Calls for a freer yuan from inner circle of China’s central bank

Current ‘stable market’ provides a window of opportunity for move to be made, as long as policymakers are willing, report says

China could be heading towards a free-floating currency after a group of economists – including officials from the central bank – suggested the time was ripe for such a move.

The comments were made in a report published on Saturday by the China Finance 40 Forum, whose members include Huang Yiping, a members of the People’s Bank of China’s monetary policy committee.

“If policymakers have the willingness and resolution [to reform the yuan], I think they can do it now,” Huang was quoted as saying in a statement released on social media after the report’s release.

“Now the timing is good.”

Huang, who co-authored the report, suggested the government had a window of opportunity to set the yuan’s exchange rate free.

“In the past, China’s currency authorities have found themselves fighting either an overwhelming yuan appreciation expectation or a deprecation anticipation,” he said.

“They have repeatedly said that the timing was bad to make the exchange rate regime more flexible, but now the market has stabilised.”

Time will tell if Beijing adopts the report’s recommendations but it is significant that they were made by such a heavyweight group.

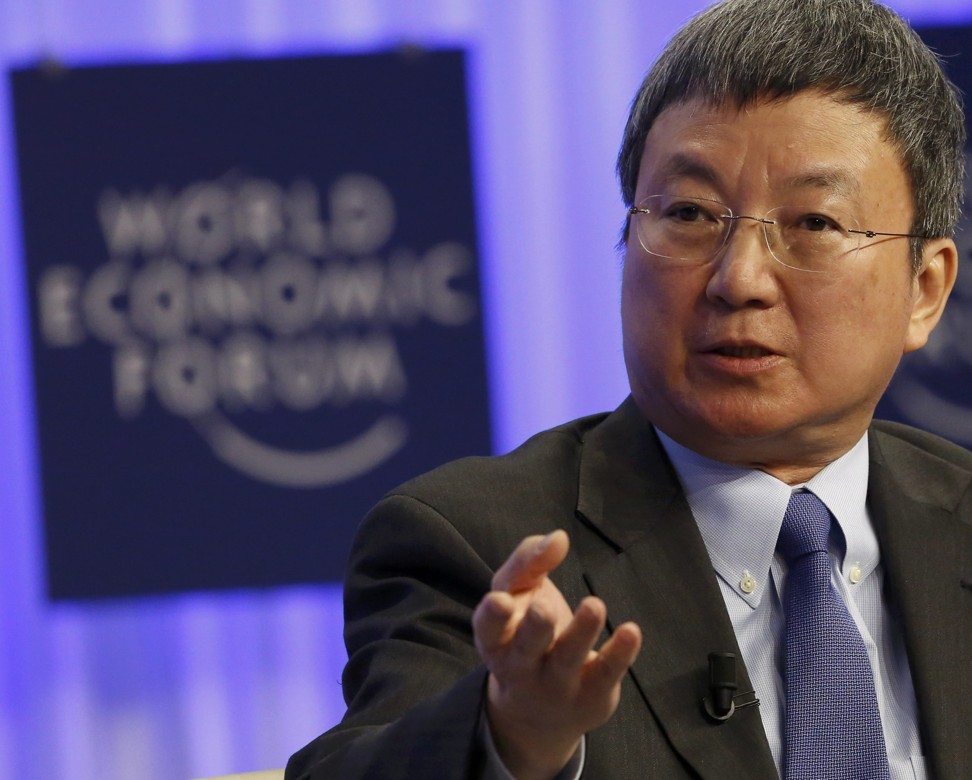

Other members of the forum with links to the central bank include Zhu Jun, the director general of its international department; Xu Zhong, its head of research; and Zhu Min, a former vice-governor and current deputy managing director of the International Monetary Fund.

Also at the release event was Guan Tao, a former senior official at the State Administration of Foreign Exchange.

Zhang Bin, a researcher at the Chinese Academy of Social Sciences and another of the report’s co-authors, said if Beijing wanted to release its currency it should first rid itself of the countercyclical factor within the existing pricing mechanism.

This would allow the currency to move within a “relatively wide annual band” and could be a stepping stone on the road to a free-floating yuan, he said.

“By doing so [removing the countercyclical factor], the authorities would be sending a message that as long as the yuan remains within the agreed range, they will keep their hands off, and not mobilise foreign reserves [to shore it up],” Zhang said.

The countercyclical factor was introduced in May to give China’s monetary authorities greater control over the yuan’s daily movements against other currencies. While it had the immediate effect of boosting the value of the yuan by about one per cent against the US dollar, it was widely criticised both at home and abroad for being a backwards step in the reform of the exchange rate mechanism.

Saturday’s report also called for Beijing to remove the cap on foreign ownership in the banking, securities and insurance sectors.

“These caps should be removed as soon as possible,” it said, adding that foreign investors – currently restricted to a maximum 50 per cent stake in life insurance firms, 49 per cent in brokerages, and 25 per cent in banks – should be allowed to set up wholly owned businesses.

The report also suggested that Beijing, in the medium to long term should seek greater integration of its capital market with those of other countries.

“To achieve a comprehensive opening up of its stock market, China should look at the ‘Shanghai-London connect’, the ‘Shanghai-Singapore connect’, and other programmes to better integrate with overseas bourses,” it said.

The “connects” to which the report was referring are suggested mechanisms for allowing brokers in London, Shanghai, Singapore or anywhere else in the world to trade stocks on foreign exchanges out of hours.

In July, President Xi Jinping told an industry conference that the opening up of China’s financial markets was an important step in the country’s wider reforms. Last month, the State Council, China’s cabinet, launched 22 policies to boost foreign investment and vowed to set a timetable for the opening up of the financial sector.