Why China’s hollowed-out manufacturing hub is pinning its hopes on a hi-tech revival

Dongguan readies itself for rise of the robots after years of churning out cheap shoes, clothing and toys

The four-storey building in Dongguan used to be a busy factory, full of young migrant workers.

Recently resurrected, with a shiny, glass curtain wall replacing dusty concrete, it is now home to dozens of domestically funded tech and internet start-ups.

Opened in the 1990s by SAE Magnetics, a subsidiary of Japanese electronics giant TDK, the factory employed around 20,000 workers at its peak and made hard disc parts for companies including Samsung, Toshiba and Fujitsu.

But despite being portrayed as a shining example of Dongguan’s economic miracle, which saw the city turn into China’s undisputed export leader and the capital of its labour-intensive manufacturing, it lost its lustre over time, along with tens of thousands of similar factories across the city.

The old-economy stalwarts, battered by soaring labour and raw material costs and falling orders from overseas, shut down or shrank. It now charges its new tenants, Chinese e-commerce and hi-tech companies, rents that are two or three times higher than it could ask before.

That is all part of a broader transformation in Dongguan as the city, between Shenzhen and Guangzhou, looks to become a smart manufacturing base focused on the emerging mainland market, banking on the rise of domestic tech brands and booming domestic consumption.

