously agreed to buy more US goods, agreement on the details of that deal have yet to be reached.

Not only did the latest talks in Beijing this past weekend fail to clarify this issue, Beijing has since threatened to rescind the offer if the Trump administration proceeds with a plan to slap tariffs on US$50 billion of Chinese goods.

Jake Parker, vice-president of China operations at the US-China Business Council, said that the US trade delegation had explored ways to increase US exports and decrease its trade deficit with China.

But he added: “There was limited discussion on restricting technology transfer or imposing tariffs on Chinese imports related to the 301 trade case” into alleged unfair practices.

“We have not heard yet if and when talks around those issues will take place, but they need to – these are important issues for companies,” he said.

The Trump administration’s own internal divisions may also be affecting the direction of the talks.

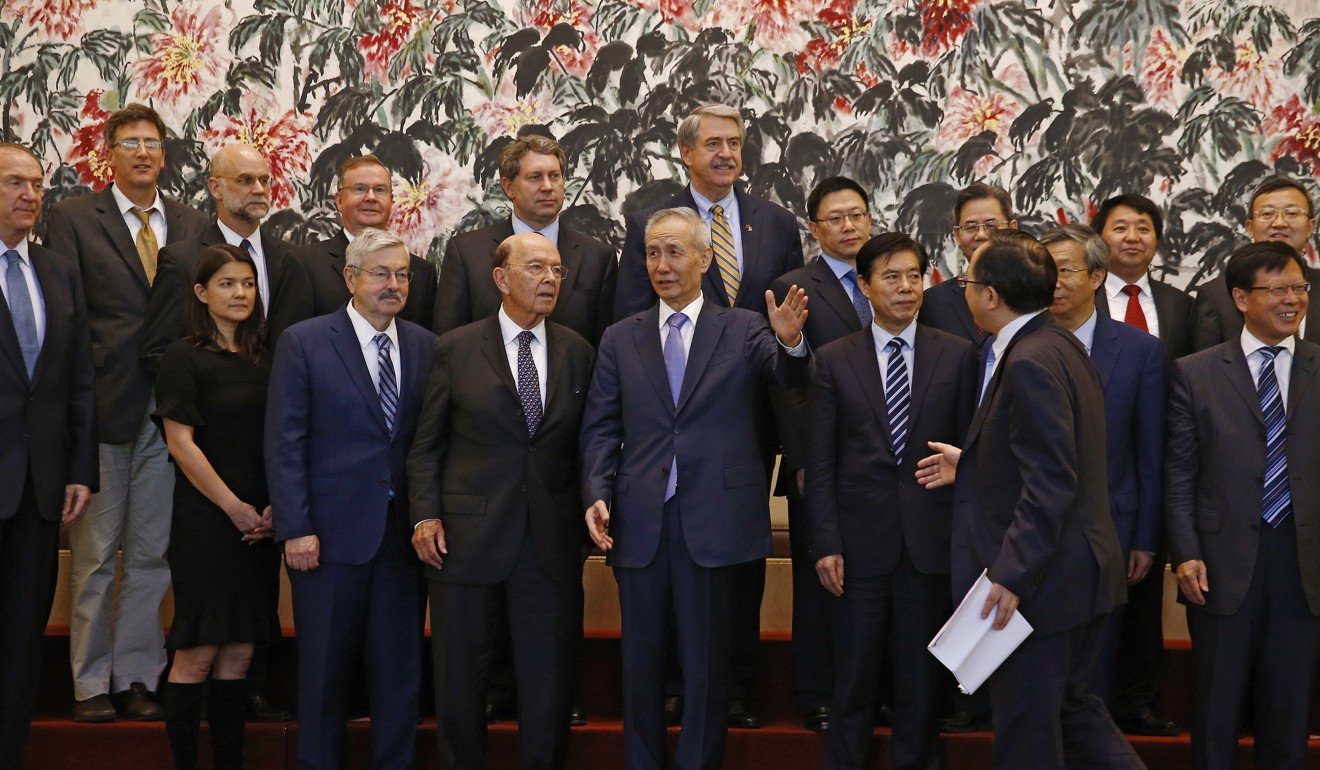

Commerce Secretary Wilbur Ross, who led the US delegation for the latest round of talks in Beijing, is generally seen as part of the faction that is keen to promote free trade. But others, including US Trade Representative Robert Lighthizer, are known to take a more hawkish stance.

