Chinese investors warned of dangers that lie in wait along the New Silk Road

Public and private institutions are mapping risks for participants in the belt and road plan

Mainland investors are being given risk maps to guide them along the New Silk Road.

The risk assessments come from official and private sources and coincide with an investment shift away from property and hotels and towards projects aligned with the country’s ambitious belt and road trade plan.

They include risk ratings from brokerage firm Minsheng Securities that measure the political and economic performance of the countries. Malaysia, for instance, scored 76 and is regarded as much safer than Egypt, which scored 58.5, according to the brokerage’s research published in China Money Market, a monthly journal produced by the central bank.

The Ministry of Commerce, Chinese Academy of Social Sciences (CASS) and a handful of private institutions have also put out basic risk guidance on the belt and road countries, some of which are located in the world’s most dangerous territories.

The commerce ministry’s risk report gives an overview of each country’s history, society and economy as well as investment policies and institutions. It also provides the details of Chinese companies and business groups based in those countries.

CASS has meanwhile published risk assessments for 57 countries. Of the 35 that are covered by the belt and road plan, only Singapore was given a double A rating.

Information will also come from the National Development and Reform Commission – the economic planning agency that approves big overseas projects. It said on Friday that it would offer mainland businesses guidance to improve risk controls and reduce “vicious competition and corruption” when they are “going out” to the belt and road countries.

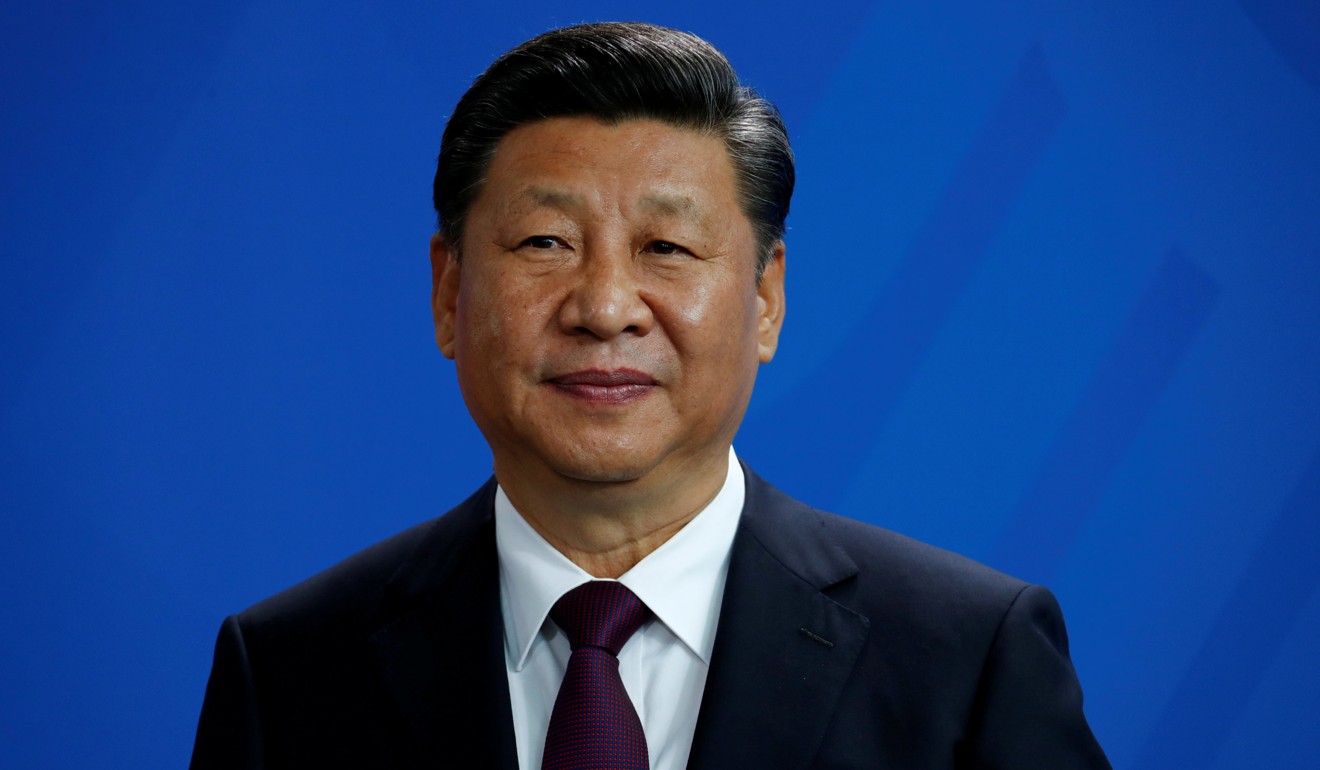

Driven by President Xi Jinping, Beijing’s biggest economic diplomacy project aims to boost trade and investment along the historic Silk Road as well as along sea routes to Africa.

It is gaining momentum due to Beijing’s deep pockets and the demand for infrastructure – such as roads, bridges and factories – in many of the countries it covers.

According to the latest government data, the plan has consent and recognition from 69 countries and international agencies.

Beijing on Friday made clear that it did not want to see mainland money flowing into foreign property, hotels and soccer clubs by making investors seek special approval for such ventures.

But the government also stressed that projects to do with the New Silk Road scheme and those that will expand China’s industrial capacity abroad would be encouraged.

Investments to secure supplies of energy and raw materials would also be given the green light as long as they included properly thought out profitability studies.

According to the commerce ministry, the country invested some US$7.7 billion in 50 belt and road countries in the first seven months of this year – up 13.4 per cent from a year earlier. But overall outbound investments were down 44 per cent in the same period, to US$57.2 billion.

There are major risks along both the ancient Silk Road, which passes through Asia to Europe, and the maritime route, which passes through Southeast Asia and the Indian Ocean to the shores of Africa.

In a research note published in May, Cecilia Joy Perez and Derek Scissors from the American Enterprise Institute noted that the benefits of belt and road investments for both China and host countries were “unlikely to prove durable” and Beijing had “overstated” its potential.

Yu Yongding, a researcher with CASS, told a conference in Beijing earlier this month that regulators should be alert to the risk of capital flight disguised as belt and road investment.

“Companies want to be linked with the ‘Belt and Road Initiative’ because it makes it easier to get support from the banks and government, but standard commercial practices should be applied,” Yu said in the speech. “We should be very cautious about promoting belt and road investment.”