China-US trade talks unofficially resume, but progress hamstrung by mutual ‘deep mistrust’, sources say

Washington wants Beijing to make swift changes to its economic model because it doubts it will make them gradually

China and the United States held unofficial talks last week but a deep and mutual distrust continues to hamper efforts to de-escalate their trade dispute, people close to the situation in Beijing and Washington told the South China Morning Post.

According to sources, US Treasury Secretary Steven Mnuchin called China’s Vice-Premier Liu He last week in a bid to persuade Beijing to approve US chip maker Qualcomm’s takeover deal of the Netherlands-based NXP Semiconductors.

Several countries, including China, had a say in the matter because Qualcomm sells its products globally and the proposed merger could have been seen as giving the company a price monopoly.

The refusal by Beijing’s antitrust regulators to approve the deal – eight other countries cleared it – effectively made Qualcomm the first casualty of the trade dispute, even though China said it had nothing to do with the issue.

The sources also said that senior officials from the US treasury and commerce departments spoke to Liao Min, one of Beijing’s main trade negotiators and deputy director of the Office of the Central Financial and Economic Affairs Commission, a Communist Party policymaking body.

The purpose of the talks was to “prepare for more formal negotiations” but progress had been slow because of the mistrust on both sides, two sources said.

“The US wants very fast changes to the status quo because it does not trust China to make changes gradually,” said one source in Washington.

A senior US administration official said there had been contact with Chinese officials.

“We are trying to figure out whether the conditions present themselves for a specific engagement between the two sides,” the official said, adding that the US trade representative is the lead negotiator for the US side.

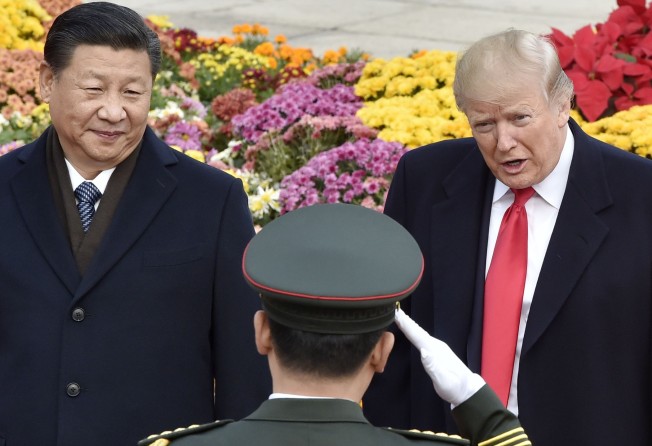

Michael Pillsbury, director of the Centre for Chinese Strategy at the Hudson Institute, a conservative think tank in Washington, said at an event in Beijing on Monday that despite the dispute between the US and China, the relationship between Presidents Donald Trump and Xi Jinping remained solid.

“I told you, some people say, there have been more than 30 phone calls between Mr Trump and Mr Xi Jinping. That’s a lot, in 18 months [since Trump took office]. And four meetings in person. So, the basic foundation of US-China cooperation is very strong,” he said.

Tu Xinquan, a professor at the University of International Business and Economics in Beijing, said that the US had been very critical of China’s state-supported economic growth model and wanted to get rid of it because it knew it gave Beijing an advantage.

“But the US demands too much and wants things to happen too quickly,” he said. “It goes beyond what China can accept.”

Jake Parker, vice-president of China operations at the US-China Business Council, agreed that Washington had an image of what it wanted Beijing to be.

“The US wants to see signs that China is operating like a market economy,” he said.

Washington was looking for any kind of public announcement that Beijing was revising its “Made in China 2025” plan for technological upgrading, reducing support for state-owned enterprises, and liberalising rules on foreign investment which would give “specific licences to specific US companies in some sectors”, Parker said.

“We understand these are not easy reforms, but they would make a big difference in rebuilding the confidence of the business community and US negotiators,” he said.

Despite Washington’s wish list, Shi Yinhong, a government adviser and professor of international relations at Renmin University, said that China was wary of granting too big a concession to the US in return for what might turn out to be only a short-lived truce in the trade dispute.

Also, if Beijing gave any indication it was prepared to back down, Trump would exploit it to push for an even better deal for the US, he said.

Shi is one of several Chinese experts to suggest that Washington is using the trade dispute to curtail China’s efforts to develop its economy, technology and military. Many have also said that the conflict could also provide Beijing with the impetus it needs to initiate important reforms.

While it is not known exactly how the latest talks were initiated, China’s Ministry of Commerce this week accused the US of exerting pressure on Beijing by “spreading the idea that it [Washington] was ready to resume talks”.

Officials from the two sides also discussed the depreciation of the yuan, although the US side said that Trump’s latest tariff threat was unrelated to the changes in the currency’s value. The yuan fell to its lowest level in 15 months on Friday, breaking the mark of 6.9 to the US dollar.

Since the trade dispute started, Washington and Beijing have imposed 25 per cent tariffs on US$34 billion worth of each other’s imports and more punitive duties are in the pipeline.

US Trade Representative Robert Lighthizer said this week that Washington was considering raising existing tariffs on US$200 billion worth of Chinese products to 25 per cent from 10 per cent, but “remains ready to engage with China” to resolve the dispute.

China’s Ministry of Foreign Affairs said on Wednesday that US efforts to “pressure and blackmail” Beijing would not work and that it was ready to launch countermeasures if necessary.

Also on Wednesday, the US Department of Commerce slapped restrictions on dozens of key Chinese companies – including state-owned developers of military technologies such as air defence and satellite systems – for reasons of national security.

Whatever happens in the next phase of the trade dispute, the impact on China’s stock market has already been immense. Since reaching a high in January, the value of mainland stocks has fallen by about US$1.6 trillion – roughly the size of Canada’s gross domestic product – jeopardising China’s position as the largest capital market in Asia.