Get ready for short-term trade pain, US tells American companies in China

Time is running out for both countries to avert the first tariff shots but two key dates could lead to a deal, sources say

US officials have warned American companies operating in China of pain ahead as the first round of tariffs looms in an expected trade war between the two countries, sources said.

Two US business sources said that the US embassy in Beijing told American companies on Thursday to be prepared for fallout over the short term, suggesting that the trade clash with China could last some time but would be in their interest over the long run. The embassy declined to comment.

American companies have been concerned about being caught up in the trade confrontation, worried that they could be subject to reprisals such as delays in Chinese licence approvals, prolonged takeover reviews and exclusion from procurement contracts.

Some US companies have already reported cases of the Chinese authorities rejecting visa applications for US executives, according to two other members of the American business community.

Senior Chinese officials have sought to allay those fears. On Tuesday, Liao Min, deputy director of the Office of the Central Commission for Financial and Economic Affairs and a member of China’s negotiation team in the trade row, met US business representatives in Beijing.

Two sources briefed on the meeting said that the Chinese officials were “open” about the issue and stressed that China would continue to open up its economy. But the sources said that many international firms were yet to be convinced by the rhetoric.

The stepped-up contact between Chinese officials and US firms came after a meeting between Chinese President Xi Jinping and a group of US and European business executives last week.

At that gathering, Xi said that China’s door to the outside world would open wider but he also warned that China would fight back if the US took harsh action.