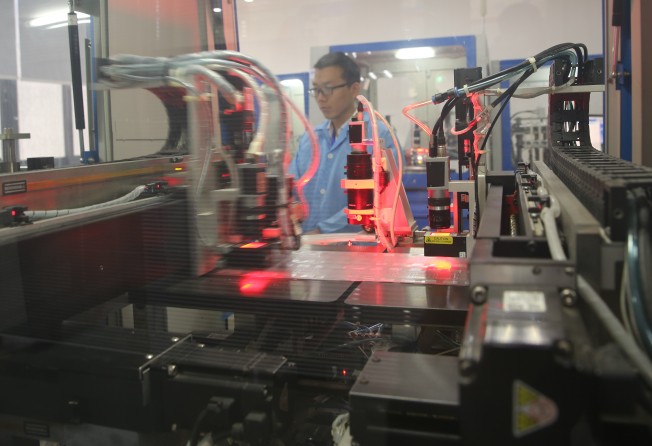

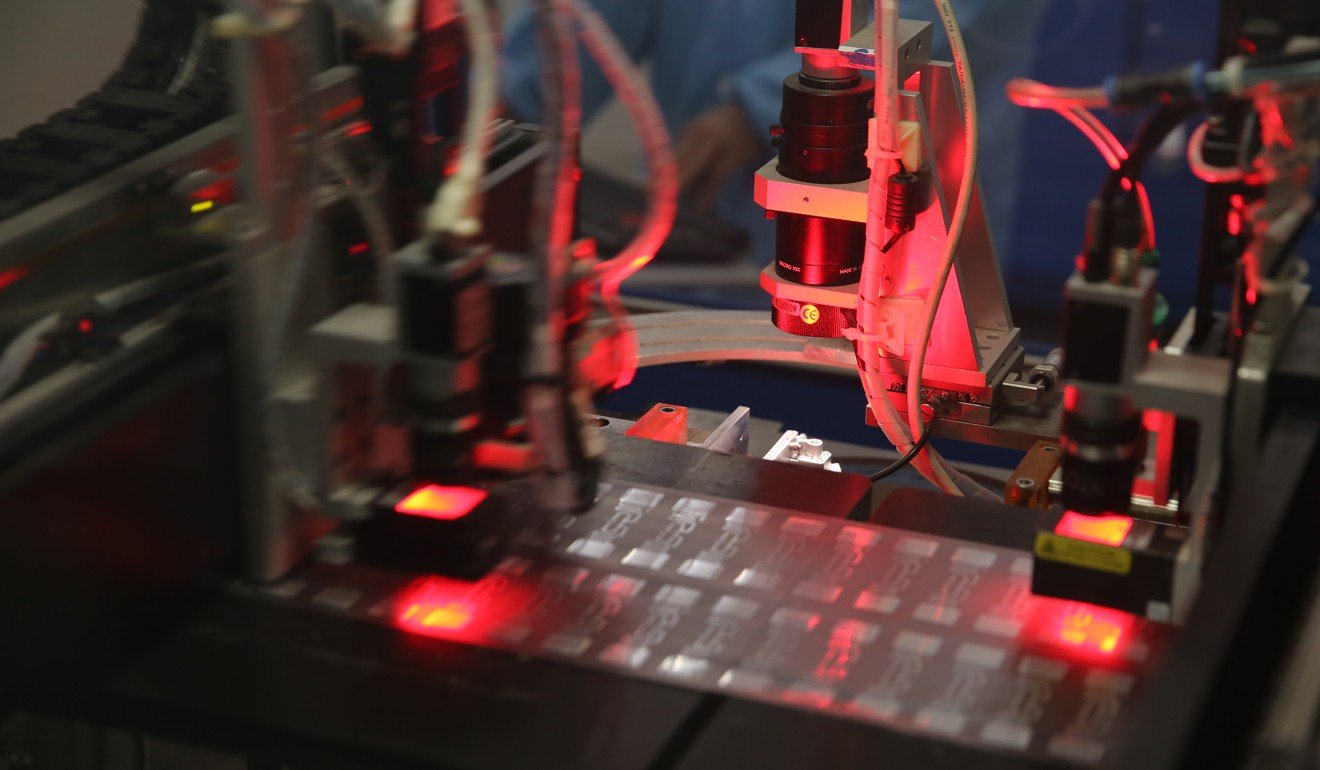

As the processing of low-end exports – previously the biggest driver of Dongguan’s economy – declined, factories turned their attention to supplying emerging Chinese hi-tech brands, introducing smart equipment to replace increasingly expensive workers.

Infusions of economic stimulus from various levels of government and Shenzhen’s transformation into a global technology hub have seen the number of advanced and hi-tech manufacturing companies in Dongguan triple since 2012. It is now home to 5,000 such enterprises and they helped the city’s gross domestic product grow at the fastest pace in four years in the first nine months of last year, rising 8.1 per cent to 548.4 billion yuan (US$85.2 billion).

The withering of foreign orders as a result of the 2007-08 global financial crisis dealt a blow to Dongguan’s economic output growth. Its GDP growth, 18.1 per cent in 2007, sputtered to 5.3 per cent in 2009 and hit rock bottom – just 1.3 per cent – in the first three months of 2012.

In 2012 and 2013, Dongguan was better known for rampant prostitution than manufacturing, but a crackdown in early 2014 stamped that out, with 6,500 police raiding almost 2,000 entertainment venues.

Today, it is a key part of the Guangdong provincial government’s plans to create a “Chinese Silicon Valley-style tech corridor” as a new economic engine for the region. The government blueprint for the Guangzhou-Shenzhen Technology Innovation Corridor, released in September, envisions Guangzhou, Dongguan and Shenzhen leading the country in terms of science and technology capacity by 2020.

The GDP of the three cities in 2016 was 4.6 trillion yuan, accounting for 67.6 per cent of the output in the mainland portion of the Pearl River Delta.

Dongguan is anticipating annual GDP growth of 8 per cent in the next five years, with local GDP of more than 920 billion yuan by 2020.

In the first three quarters of last year, the added value of Dongguan’s advanced and hi-tech manufacturing industries rose more than 16 per cent to 215.9 billion yuan, according to official data, accounting for 89.1 per cent of the total added value of the city’s industrial enterprises.

We believe [the] Dongguan economic slump has finally ended

“We believe [the] Dongguan economic slump has finally ended,” said Wang Songhui, a senior official in the city’s commerce bureau. “So far, we see a stable developmental tendency in the city’s economy.

“Foreign firms dominated Dongguan’s industrial output and exports until the early 2010s. But domestically funded enterprises have now caught up so fast and contribute about half of the city’s industrial output.”

In the first nine months of last year, the added value of Dongguan’s domestic enterprises was 115.5 billion yuan, up 18.1 per cent year on year, while the figure for foreign firms was up 5 per cent at 126.8 billion yuan. The total number of foreign firms in the city, including those from Hong Kong, Macau and Taiwan, had dropped from 15,000 in the late 2000s to about 11,000 last year, Wang said, adding that Dongguan was now home to a million enterprises, including self-employed entrepreneurs.

Economist Peng Peng, the vice-president of the Guangdong-based South Nongovernmental Think-tank, said Dongguan’s economy was now more vibrant.