Chinese observers said that Ross had not been given enough power to make decisions.

He Weiwen, a former economic and commercial counsellor at China’s consulates in New York and San Francisco, said that Ross was in charge of detailed transactional deals and investment projects rather than policymaking, but that Lighthizer – whose office is responsible for the Section 301 case – was one of the key policymakers in these negotiations.

“It is important that China should directly talk with Lighthizer,” He said. “But the fundamental issue is that the US wants to curtail ‘Made in China 2025.’ There is set to be a lot of wrestling with the US in this regard.”

The Made in China 2025 strategy to boost the hi-tech sector is another area of contention that remains to be resolved.

Beijing has stated that it is one of its core interests and has shown little willingness to make radical changes.

The U.S. has made such bad trade deals over so many years that we can only WIN!

— Donald J. Trump (@realDonaldTrump) June 4, 2018

Trump has sent out conflicting signals towards China in recent weeks.

Despite China’s agreement to buy more US goods, the White House last week indicated its willingness to push ahead with plans to impose 25 per cent tariffs on US$50 billion of Chinese goods – details of which are to be announced on June 15 – and outline restrictions on Chinese access to sensitive American-made technology by the end of the month.

China has responded by warning that it would end its agreement to buy more US goods if the sanctions were imposed.

He contended that Trump was following this path for political reasons and warned that “China will not serve the US to meet its domestic political needs”.

On Monday Trump issued a series of tweets defending his stance, insisting that the US could “only WIN” in a trade war and promising to bring down barriers for US farmers and businesses.

On Friday, the US imposed 25 per cent tariffs on steel imports and 10 per cent tariffs on aluminium from its allies, including European nations and Canada, triggering protests from G7 finance ministers.

French Finance Minister Bruno Le Maire even referred to the bloc as G6+1 as an indication of the deepening rift.

James Zimmerman, a partner in the Beijing office of the international law firm Perkins Coie and the former chairman of the American Chamber of Commerce in China, said that China was closely monitoring the reaction of the EU and Canada, and was likely to follow their strategy in responding to Trump.

“The ‘just say no’ crowd in China is getting emboldened by the American allies that are strongly pushing back as the US ratchets up the pressure,” Zimmerman said.

“Knowing that at the end of the day Trump has no stomach for a debilitating trade war, Beijing’s strategy is to manipulate and play the US, and without giving back any meaningful concessions,” he said.

Parker said that tariffs would inflict real harm on the US economy. “A better alternative would be to work with other like-minded countries in a coordinated approach to the issues with China.

“It would increase leverage and undercut the retaliatory risk to American companies,” he said.

The tariffs on US allies also risk hampering their joint efforts to address mutual concerns about Chinese trade practices including forced technology transfers and state support for businesses.

Lighthizer, EU Trade Commissioner Cecilia Malmstrom and Japan’s economic minister Hiroshige Seko issued a joint statement on Friday, pledging to “address non market-oriented policies and practices that lead to severe overcapacity and create unfair competitive conditions”.

Without naming China, the joint statement said the nations would push for “stronger rules on industrial subsidies and state-owned enterprises” and criticised forced technology transfers.

But the EU, which that day filed a complaint with the World Trade Organisation about China’s practices, is also pursuing a WTO complaint about the US steel and aluminium tariffs – putting it on the same side as China on this issue.

“The world stands on the brink of a trade war,” said Robert Carnell, ING’s head of research for Asia-Pacific.

He said that the US-EU alliance “no longer seems inviolate” but that it would take time and effort to build trust between Europe and China – which Beijing could hasten by showing greater respect for intellectual property and opening up its investment opportunities.

Zimmerman said: “Trump’s threat of sanctions, the internal infighting among the US team, and lack of a sensible Plan B is not a cohesive strategy but evidence of a desperate desire for a deal, any deal”.

“In addition, the end result of Trump’s confrontational tactics will only create resentment among its allies and trading partners, and any perceived gains will be incidental and could prove pyrrhic in the long-term.”