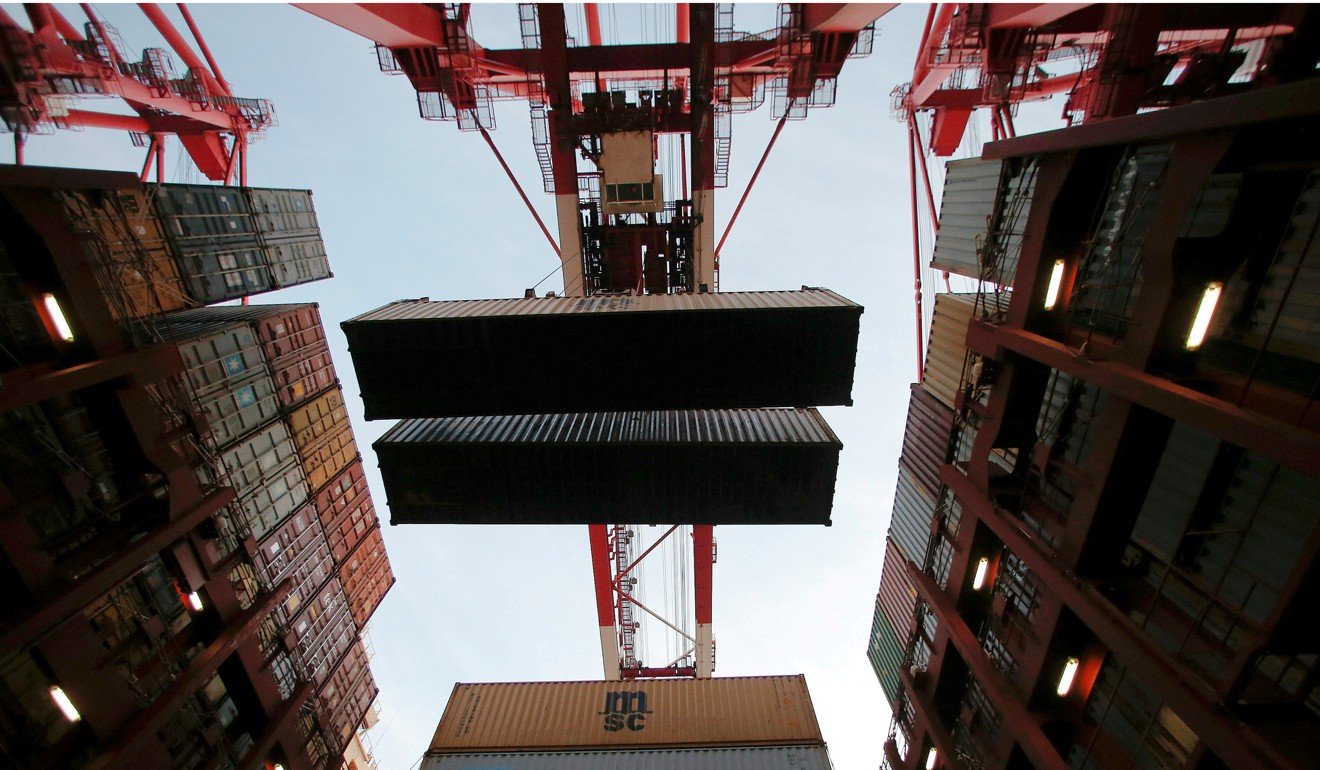

Despite the two countries agreeing in May to put the tit-for-tat posturing on hold, tensions were revived this month when Washington announced plans to levy 25 per cent tariffs on US$34 billion worth of Chinese products beginning on July 6. Beijing fired back with the threat of tariffs on an equivalent amount of American goods.

US President Donald Trump threatened to impose additional tariffs on up to US$450 billion of Chinese products, and Beijing vowed to apply “qualitative and quantitative” countermeasures.

China imported some US$140 billion worth of US products last year but exported US$400 billion of goods to the United States, giving it limited capacity to match Washington in punitive tariffs.

But US investment in China exceeds Chinese investment in America. By the end of last year, US companies had “significantly more historical investment” in China, estimated at about US$256 billion, than Chinese firms had in the US, according to a report by the National Committee on United States-China Relations and Rhodium Group in April.

While China cannot match the US on a like-for-like basis – it simply does not buy the same amounts of American goods – it could exert pressure on multinational corporations with operations in China to influence US policymakers and ease the trade tension, according to observers.

US companies are worried that the pain could come through indirect ways, and some analysts have suggested that US firms in areas such as in pharmaceuticals, cars and aircraft may be at greatest risk.

The business sources said that time was running out for both countries to avert the introduction of punitive tariffs by the July 6 deadline, but that China and the United States were likely to resume talks and reach some settlement down the road.

In a report published on Tuesday, Shunsuke Kobayashi and Yota Hirono from the Japan-based Daiwa Institute of Research, said that the US midterm elections in November could be a factor in reaching a deal.

“Trump feels the need to make a show of some success … in trade policy before that time in order to fulfil a campaign promise, the last one left undone,” the report said.

A former Chinese trade official also said that some sort of agreement might be reached ahead of the 40th anniversary of China’s reform and opening up of markets.

The former official said that a trade war with the United States would take some of the shine off the anniversary later this year and that “the leadership in Beijing has to achieve some agreement with the US before the celebration”.

One of the US sources said that China might announce further “substantial” opening up for the anniversary, but foreign companies want swift action rather than promises on paper from Beijing.

In a step towards opening up, China issued a revised “negative list” for foreign investment on Thursday night, cutting the number of business sectors off limits to foreign players from 63 to 48, and expanding foreign commercial activity in finance, transport, professional services, and car and aircraft manufacturing.

The revised list had been scheduled to be unveiled at the end of June but that date coincided with a US announcement of investment restrictions.

The US-China Business Council said that the extent of the opening would depend on follow-up regulations.

“Licensing and other requirements in the past have limited the full realisation of openings in some sectors,” the council said.

“In addition, the new list retains foreign ownership restrictions in certain sectors such as cloud computing, which the Chinese government deems a sensitive sector for national security.”

Trump said on Wednesday that he would rely on a strengthened Committee on Foreign Investments in the United States to review and contain Chinese investment in sensitive US technology, a softening from a previous proposal to impose additional restrictions specifically targeting China.