“You can see a trend that local enterprises in Dongguan are actively upgrading to higher industrial chains,” he said. “That’s the only way to help cover part of soaring manufacturing costs, like labour, rent and raw materials, and remain competitive.”

Most of the financial support and preferential policies from government have sought to foster the introduction of advanced equipment, with the local authorities viewing automation as the way to upgrade the city’s manufacturing sector.

Since 2014, the city government has given local manufacturers subsidies of 200 million yuan a year to support the adoption of automation, and by January last year there were 76,315 industrial robots and pieces of automated equipment on assembly lines across Dongguan, replacing nearly 200,000 workers. The city’s economy and information technology bureau said labour productivity had risen 2.5 times as a result and manufacturing costs had fallen an average of 9 per cent.

The emerging mainland market for consumer electronic products has buoyed Dongguan’s economic recovery, with three domestic smartphone giants – Oppo, Vivo and Huawei – producing 257 million mobile phones in Dongguan in the first nine months of last year. They were worth 83.8 billion yuan – up 45 per cent year on year.

The city shipped more than 300 million mobile phones last year – a fifth of the global total.

The boom in emerging Chinese tech manufacturers has also given Dongguan’s robotics industry a boost. It was home to about 400 companies focused on producing robots and automated equipment last year, according to official data. They employed more than 55,000 people, with output valued at 35 billion yuan.

Wang Yuhui, the general manager of Guangdong Sygole Intelligent Technology, a four-year-old start-up specialising in radio frequency identification (RFID) for industrial robots, estimated that the company’s revenue rose 50 per cent last year to about 100 million yuan. He said it had about 60 employees, half of whom were engineers engaged in research and development, and predicted that its production capacity would double in the next year.

Dongguan’s robot and automation industry is now in its golden era

“Dongguan’s robot and automation industry is now in its golden era,” he said. “The city has a unique advantage as growing domestic tech brands set up their manufacturing bases here. All of our new products can be quickly tested in nearby factories. We can customise our products based on customer demand, using first-hand market information.

“If the trend continues, no foreign brands will be able to rival us in the future. So far, the major clients for industrial robots are big companies. The peak time of the robotics industry will arrive when all the small factories start using robots as their main labour force.”

Meanwhile, the prospects are bleak for the city’s remaining small, export-oriented manufacturers that are focused on traditional markets.

“You can see the number of migrant workers falling in Dongguan as labour-intensive manufacturers leave,” said 51-year-old Yuan Hongzhu, who founded Datu Shoes in Dongguan’s Liaobu town 15 years ago.

“Traditional manufacturers like us get no benefit from this tech boom driven by government subsidies, but only struggle with depression problems. We keep losing foreign orders. In the past, my factory could produce 170,000 pairs of shoes a month, but now it’s only 60,000.”

Dongguan used to be one of China’s grittiest, most prosperous manufacturing hubs. Between 2003 and 2006, its GDP growth led the mainland, topping 19.5 per cent each year.

Home to around 8 million people, it relied heavily on labour-intensive manufacturing for its economic development in the past, and particularly on investors from Hong Kong and Taiwan intent on producing shoes, clothing, textiles, furniture and toys.

Yuan said the orders had left Dongguan along with a large number of factories set up by Hong Kong and Taiwanese investors, who had moved to hinterland provinces or South Asia to take advantage of lower costs.

“But the [monthly] rent for a 6,000-square metre (64,583-square feet), three-storey factory has skyrocketed from 45,000 yuan last year to 60,000 yuan this year because of those new tech companies moving from Shenzhen,” he said.

Yuan said that when veteran shoe makers gathered in Dongguan they could not help but worry that orders would decline further due to global trade headwinds.

Another Dongguan shoe manufacturer, Luo Qiyuan, said the only hope was the domestic market. He previously focused on exporting shoes to America but set up a high-end brand, east wolf, targeting the mainland market last year.

“We can have 15 per cent net profit selling high-end shoe to Chinese customers, much higher than foreign orders,” Luo said. “Few Dongguan-based bosses talk about foreign expansion. We’re all trying our best to upgrade industry to make money from the Chinese market.

“Chinese people are getting wealthy. Sooner or later they will prefer Chinese luxury brands.”